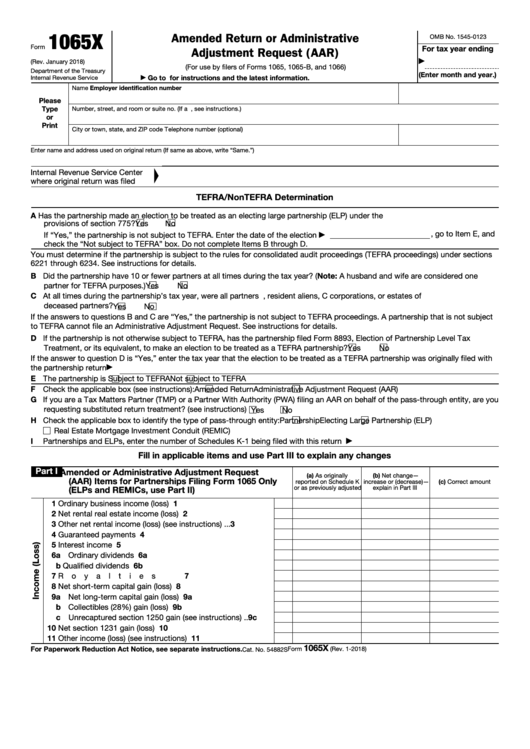

1065X

Amended Return or Administrative

OMB No. 1545-0123

Form

For tax year ending

Adjustment Request (AAR)

(Rev. January 2018)

▶

(For use by filers of Forms 1065, 1065-B, and 1066)

Department of the Treasury

(Enter month and year.)

Go to for instructions and the latest information.

Internal Revenue Service

▶

Name

Employer identification number

Please

Type

Number, street, and room or suite no. (If a P.O. box, see instructions.)

or

Print

City or town, state, and ZIP code

Telephone number (optional)

Enter name and address used on original return (If same as above, write “Same.”)

Internal Revenue Service Center

where original return was filed

TEFRA/NonTEFRA Determination

A Has the partnership made an election to be treated as an electing large partnership (ELP) under the

provisions of section 775?

Yes

No

, go to Item E, and

If “Yes,” the partnership is not subject to TEFRA. Enter the date of the election

▶

check the “Not subject to TEFRA” box. Do not complete Items B through D.

You must determine if the partnership is subject to the rules for consolidated audit proceedings (TEFRA proceedings) under sections

6221 through 6234. See instructions for details.

B Did the partnership have 10 or fewer partners at all times during the tax year? (Note: A husband and wife are considered one

partner for TEFRA purposes.)

Yes

No

C At all times during the partnership’s tax year, were all partners U.S. citizens, resident aliens, C corporations, or estates of

deceased partners?

Yes

No

If the answers to questions B and C are “Yes,” the partnership is not subject to TEFRA proceedings. A partnership that is not subject

to TEFRA cannot file an Administrative Adjustment Request. See instructions for details.

D If the partnership is not otherwise subject to TEFRA, has the partnership filed Form 8893, Election of Partnership Level Tax

Treatment, or its equivalent, to make an election to be treated as a TEFRA partnership?

Yes

No

If the answer to question D is “Yes,” enter the tax year that the election to be treated as a TEFRA partnership was originally filed with

the partnership return

▶

E The partnership is

Subject to TEFRA

Not subject to TEFRA

F Check the applicable box (see instructions):

Amended Return

Administrative Adjustment Request (AAR)

G If you are a Tax Matters Partner (TMP) or a Partner With Authority (PWA) filing an AAR on behalf of the pass-through entity, are you

requesting substituted return treatment? (see instructions)

Yes

No

H Check the applicable box to identify the type of pass-through entity:

Partnership

Electing Large Partnership (ELP)

Real Estate Mortgage Investment Conduit (REMIC)

I

Partnerships and ELPs, enter the number of Schedules K-1 being filed with this return

.

.

.

.

.

.

▶

Fill in applicable items and use Part III to explain any changes

Part I

Amended or Administrative Adjustment Request

(a) As originally

(b) Net change—

(AAR) Items for Partnerships Filing Form 1065 Only

reported on Schedule K

increase or (decrease)—

(c) Correct amount

or as previously adjusted

explain in Part III

(ELPs and REMICs, use Part II)

1

Ordinary business income (loss) .

.

.

.

.

.

.

.

1

2

Net rental real estate income (loss)

.

.

.

.

.

.

.

2

3

Other net rental income (loss) (see instructions) .

.

.

3

4

4

Guaranteed payments

.

.

.

.

.

.

.

.

.

.

.

5

Interest income .

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6a Ordinary dividends

.

.

.

.

.

.

.

.

.

.

.

.

6a

b Qualified dividends

6b

.

.

.

.

.

.

.

.

.

.

.

.

7

Royalties .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

Net short-term capital gain (loss) .

.

.

.

.

.

.

.

8

9a Net long-term capital gain (loss) .

9a

.

.

.

.

.

.

.

b Collectibles (28%) gain (loss) .

.

.

.

.

.

.

.

.

9b

c Unrecaptured section 1250 gain (see instructions) .

.

9c

10

10

Net section 1231 gain (loss)

.

.

.

.

.

.

.

.

.

11

11

Other income (loss) (see instructions)

.

.

.

.

.

.

1065X

For Paperwork Reduction Act Notice, see separate instructions.

Form

(Rev. 1-2018)

Cat. No. 54882S

1

1 2

2 3

3 4

4