Form 32-019 - Information Form - Worksheets

ADVERTISEMENT

Information Form

Filing Frequencies

Are you using the correct filing frequency?

Annual: Less than $120 a year in state tax collected

n

Quarterly: Less than $1,500 each month in state tax collected

n

Monthly: More than $1,500 each month in state tax collected

n

Permits cannot be transferred

Permits cannot be transferred from one owner to another or from

one type of business to another, for example, when changing from

a sole proprietorship to a corporation. The prior owner must cancel

his/her permit and the new owner must apply for a new permit.

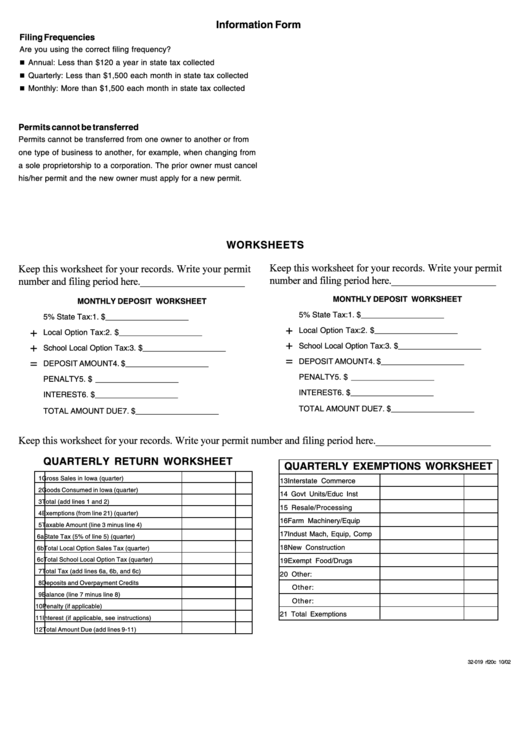

WORKSHEETS

Keep this worksheet for your records. Write your permit

Keep this worksheet for your records. Write your permit

number and filing period here. ____________________

number and filing period here. ____________________

MONTHLY DEPOSIT WORKSHEET

MONTHLY DEPOSIT WORKSHEET

5% State Tax:

1. $ ___________________

5% State Tax:

1. $ ___________________

+

+

Local Option Tax:

2. $ ___________________

Local Option Tax:

2. $ ___________________

+

+

School Local Option Tax: 3. $ ___________________

School Local Option Tax: 3. $ ___________________

=

=

DEPOSIT AMOUNT

4. $ ___________________

DEPOSIT AMOUNT

4. $ ___________________

PENALTY

5. $ ___________________

PENALTY

5. $ ___________________

INTEREST

6. $ ___________________

INTEREST

6. $ ___________________

TOTAL AMOUNT DUE

7. $ ___________________

TOTAL AMOUNT DUE

7. $ ___________________

Keep this worksheet for your records. Write your permit number and filing period here. ______________________

QUARTERLY RETURN WORKSHEET

QUARTERLY EXEMPTIONS WORKSHEET

1 Gross Sales in Iowa (quarter)

13 Interstate Commerce

2 Goods Consumed in Iowa (quarter)

14 Govt Units/Educ Inst

3 Total (add lines 1 and 2)

15 Resale/Processing

4 Exemptions (from line 21) (quarter)

16 Farm Machinery/Equip

5 Taxable Amount (line 3 minus line 4)

17 Indust Mach, Equip, Comp

6a State Tax (5% of line 5) (quarter)

18 New Construction

6b Total Local Option Sales Tax (quarter)

6c Total School Local Option Tax (quarter)

19 Exempt Food/Drugs

7 Total Tax (add lines 6a, 6b, and 6c)

20 Other:

8 Deposits and Overpayment Credits

Other:

9 Balance (line 7 minus line 8)

Other:

10 Penalty (if applicable)

21 Total Exemptions

11 Interest (if applicable, see instructions)

12 Total Amount Due (add lines 9-11)

32-019 rf20c 10/02

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4