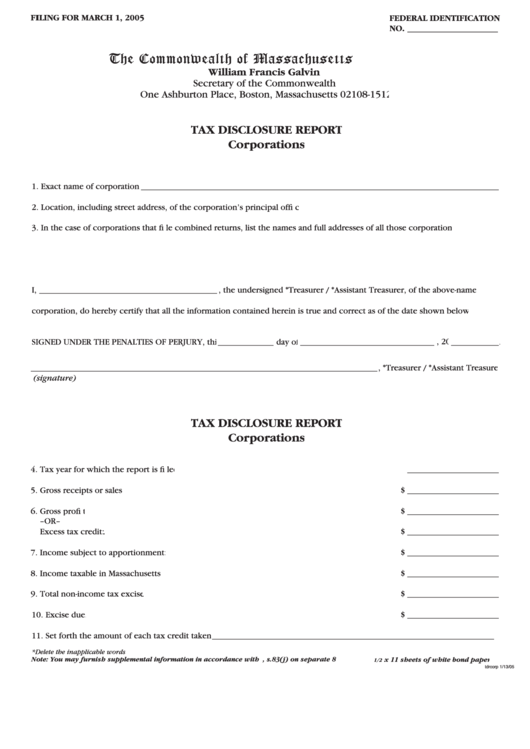

FILING FOR MARCH 1, 2005

FILING FOR MARCH 1, 2005

FEDERAL IDENTIFICATION

NO. _____________________

The Commonwealth of Massachusetts

William Francis Galvin

Secretary of the Commonwealth

One Ashburton Place, Boston, Massachusetts 02108-1512

TAX DISCLOSURE REPORT

Corporations

1. Exact name of corporation:___________________________________________________________________________________

1. Exact name of corporation:___________________________________________________________________________________

1. Exact name of corporation:

2. Location, including street address, of the corporation’s principal office:______________________________________________

2. Location, including street address, of the corporation’s principal office:______________________________________________

2. Location, including street address, of the corporation’s principal office:

3. In the case of corporations that file combined returns, list the names and full addresses of all those corporations:

I, _________________________________________, the undersigned *Treasurer / *Assistant Treasurer, of the above-named

corporation, do hereby certify that all the information contained herein is true and correct as of the date shown below.

SIGNED UNDER THE PENALTIES OF PERJURY, this _____________ day of _______________________________

day of _______________________________

day of

, 20 ___________.

________________________________________________________________________________, *Treasurer / *Assistant Treasurer

(signature)

TAX DISCLOSURE REPORT

Corporations

4.Tax year for which the report is filed:...................................................................................................

4.Tax year for which the report is filed:...................................................................................................

4.Tax year for which the report is filed:

_____________________

5. Gross receipts or sales:.........................................................................................................................

5. Gross receipts or sales:.........................................................................................................................

5. Gross receipts or sales:

$ _____________________

6. Gross profit: ........................................................................................................................................$ _____________________

–OR–

Excess tax credit:.................................................................................................................................

Excess tax credit:.................................................................................................................................

Excess tax credit:

$ _____________________

7. Income subject to apportionment:......................................................................................................

7. Income subject to apportionment:......................................................................................................

7. Income subject to apportionment:

$ _____________________

8. Income taxable in Massachusetts:........................................................................................................

8. Income taxable in Massachusetts:........................................................................................................

8. Income taxable in Massachusetts:

$ _____________________

9.Total non-income tax excise:................................................................................................................

9.Total non-income tax excise:................................................................................................................

9.Total non-income tax excise:

$ _____________________

10. Excise due:.........................................................................................................................................

10. Excise due:.........................................................................................................................................

10. Excise due:

$ _____________________

11. Set forth the amount of each tax credit taken: _________________________________________________________________

11. Set forth the amount of each tax credit taken: _________________________________________________________________

11. Set forth the amount of each tax credit taken:

*Delete the inapplicable words.

Note: You may furnish supplemental information in accordance with M.G.L. Ch 62C, s.83(j) on separate 8

x 11 sheets of white bond paper.

1/2

tdrcorp 1/13/05

1

1