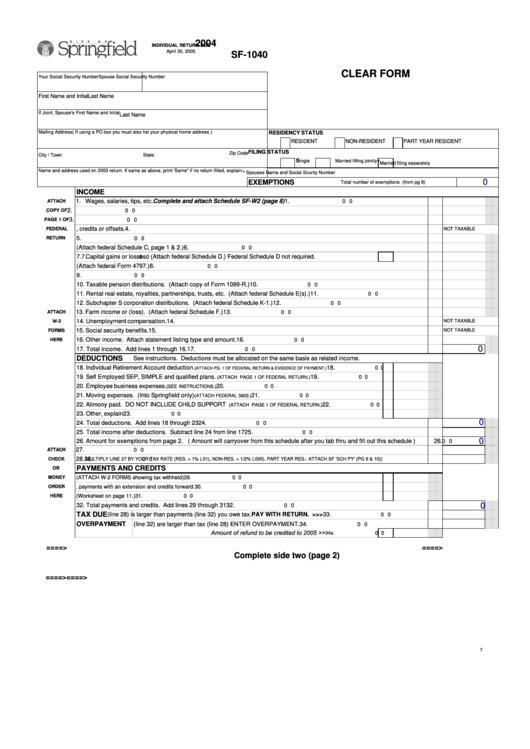

2004

INDIVIDUAL RETURN DUE

April 30, 2005

SF-1040

CLEAR FORM

Your Social Security Number

Spouse Social Security Number

First Name and Intial

Last Name

If Joint, Spouse's First Name and Intial

Last Name

Mailing Address( If using a PO box you must also list your physical home address )

RESIDENCY STATUS

RESIDENT

NON-RESIDENT

PART YEAR RESIDENT

FILING STATUS

Zip Code

City / Town

State

S

ingle

Married filling jointly

*

Married filing separately

Name and address used on 2003 return. If same as above, print 'Same" if no return filled, explain:

* Spouses Name and Social Scurity Number

0

EXEMPTIONS

Total number of exemptions (from pg 8)

INCOME

1. Wages, salaries, tips, etc.

Complete and attach Schedule SF-W2 (page 8)

1.

0 0

ATTACH

2. Taxable interest.

2.

COPY OF

0 0

PAGE 1 OF

3. Ordinary dividends.

3.

0 0

4. Taxable refunds, credits or offsets.

4.

NOT TAXABLE

FEDERAL

5. Alimony received.

5.

RETURN

0 0

6. Business income. (Attach federal Schedule C, page 1 & 2.)

6.

0 0

7.

Capital gains or losses. (Attach federal Schedule D.) Federal Schedule D not required.

7.

0 0

8. Other gains or losses. (Attach federal Form 4797.)

8.

0 0

9. Taxable IRA distributions.

9.

0 0

10. Taxable pension distributions. (Attach copy of Form 1099-R.)

10.

0 0

11. Rental real estate, royalties, partnerships, trusts, etc. (Attach federal Schedule E(s).)

11.

0 0

12. Subchapter S corporation distributions. (Attach federal Schedule K-1.)

12.

0 0

13. Farm income or (loss). (Attach federal Schedule F.)

13.

0 0

ATTACH

14. Unemployment compensation.

14.

NOT TAXABLE

W-2

15. Social security benefits.

15.

NOT TAXABLE

FORMS

16. Other income. Attach statement listing type and amount.

16.

HERE

0 0

0

17.

Total income. Add lines 1 through 16.

17.

0 0

DEDUCTIONS

See instructions. Deductions must be allocated on the same basis as related income.

18. Individual Retirement Account deduction.

18.

0 0

(ATTACH PG. 1 OF FEDERAL RETURN & EVIDENCE OF PAYMENT.)

19. Self Employed SEP, SIMPLE and qualified plans.

19.

0 0

(ATTACH PAGE 1 OF FEDERAL RETURN.)

20. Employee business expenses.

20.

0 0

(SEE INSTRUCTIONS.)

21. Moving expenses. (Into Springfield only)

21.

0 0

(ATTACH FEDERAL 3903.)

22. Alimony paid. DO NOT INCLUDE CHILD SUPPORT

22.

0 0

(ATTACH PAGE 1 OF FEDERAL RETURN.)

23. Other, explain

23.

0 0

0

24.

Total deductions. Add lines 18 through 23

24.

0 0

25.

Total income after deductions. Subtract line 24 from line 17

25.

0 0

0

26. Amount for exemptions from page 2. ( Amount will carryover from this schedule after you tab thru and fill out this schedule )

26.

0 0

27.

Total income subject to tax. Subtract line 26 from line 25

27.

0 0

ATTACH

28.

28.

CHECK

MULTIPLY LINE 27 BY YOUR TAX RATE (RES. = 1% (.01), NON-RES. = 1/2% (.005), PART YEAR RES.- ATTACH SF 'SCH PY' (PG 9 & 10))

0 0

PAYMENTS AND CREDITS

OR

MONEY

29. Tax withheld by your employer (ATTACH W-2 FORMS showing tax withheld)

29.

0 0

ORDER

30. Payments on 2004 Declaration of Estimated Income Tax, payments with an extension and credits forward.

30.

0 0

31. Credit for tax paid to another city and for tax paid by a partnership. (Worksheet on page 11.)

31.

0 0

HERE

0

32.

Total payments and credits. Add lines 29 through 31

32.

0 0

TAX DUE

33. If tax (line 28) is larger than payments (line 32) you owe tax.

PAY WITH RETURN. >>> 33.

0 0

OVERPAYMENT

34. If payments (line 32) are larger than tax (line 28) ENTER OVERPAYMENT.

34.

0 0

Amount of refund to be credited to 2005 >>

34a.

0 0

====>

====>

Complete side two (page 2)

====>

====>

7

1

1 2

2 3

3