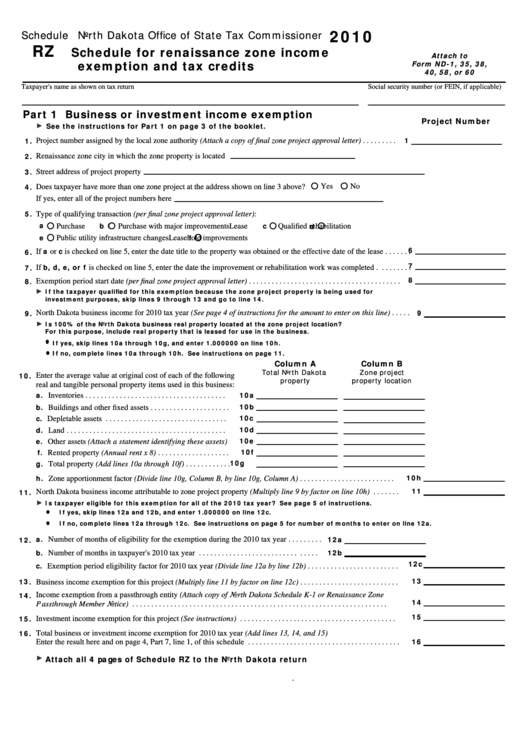

2010

Schedule

North Dakota Office of State Tax Commissioner

RZ

Schedule for renaissance zone income

Attach to

exemption and tax credits

Form ND-1, 35, 38,

40, 58, or 60

Taxpayer's name as shown on tax return

Social security number (or FEIN, if applicable)

Part 1 Business or investment income exemption

Project Number

See the instructions for Part 1 on page 3 of the booklet.

1

1.

Project number assigned by the local zone authority (Attach a copy of final zone project approval letter) . . . . . . . . .

2.

Renaissance zone city in which the zone property is located

3.

Street address of project property

4.

Does taxpayer have more than one zone project at the address shown on line 3 above?

Yes

No

If yes, enter all of the project numbers here

5.

Type of qualifying transaction (per final zone project approval letter):

a

b

c

d

Purchase

Purchase with major improvements

Lease

Qualified rehabilitation

e

f

Public utility infrastructure changes

Leasehold improvements

6

a

c

6.

If

or

is checked on line 5, enter the date title to the property was obtained or the effective date of the lease . . . . . . .

7

b, d, e, or f

7.

If

is checked on line 5, enter the date the improvement or rehabilitation work was completed . . . . . . . . .

8

8.

Exemption period start date (per final zone project approval letter) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If the taxpayer qualified for this exemption because the zone project property is being used for

investment purposes, skip lines 9 through 13 and go to line 14.

9.

9

North Dakota business income for 2010 tax year (See page 4 of instructions for the amount to enter on this line) . . . . .

Is 100% of the North Dakota business real property located at the zone project location?

For this purpose, include real property that is leased for use in the business.

If yes, skip lines 10a through 10g, and enter 1.000000 on line 10h.

If no, complete lines 10a through 10h. See instructions on page 11.

Column A

Column B

Total North Dakota

Zone project

10.

Enter the average value at original cost of each of the following

property

property location

real and tangible personal property items used in this business:

a.

10a

Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10b

b.

Buildings and other fixed assets . . . . . . . . . . . . . . . . . . . . .

10c

c.

Depletable assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10d

d.

Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10e

e.

Other assets (Attach a statement identifying these assets)

10f

f.

Rented property (Annual rent x 8) . . . . . . . . . . . . . . . . . . .

10g

g.

Total property (Add lines 10a through 10f) . . . . . . . . . . . .

10h

h.

Zone apportionment factor (Divide line 10g, Column B, by line 10g, Column A) . . . . . . . . . . . . . . . . . . . . . . . . .

11

11.

North Dakota business income attributable to zone project property (Multiply line 9 by factor on line 10h) . . . . . . .

Is taxpayer eligible for this exemption for all of the 2010 tax year? See page 5 of instructions.

If yes, skip lines 12a and 12b, and enter 1.000000 on line 12c.

If no, complete lines 12a through 12c. See instructions on page 5 for number of months to enter on line 12a.

a.

12.

12a

Number of months of eligibility for the exemption during the 2010 tax year . . . . . . . . .

b.

12b

Number of months in taxpayer's 2010 tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12c

c.

Exemption period eligibility factor for 2010 tax year (Divide line 12a by line 12b) . . . . . . . . . . . . . . . . . . . . . . . .

13

13.

Business income exemption for this project (Multiply line 11 by factor on line 12c) . . . . . . . . . . . . . . . . . . . . . . . . . .

14.

Income exemption from a passthrough entity (Attach copy of North Dakota Schedule K-1 or Renaissance Zone

14

Passthrough Member Notice) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

15.

Investment income exemption for this project (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16.

Total business or investment income exemption for 2010 tax year (Add lines 13, 14, and 15)

16

Enter the result here and on page 4, Part 7, line 1, of this schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Attach all 4 pages of Schedule RZ to the North Dakota return

.

1

1 2

2 3

3 4

4