Form Mo-Ptc - Property Tax Credit Claim - 1999 Page 4

ADVERTISEMENT

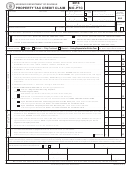

1999 FORM MO-PTC

PAGE 4

PART 2 — OTHER INCOME OR LOSS

Complete Part 2 if you did not file a Form MO-1040 and you had other income or loss not included in Section A, Page 1.

1. Rents and royalties

A. ADDRESS/TYPE

C. DEPRECIATION

F. (COL. B LESS

B. INCOME

D. REPAIRS

E. OTHER EXPENSES

OF RENTAL PROPERTY

(OR DEPLETION)

COLS. C, D, AND E)

00

00

00

00

00

00

00

00

00

00

00

Total of Column F . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2. Sale of real estate, stocks, bonds, etc.

B.

DATE ACQUIRED

AND

DATE SOLD

C. GROSS

D. COST OR OTHER BASIS

E. GAIN OR LOSS

A. KIND OF PROPERTY

MO/DAY/YEAR

MO/DAY/YEAR

SALES PRICE

AND EXPENSE OF SALE

(COL. C LESS COL. D)

00

00

00

00

00

00

00

Total of Column E . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3. Farm, business, partnership, fiduciary and miscellaneous income or loss (specify and enclose schedule)

00

. . . . . . . . . . . . . . .

3

4. Total—add Lines 1 through 3 and enter on Section B, Line C, page 2. Nonbusiness losses

included on Lines 1 through 3 should be entered on Section B, Line G and be added back

00

(not subtracted) to your household income. (See instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

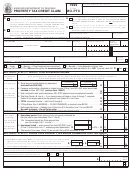

Frequently Asked Questions

1. What is household income?

Household income consists of any income you received throughout the year including: 1) social security; 2) pensions and annuities, dividends and

interest income; 3) public relief or public assistance and unemployment; 4) wages, tips, etc. Your property tax credit is based upon total household

income. (All income whether taxable or non-taxable, must be reported.)

2. Who qualifies for the pharmaceutical tax credit?

Any resident claimant who was age 65 or older, on or before December 31, 1999 qualifies for the pharmaceutical tax credit. If you are married, fil-

ing a combined Form MO-PTC, Property Tax Credit Claim, and you and your spouse are both age 65 or older, then you and your spouse both quali-

fy for the pharmaceutical tax credit. The credit amount is $200 if you were not required to file a Form MO-1040. If you are required to file a Form

MO-1040, you must figure your credit on Form MO-1040.

3. If I am filing a Form MO-1040, do I have to figure the pharmaceutical tax credit on Form MO-1040?

YES!! The pharmaceutical tax credit is based upon Missouri adjusted gross income, rather than household income. The pharmaceutical tax credit

must be reduced if your Missouri adjusted gross income exceeds $15,000.

4. What is the difference between Missouri adjusted gross income and household income?

Missouri adjusted gross income is reported on Form MO-1040 and includes income that is taxable. Household income is reported on Form

MO-PTC and includes some income which may not be taxable and is not included on Form MO-1040, such as social security benefits, SSI, public

relief and public assistance. Your household income is most likely more than your Missouri adjusted gross income.

5. Will the amount of school tax I enter affect my property tax credit?

No. The department needs the amount of school tax applicable to your credit or refund, but the school tax amount will not change the result of your

credit or refund.

6. If I am filing a Form MO-1040, Individual Income Tax Return and a Form MO-PTC, Property Tax Credit Claim, do I have to file them together?

YES!! It is important to file your Form MO-1040 and Form MO-PTC together and mail them to: Missouri Department of Revenue, P.O. Box 2800,

Jefferson City, MO 65105-2800. If you do not file and mail the two forms together, the processing of your return will be delayed. (Form MO-1040A,

Form MO-1040B or Form MO-1040C cannot be filed with Form MO-PTC.)

MO 860-1089 (11-99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4