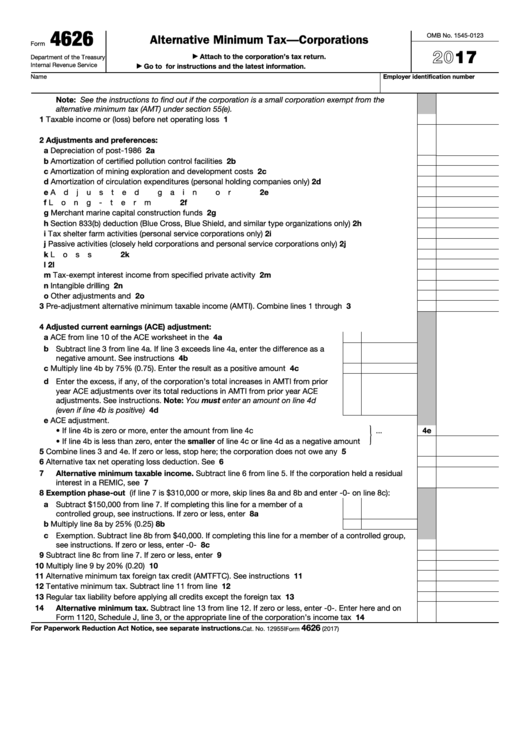

4626

OMB No. 1545-0123

Alternative Minimum Tax—Corporations

Form

2017

Attach to the corporation’s tax return.

Department of the Treasury

▶

Internal Revenue Service

Go to for instructions and the latest information.

▶

Name

Employer identification number

Note: See the instructions to find out if the corporation is a small corporation exempt from the

alternative minimum tax (AMT) under section 55(e).

1

1

Taxable income or (loss) before net operating loss deduction .

.

.

.

.

.

.

.

.

.

.

.

.

.

2

Adjustments and preferences:

a Depreciation of post-1986 property

2a

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b Amortization of certified pollution control facilities

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2b

c Amortization of mining exploration and development costs

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2c

d Amortization of circulation expenditures (personal holding companies only) .

2d

.

.

.

.

.

.

.

.

e Adjusted gain or loss .

2e

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

f

Long-term contracts .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2f

g Merchant marine capital construction funds

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2g

h Section 833(b) deduction (Blue Cross, Blue Shield, and similar type organizations only) .

2h

.

.

.

.

i

Tax shelter farm activities (personal service corporations only)

.

.

.

.

.

.

.

.

.

.

.

.

.

2i

j

Passive activities (closely held corporations and personal service corporations only) .

.

.

.

.

.

2j

k Loss limitations .

2k

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

l

Depletion .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2l

m Tax-exempt interest income from specified private activity bonds

.

.

.

.

.

.

.

.

.

.

.

.

2m

n Intangible drilling costs

2n

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

o Other adjustments and preferences .

2o

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

Pre-adjustment alternative minimum taxable income (AMTI). Combine lines 1 through 2o .

.

.

.

.

3

4

Adjusted current earnings (ACE) adjustment:

a ACE from line 10 of the ACE worksheet in the instructions .

.

.

.

.

.

.

.

4a

b Subtract line 3 from line 4a. If line 3 exceeds line 4a, enter the difference as a

4b

negative amount. See instructions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

c Multiply line 4b by 75% (0.75). Enter the result as a positive amount

.

.

.

.

4c

d Enter the excess, if any, of the corporation’s total increases in AMTI from prior

year ACE adjustments over its total reductions in AMTI from prior year ACE

adjustments. See instructions. Note: You must enter an amount on line 4d

(even if line 4b is positive)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4d

e ACE adjustment.

}

4e

• If line 4b is zero or more, enter the amount from line 4c

.

.

.

• If line 4b is less than zero, enter the smaller of line 4c or line 4d as a negative amount

5

Combine lines 3 and 4e. If zero or less, stop here; the corporation does not owe any AMT .

.

.

.

5

6

6

Alternative tax net operating loss deduction. See instructions .

.

.

.

.

.

.

.

.

.

.

.

.

.

7

Alternative minimum taxable income. Subtract line 6 from line 5. If the corporation held a residual

interest in a REMIC, see instructions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

Exemption phase-out (if line 7 is $310,000 or more, skip lines 8a and 8b and enter -0- on line 8c):

a Subtract $150,000 from line 7. If completing this line for a member of a

controlled group, see instructions. If zero or less, enter -0- .

.

.

.

.

.

.

.

8a

b Multiply line 8a by 25% (0.25) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8b

c Exemption. Subtract line 8b from $40,000. If completing this line for a member of a controlled group,

see instructions. If zero or less, enter -0-

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8c

9

Subtract line 8c from line 7. If zero or less, enter -0- .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

10

10

Multiply line 9 by 20% (0.20)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

Alternative minimum tax foreign tax credit (AMTFTC). See instructions .

.

.

.

.

.

.

.

.

.

.

11

12

Tentative minimum tax. Subtract line 11 from line 10 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

13

13

Regular tax liability before applying all credits except the foreign tax credit

.

.

.

.

.

.

.

.

.

14

Alternative minimum tax. Subtract line 13 from line 12. If zero or less, enter -0-. Enter here and on

Form 1120, Schedule J, line 3, or the appropriate line of the corporation’s income tax return

.

.

.

14

4626

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 12955I

Form

(2017)

1

1