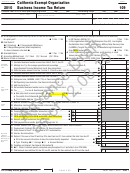

Schedule H Advertising Income and Excess Advertising Costs

Part I Income from Periodicals Reported on a Consolidated Basis

1 Name of periodical

2 Gross

3 Direct

4 Advertising income

5 Circulation

6 Readership

7 If column 5 is greater than

advertising

advertising

or excess advertising

income

costs

column 6, enter the income

income

costs

costs . If column 2 is

shown in column 4, in

greater than column 3,

Part III, column A(b) . If

complete columns 5,

column 6 is greater than

6, and 7 . If column 3

column 5, subtract the sum

is greater than

of column 6 and column 3

column 2, enter the

from the sum of column 5

excess in Part III,

and column 2 . Enter amount

column B(b) . Do not

in Part III, column A(b) . If the

complete columns 5,

amount is less than zero,

6, and 7 .

enter -0- .

Totals . . . . . . . . . . . . . . . . . . .

Part II Income from Periodicals Reported on a Separate Basis

Part III Column A – Net Advertising Income

Part III Column B – Excess Advertising Costs

(a) Enter “consolidated periodical” and/or

(b) Enter total amount from Part I, column 4 or

(a) Enter “consolidated periodical” and/or

(b) Enter total amount from Part I, column 4,

names of non-consolidated periodicals

7, and amounts listed in Part II, cols . 4 and 7

names of non-consolidated periodicals

and amounts listed in Part II, column 4

Enter total here and on Side 2, Part I, line 11

Enter total here and on Side 2, Part II, line 27

Schedule I Compensation of Officers, Directors, and Trustees

1 Name of Officer

2 SSN or ITIN

3 Title

4 Percent of time devoted

5 Compensation attributable

6 Expense account allowances

to business

to unrelated business

%

%

%

%

%

Total . Enter here and on Side 2, Part II, line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

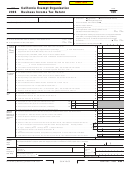

Schedule J Depreciation (Corporations and Associations only. Trusts use form FTB 3885F.)

1 Group and guideline class or description

2 Date acquired

3 Cost or other basis

4 Depreciation allowed

5 Method of computing

6 Life or rate 7 Depreciation for

of property

or allowable in prior

depreciation

this year

years

1 Total additional first-year depreciation (do not include in items below) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Other depreciation:

Buildings . . . . . . . . . . . . . . . . . . . .

Furniture and fixtures . . . . . . . . . . .

Transportation equipment . . . . . . .

Machinery and other equipment . . .

Other (specify)________________

___________________________

3 Other depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Amount of depreciation claimed elsewhere on return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Balance . Subtract line 5 from line 4 . Enter here and on Side 2, Part II, line 21a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Form 109

2010 Side 5

3645103

C1

1

1 2

2 3

3 4

4 5

5