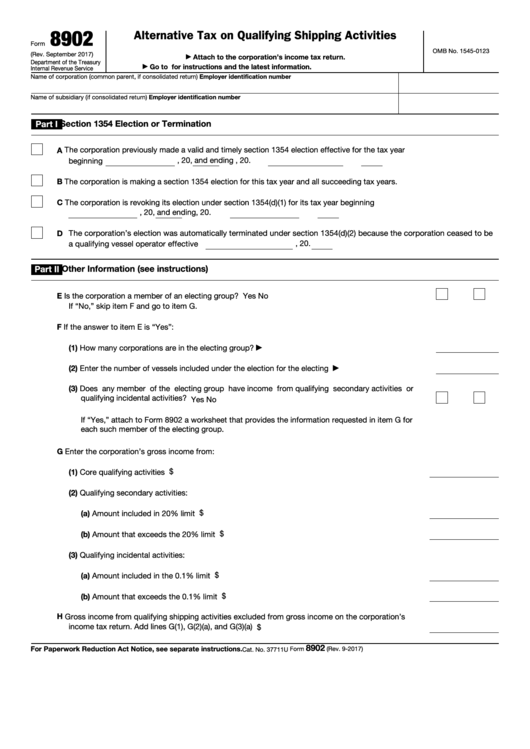

8902

Alternative Tax on Qualifying Shipping Activities

Form

OMB No. 1545-0123

(Rev. September 2017)

Attach to the corporation’s income tax return.

▶

Department of the Treasury

Go to for instructions and the latest information.

▶

Internal Revenue Service

Name of corporation (common parent, if consolidated return)

Employer identification number

Name of subsidiary (if consolidated return)

Employer identification number

Part I

Section 1354 Election or Termination

A The corporation previously made a valid and timely section 1354 election effective for the tax year

, 20

, and ending

, 20

.

beginning

B The corporation is making a section 1354 election for this tax year and all succeeding tax years.

C The corporation is revoking its election under section 1354(d)(1) for its tax year beginning

, 20

, and ending

, 20

.

D The corporation’s election was automatically terminated under section 1354(d)(2) because the corporation ceased to be

, 20

.

a qualifying vessel operator effective

Other Information (see instructions)

Part II

E Is the corporation a member of an electing group? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

If “No,” skip item F and go to item G.

F If the answer to item E is “Yes”:

(1) How many corporations are in the electing group? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

(2) Enter the number of vessels included under the election for the electing group .

.

.

.

.

.

.

▶

(3) Does any member of the electing group have income from qualifying secondary activities or

qualifying incidental activities?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

If “Yes,” attach to Form 8902 a worksheet that provides the information requested in item G for

each such member of the electing group.

G Enter the corporation’s gross income from:

$

(1) Core qualifying activities

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(2) Qualifying secondary activities:

$

(a) Amount included in 20% limit

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

$

(b) Amount that exceeds the 20% limit

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(3) Qualifying incidental activities:

$

(a) Amount included in the 0.1% limit .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

$

(b) Amount that exceeds the 0.1% limit

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

H Gross income from qualifying shipping activities excluded from gross income on the corporation’s

income tax return. Add lines G(1), G(2)(a), and G(3)(a) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

$

8902

For Paperwork Reduction Act Notice, see separate instructions.

Form

(Rev. 9-2017)

Cat. No. 37711U

1

1 2

2