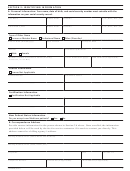

SECtion 4: PraCtiCE loCation inforMation

a. Establishing a Professional Corporation, Professional association, limited liability Company, etc.

If you are the sole owner of a professional corporation, a professional association, or a limited liability

company, and will bill Medicare through this business entity, complete this section 4A, skip to Section 4C,

and complete the remainder of the application with information about your business entity.

Legal Business Name as Reported to the Internal Revenue Service

Tax Identification Number

Medicare Identification Number (if issued)

NPI

Incorporation Date (mm/dd/yyyy) (if applicable)

State Where Incorporated (if applicable)

Is this supplier an Indian Health Facility enrolling with the designated Indian Health Services (IHS) Medicare

Administrative Contractor (MAC)?

Yes

No

Identify the type of organizational structure of this provider/supplier (Check one)

Corporation

Limited Liability Company

Partnership

Sole Proprietor

Other (Specify):

____________

Identify how your business is registered with the IRS. (notE: If your business is a Federal and/or State

government provider or supplier, indicate “Non-Profit” below.)

Proprietary

Non-Profit

notE: If a checkbox indicating Proprietaryship or non-profit status is not completed, the provider/supplier

will be defaulted to “Proprietary.”

final advErSE lEgal aCtion hiStory

1. Has your organization, under any current or former name or business identity, ever had any of the

final adverse legal actions listed on page 12 of this application imposed against it?

YES–Continue Below

NO–Skip to Section 4B

2. If yes, report each final adverse legal action, when it occurred, the Federal or State agency or the court/

administrative body that imposed the action, and the resolution, if any.

Attach a copy of the final adverse legal action documentation and resolution.

final advErSE lEgal aCtion

datE

taKEn by

rESolution

If you are the sole owner of a professional corporation, a professional association, or a limited

liability company, and will bill Medicare through this business entity, you do not need to complete a

CMS-855R that reassigns your benefits to the business entity.

b. individual affiliations

Complete this section with information about your private practice and group affiliations.

Furnish the requested information about each group/organization to which you will reassign your benefits.

In addition, either you or each group/organization reported in this section must complete and submit a

CMS 855R(s) (Individual Reassignment of Benefits) with this application. Reassigning benefits means that

you are authorizing the group/organization to bill and receive payment from Medicare for the services you

have rendered at the group/organization’s practice location.

If you are an individual who is reassigning all of your benefits to a group, neither you nor the group needs

to submit a CMS-588 (Electronic Funds Transfer Authorization Agreement) to facilitate that reassignment.

CMS-855I (07/11)

14

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28