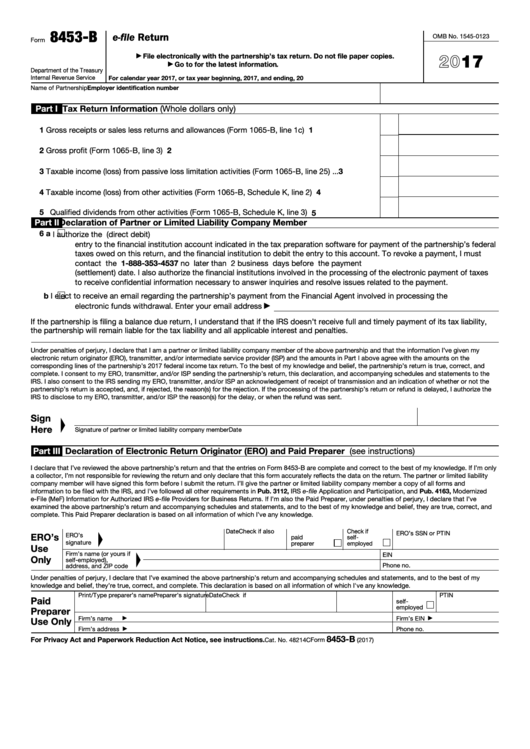

8453-B

U.S. Electing Large Partnership Declaration for an IRS e-file Return

OMB No. 1545-0123

Form

2017

File electronically with the partnership’s tax return. Do not file paper copies.

▶

Go to for the latest information.

▶

Department of the Treasury

Internal Revenue Service

For calendar year 2017, or tax year beginning

, 2017, and ending

, 20

Name of Partnership

Employer identification number

Part I

Tax Return Information (Whole dollars only)

1 Gross receipts or sales less returns and allowances (Form 1065-B, line 1c) .

.

.

.

.

.

1

2 Gross profit (Form 1065-B, line 3)

2

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3 Taxable income (loss) from passive loss limitation activities (Form 1065-B, line 25)

.

.

.

3

4 Taxable income (loss) from other activities (Form 1065-B, Schedule K, line 2) .

4

.

.

.

.

5 Qualified dividends from other activities (Form 1065-B, Schedule K, line 3) .

.

.

.

.

.

5

Part II

Declaration of Partner or Limited Liability Company Member

6 a

I authorize the U.S. Treasury and its designated Financial Agent to initiate an electronic funds withdrawal (direct debit)

entry to the financial institution account indicated in the tax preparation software for payment of the partnership’s federal

taxes owed on this return, and the financial institution to debit the entry to this account. To revoke a payment, I must

contact the U.S. Treasury Financial Agent at 1-888-353-4537 no later than 2 business days before the payment

(settlement) date. I also authorize the financial institutions involved in the processing of the electronic payment of taxes

to receive confidential information necessary to answer inquiries and resolve issues related to the payment.

b

I elect to receive an email regarding the partnership’s payment from the Financial Agent involved in processing the

electronic funds withdrawal. Enter your email address

▶

If the partnership is filing a balance due return, I understand that if the IRS doesn’t receive full and timely payment of its tax liability,

the partnership will remain liable for the tax liability and all applicable interest and penalties.

Under penalties of perjury, I declare that I am a partner or limited liability company member of the above partnership and that the information I’ve given my

electronic return originator (ERO), transmitter, and/or intermediate service provider (ISP) and the amounts in Part I above agree with the amounts on the

corresponding lines of the partnership’s 2017 federal income tax return. To the best of my knowledge and belief, the partnership’s return is true, correct, and

complete. I consent to my ERO, transmitter, and/or ISP sending the partnership’s return, this declaration, and accompanying schedules and statements to the

IRS. I also consent to the IRS sending my ERO, transmitter, and/or ISP an acknowledgement of receipt of transmission and an indication of whether or not the

partnership’s return is accepted, and, if rejected, the reason(s) for the rejection. If the processing of the partnership’s return or refund is delayed, I authorize the

IRS to disclose to my ERO, transmitter, and/or ISP the reason(s) for the delay, or when the refund was sent.

Sign

Here

Signature of partner or limited liability company member

Date

Part III

Declaration of Electronic Return Originator (ERO) and Paid Preparer (see instructions)

I declare that I’ve reviewed the above partnership’s return and that the entries on Form 8453-B are complete and correct to the best of my knowledge. If I’m only

a collector, I’m not responsible for reviewing the return and only declare that this form accurately reflects the data on the return. The partner or limited liability

company member will have signed this form before I submit the return. I’ll give the partner or limited liability company member a copy of all forms and

information to be filed with the IRS, and I’ve followed all other requirements in Pub. 3112, IRS e-file Application and Participation, and Pub. 4163, Modernized

e-File (MeF) Information for Authorized IRS e-file Providers for Business Returns. If I’m also the Paid Preparer, under penalties of perjury, I declare that I’ve

examined the above partnership’s return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and

complete. This Paid Preparer declaration is based on all information of which I’ve any knowledge.

Date

Check if also

Check if

ERO’s SSN or PTIN

ERO’s

ERO’s

paid

self-

signature

preparer

employed

Use

Firm’s name (or yours if

EIN

Only

self-employed),

Phone no.

address, and ZIP code

Under penalties of perjury, I declare that I’ve examined the above partnership’s return and accompanying schedules and statements, and to the best of my

knowledge and belief, they’re true, correct, and complete. This declaration is based on all information of which I've any knowledge.

Print/Type preparer’s name

Preparer’s signature

Date

Check if

PTIN

Paid

self-

employed

Preparer

Firm’s name

Firm’s EIN

Use Only

▶

▶

Firm’s address

Phone no.

▶

8453-B

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Cat. No. 48214C

Form

(2017)

1

1 2

2