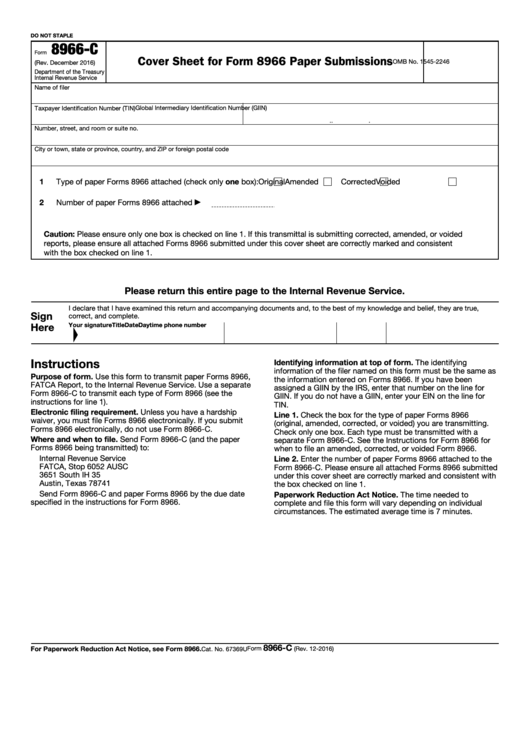

DO NOT STAPLE

8966-C

Form

Cover Sheet for Form 8966 Paper Submissions

OMB No. 1545-2246

(Rev. December 2016)

Department of the Treasury

Internal Revenue Service

Name of filer

Global Intermediary Identification Number (GIIN)

Taxpayer Identification Number (TIN)

.

.

.

Number, street, and room or suite no.

City or town, state or province, country, and ZIP or foreign postal code

1

Type of paper Forms 8966 attached (check only one box):

Original

Amended

Corrected

Voided

2

Number of paper Forms 8966 attached

▶

Caution: Please ensure only one box is checked on line 1. If this transmittal is submitting corrected, amended, or voided

reports, please ensure all attached Forms 8966 submitted under this cover sheet are correctly marked and consistent

with the box checked on line 1.

Please return this entire page to the Internal Revenue Service.

I declare that I have examined this return and accompanying documents and, to the best of my knowledge and belief, they are true,

Sign

correct, and complete.

Here

Your signature

Title

Date

Daytime phone number

Instructions

Identifying information at top of form. The identifying

information of the filer named on this form must be the same as

Purpose of form. Use this form to transmit paper Forms 8966,

the information entered on Forms 8966. If you have been

FATCA Report, to the Internal Revenue Service. Use a separate

assigned a GIIN by the IRS, enter that number on the line for

Form 8966-C to transmit each type of Form 8966 (see the

GIIN. If you do not have a GIIN, enter your EIN on the line for

instructions for line 1).

TIN.

Electronic filing requirement. Unless you have a hardship

Line 1. Check the box for the type of paper Forms 8966

waiver, you must file Forms 8966 electronically. If you submit

(original, amended, corrected, or voided) you are transmitting.

Forms 8966 electronically, do not use Form 8966-C.

Check only one box. Each type must be transmitted with a

Where and when to file. Send Form 8966-C (and the paper

separate Form 8966-C. See the Instructions for Form 8966 for

Forms 8966 being transmitted) to:

when to file an amended, corrected, or voided Form 8966.

Internal Revenue Service

Line 2. Enter the number of paper Forms 8966 attached to the

FATCA, Stop 6052 AUSC

Form 8966-C. Please ensure all attached Forms 8966 submitted

3651 South IH 35

under this cover sheet are correctly marked and consistent with

Austin, Texas 78741

the box checked on line 1.

Send Form 8966-C and paper Forms 8966 by the due date

Paperwork Reduction Act Notice. The time needed to

specified in the instructions for Form 8966.

complete and file this form will vary depending on individual

circumstances. The estimated average time is 7 minutes.

8966-C

For Paperwork Reduction Act Notice, see Form 8966.

Form

(Rev. 12-2016)

Cat. No. 67369U

1

1