Form Sc 1120u - Public Utility Tax Return - 2011 Page 5

ADVERTISEMENT

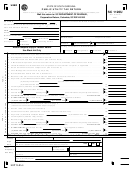

SC1120U

Page 5

SCHEDULE K

COMPUTATION OF LICENSE FEE ON GROSS RECEIPTS AND PROPERTY

1. Fair market value of Property Owned and Used in the Conduct of Business in South Carolina as determined by

South Carolina Department of Revenue for Property Tax Purposes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Fee Due: Line 1 x .001 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total

Intrastate

System

South Carolina

(A)

(B)

3. Operating Revenues, (Itemize):

$

$

4. Total Operating Revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

$

5. Other Receipts, (Itemize):

6. Total Other Receipts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

$

7. Total Gross Receipts (Add Lines 4 and 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Fee Due (Line 7, Column B x .003) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

9. Total License Fee Due (Add Lines 2 and 8) (Enter here and also on Line 16, Part II, Page 1) . . . . . . . . . . . . . . .

$

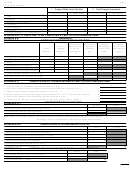

Code Section 12-20-100 as amended for taxable years beginning after 1995 provides:

(A) In the place of the license fee imposed by Section 12-20-50, every express company, street railway company, navigation company,

waterworks company, power company, electric cooperative, light company, gas company, telegraph company, and telephone

company shall file an annual report with the department and pay a license fee as follows:

(1) one dollar for each thousand dollars, or fraction of a thousand dollars, of fair market value of property owned and used within

this state in the conduct of business as determined by the department for property tax purposes for the preceding taxable year;

and

(2) three dollars for each thousand dollars, or fraction of a thousand dollars, of gross receipts derived from services rendered from

regulated business within this state during the preceding taxable year, except that with regard to electric cooperatives, only

distribution electric cooperatives are subject to the gross receipts portion of the license fee under this subitem.

(B) The minimum license fee under this section is $25.

GENERAL INFORMATION

If any corporate income tax or license fee is anticipated to be due, the taxpayer must make payment with SC1120-T by original

due date.

If no income tax or license fee is anticipated to be due and the taxpayer has requested a federal extension, then the federal

extension will be accepted as a South Carolina extension if the corporate return is received within the time as extended by the

Internal Revenue Service.

A copy of the federal or South Carolina extension(s) must be attached to the return when filed.

There is no extension for payment of corporate income tax or license fee. Any income tax or license fee due must be paid by the

prescribed due date to avoid the assessment of late penalties and interest.

INSTRUCTIONS

Line 17 Instructions - If the company paid cash to provide infrastructure for an eligible project, enter the amount on line

17. Attach a schedule to the return setting forth the name of the person completing the project, a description of the project,

under what section or sections of the statute the project qualifies, the amounts in cash that were paid for infrastructure and

to whom and when paid, a description of the infrastructure, and the date the infrastructure was completed or is expected to

be completed. If the infrastructure has not been completed as of the date the return is filed, the taxpayer must include a

waiver of the statute of limitations. The maximum credit for a single tax year may not exceed $300,000. If the credit exceeds

tax liability, the excess may be carried forward and deducted in the succeeding tax year. For more information see SC

Revenue Ruling #99-6.

Refer to SC1120 instructions if Public Utilities 'C' Corporation.

Refer to SC1120S instructions if Public Utilities 'S' Corporation.

For additional information refer to SC1120 instructions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5