Form Fllp-1 - Instructions For Statement Of Foreign Qualification - Hawaii Department Of Commerce And Consumer Affairs

ADVERTISEMENT

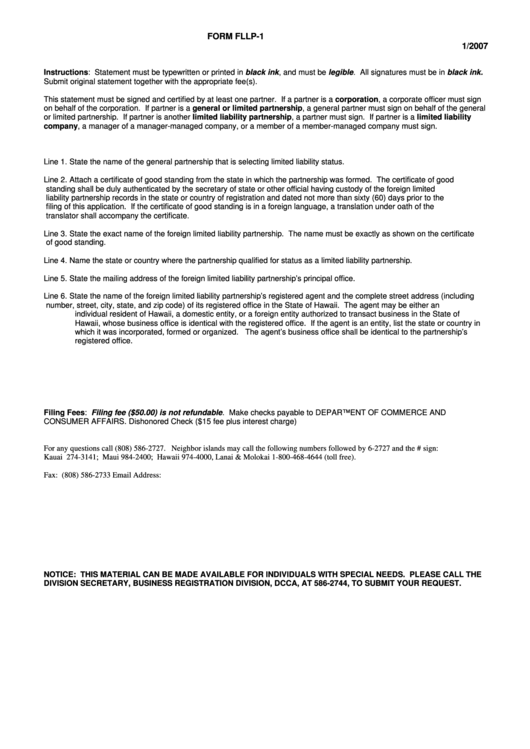

FORM FLLP-1

1/2007

Instructions: Statement must be typewritten or printed in black ink, and must be legible. All signatures must be in black ink.

Submit original statement together with the appropriate fee(s).

This statement must be signed and certified by at least one partner. If a partner is a corporation, a corporate officer must sign

on behalf of the corporation. If partner is a general or limited partnership, a general partner must sign on behalf of the general

or limited partnership. If partner is another limited liability partnership, a partner must sign. If partner is a limited liability

company, a manager of a manager-managed company, or a member of a member-managed company must sign.

Line 1. State the name of the general partnership that is selecting limited liability status.

Line 2. Attach a certificate of good standing from the state in which the partnership was formed. The certificate of good

standing shall be duly authenticated by the secretary of state or other official having custody of the foreign limited

liability partnership records in the state or country of registration and dated not more than sixty (60) days prior to the

filing of this application. If the certificate of good standing is in a foreign language, a translation under oath of the

translator shall accompany the certificate.

Line 3. State the exact name of the foreign limited liability partnership. The name must be exactly as shown on the certificate

of good standing.

Line 4. Name the state or country where the partnership qualified for status as a limited liability partnership.

Line 5. State the mailing address of the foreign limited liability partnership’s principal office.

Line 6. State the name of the foreign limited liability partnership’s registered agent and the complete street address (including

number, street, city, state, and zip code) of its registered office in the State of Hawaii. The agent may be either an

individual resident of Hawaii, a domestic entity, or a foreign entity authorized to transact business in the State of

Hawaii, whose business office is identical with the registered office. If the agent is an entity, list the state or country in

which it was incorporated, formed or organized. The agent’s business office shall be identical to the partnership’s

registered office.

Filing Fees: Filing fee ($50.00) is not refundable. Make checks payable to DEPARTMENT OF COMMERCE AND

CONSUMER AFFAIRS. Dishonored Check ($15 fee plus interest charge)

For any questions call (808) 586-2727. Neighbor islands may call the following numbers followed by 6-2727 and the # sign:

Kauai 274-3141; Maui 984-2400; Hawaii 974-4000, Lanai & Molokai 1-800-468-4644 (toll free).

Fax: (808) 586-2733

Email Address:

breg@dcca.hawaii.gov

NOTICE: THIS MATERIAL CAN BE MADE AVAILABLE FOR INDIVIDUALS WITH SPECIAL NEEDS. PLEASE CALL THE

DIVISION SECRETARY, BUSINESS REGISTRATION DIVISION, DCCA, AT 586-2744, TO SUBMIT YOUR REQUEST.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

- Hawaii Department Of Commerce And Consumer Affairs Forms

- Hawaii Department Of Commerce And Consumer Affairs Business Registration Division Forms

- Indiana Department Of Revenue Schedules

- Unsorted State Of Hawaii Department Of The Attorney General Forms

- State Of Hawaii Department Of The Attorney General Forms

- Hawaii Department Of Commerce And Consumer Affairs Insurance Division Forms

- New York City Department Of Consumer Affairs Forms

- Unsorted State Of California Health And Human Services Agency Forms

- State Of Hawaii Department Of Budget And Finance Forms

- Alabama Department Of Revenue, Tobacco Tax Section Forms

1

1