Form Ssa-1020-Inst - General Instructions For Completing The Application For Extra Help With Medicare Prescription Drug Plan Costs Page 5

ADVERTISEMENT

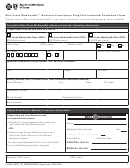

DO NOT COMPLETE THIS IS NOT AN APPLICATION.

8.

If you or your spouse, if married and living together, receive income from any of the sources listed

below, you must answer the questions for both of you. Please enter the total amount you receive

each month. If the amount changes from month to month or you do not receive it every month,

enter the average monthly income for the past year for each type in the appropriate boxes. Do

not list wages and self-employment, interest income, public assistance, medical reimbursements or

foster care payments here. If you or your spouse do not receive income from a source listed below,

place an X in the NONE box for that source.

Monthly Benefit

•

Social Security benefits

$

NONE

,

.

before deductions

•

Railroad Retirement benefits

$

NONE

,

.

before deductions

•

$

Veterans benefits before deductions

NONE

,

.

•

Other pensions or annuities before

deductions. Do not include money

$

NONE

,

.

you receive from any item you

included in question 4.

•

Other income not listed above,

including alimony, net rental income,

$

workers compensation, unemployment,

NONE

,

.

private or State disability payments, etc.

(Specify):

9.

Have any of the amounts you included in question 8 decreased during the last two years?

YES

NO

If you have worked in the last two years, you need to answer questions 10-14. If

you are married and living with your spouse and either one of you has worked

in the last two years, you need to answer questions 10-14. Otherwise, skip to

question 15.

10.

What do you expect to earn in wages before taxes and deductions this calendar year?

YOU:

NONE

$

,

.

NONE

SPOUSE:

$

,

.

SSA-1020-INST

Form

(01-2014)

Page 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8