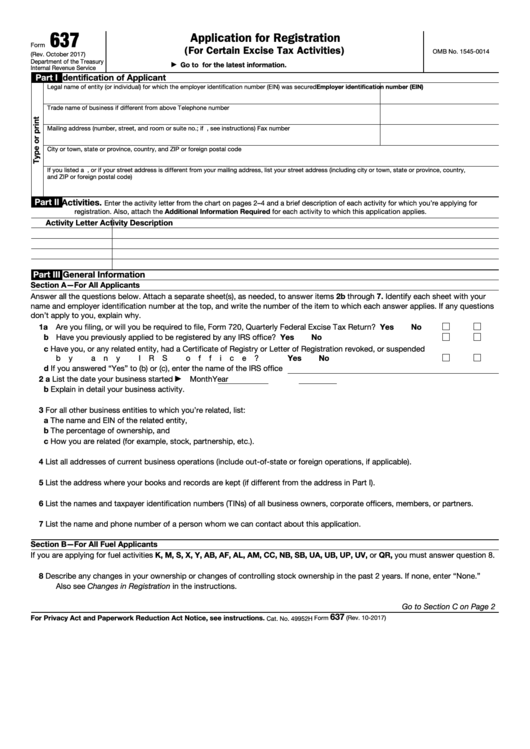

637

Application for Registration

Form

(For Certain Excise Tax Activities)

OMB No. 1545-0014

(Rev. October 2017)

Department of the Treasury

Go to for the latest information.

▶

Internal Revenue Service

Part I

Identification of Applicant

Employer identification number (EIN)

Legal name of entity (or individual) for which the employer identification number (EIN) was secured

Trade name of business if different from above

Telephone number

Mailing address (number, street, and room or suite no.; if P.O. box, see instructions)

Fax number

City or town, state or province, country, and ZIP or foreign postal code

If you listed a P.O. box above, or if your street address is different from your mailing address, list your street address (including city or town, state or province, country,

and ZIP or foreign postal code)

Part II

Activities.

Enter the activity letter from the chart on pages 2–4 and a brief description of each activity for which you’re applying for

registration. Also, attach the Additional Information Required for each activity to which this application applies.

Activity Letter

Activity Description

Part III

General Information

Section A—For All Applicants

Answer all the questions below. Attach a separate sheet(s), as needed, to answer items 2b through 7. Identify each sheet with your

name and employer identification number at the top, and write the number of the item to which each answer applies. If any questions

don’t apply to you, explain why.

1a Are you filing, or will you be required to file, Form 720, Quarterly Federal Excise Tax Return?

Yes

No

.

.

.

.

.

b Have you previously applied to be registered by any IRS office? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

c Have you, or any related entity, had a Certificate of Registry or Letter of Registration revoked, or suspended

Yes

No

by any IRS office? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

d If you answered “Yes” to (b) or (c), enter the name of the IRS office

2 a List the date your business started

Month

Year

▶

b Explain in detail your business activity.

3

For all other business entities to which you’re related, list:

a The name and EIN of the related entity,

b The percentage of ownership, and

c How you are related (for example, stock, partnership, etc.).

4

List all addresses of current business operations (include out-of-state or foreign operations, if applicable).

5

List the address where your books and records are kept (if different from the address in Part I).

6

List the names and taxpayer identification numbers (TINs) of all business owners, corporate officers, members, or partners.

7

List the name and phone number of a person whom we can contact about this application.

Section B—For All Fuel Applicants

If you are applying for fuel activities K, M, S, X, Y, AB, AF, AL, AM, CC, NB, SB, UA, UB, UP, UV, or QR, you must answer question 8.

8

Describe any changes in your ownership or changes of controlling stock ownership in the past 2 years. If none, enter “None.”

Also see Changes in Registration in the instructions.

Go to Section C on Page 2

637

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 10-2017)

Cat. No. 49952H

1

1 2

2 3

3 4

4 5

5 6

6