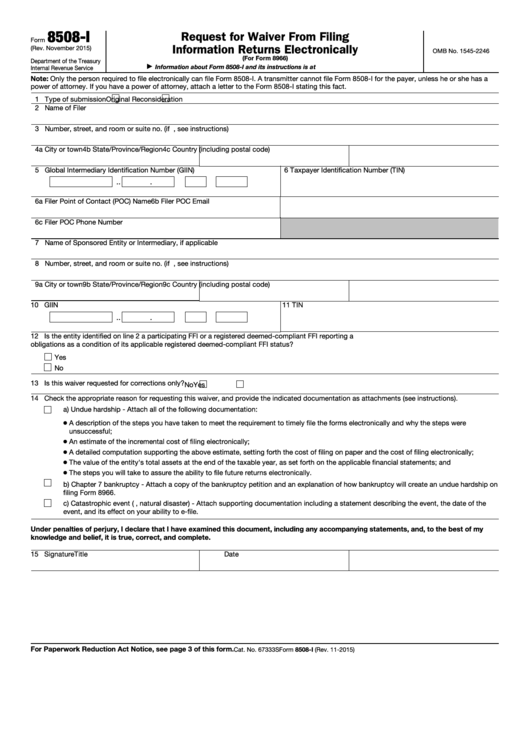

8508-I

Request for Waiver From Filing

Form

Information Returns Electronically

(Rev. November 2015)

OMB No. 1545-2246

(For Form 8966)

Department of the Treasury

Information about Form 8508-I and its instructions is at

▶

Internal Revenue Service

Note: Only the person required to file electronically can file Form 8508-I. A transmitter cannot file Form 8508-I for the payer, unless he or she has a

power of attorney. If you have a power of attorney, attach a letter to the Form 8508-I stating this fact.

1 Type of submission

Original

Reconsideration

2 Name of Filer

3 Number, street, and room or suite no. (if P.O. box, see instructions)

4a City or town

4b State/Province/Region

4c Country (including postal code)

5 Global Intermediary Identification Number (GIIN)

6 Taxpayer Identification Number (TIN)

.

.

.

6a Filer Point of Contact (POC) Name

6b Filer POC Email

6c Filer POC Phone Number

7 Name of Sponsored Entity or Intermediary, if applicable

8 Number, street, and room or suite no. (if P.O. box, see instructions)

9a City or town

9b State/Province/Region

9c Country (including postal code)

10 GIIN

11 TIN

.

.

.

12 Is the entity identified on line 2 a participating FFI or a registered deemed-compliant FFI reporting a U.S. account for which it has reporting

obligations as a condition of its applicable registered deemed-compliant FFI status?

Yes

No

13 Is this waiver requested for corrections only?

Yes

No

14 Check the appropriate reason for requesting this waiver, and provide the indicated documentation as attachments (see instructions).

a) Undue hardship - Attach all of the following documentation:

A description of the steps you have taken to meet the requirement to timely file the forms electronically and why the steps were

unsuccessful;

An estimate of the incremental cost of filing electronically;

A detailed computation supporting the above estimate, setting forth the cost of filing on paper and the cost of filing electronically;

The value of the entity's total assets at the end of the taxable year, as set forth on the applicable financial statements; and

The steps you will take to assure the ability to file future returns electronically.

b) Chapter 7 bankruptcy - Attach a copy of the bankruptcy petition and an explanation of how bankruptcy will create an undue hardship on

filing Form 8966.

c) Catastrophic event (e.g., natural disaster) - Attach supporting documentation including a statement describing the event, the date of the

event, and its effect on your ability to e-file.

Under penalties of perjury, I declare that I have examined this document, including any accompanying statements, and, to the best of my

knowledge and belief, it is true, correct, and complete.

15 Signature

Title

Date

For Paperwork Reduction Act Notice, see page 3 of this form.

Form 8508-I (Rev. 11-2015)

Cat. No. 67333S

1

1 2

2 3

3 4

4