company name

naic no.

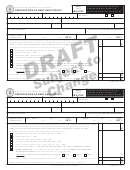

CREDITS FOR GUARANTY ASSOCIATION ASSESSMENTS

credits for missouri property and casualty insurance guaranty association assessments begin the year after the year of

assessment. credits are 33 1/3% for three years.

please complete the following information to support the credit amount shown on line 7 for premium tax credit.

assessment year

assessment amount

percent

credit

2008

33.2%*

2009

33.4%

2010

33 %

.4

TOTAL

0.00%

* lesser of 33.4% or remaining balance

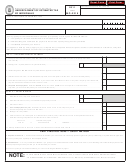

PREMIUM TAX RETURN CHECK LIST

Please verify that the following items have been completed, or are being submitted with your 2011 Premium Tax Return, which

is due March 1, 2012.

make sure the front page is filled out completely, and that it is signed and notarized.

send a copy of page 2 of your company’s annual statement.

send copies of invoices and cancelled checks for any exam fees taken as a credit (both current year and carryover amounts).

send a copy of your company’s annual missouri secretary of state registration fee invoice, along with proof of payment during

2011, to receive this credit. late payment penalties are not allowed to be included in the credit taken on the return. if you have any

questions regarding the filing and payment of your annual registration fee, you can contact the missouri secretary of state’s office

at (866) 223-6535.

send copies of paid personal property tax receipts, or send copies of tax receipts with supporting cancelled check copies for any

personal property tax taken as a credit. the tax receipts must be in your company’s name, and show that it was paid in 2011.

send copies of certificates of contribution for any missouri guaranty association credits taken. complete the information on the top

of this page, listing the credits under the appropriate years.

send approved credit receipts from the issuing agencies for credits taken on page 2, line 7 (see item below for further instructions

for low income housing credit). discrepancies in reporting credits on the appropriate lines may delay the use of the credits.

submit k-1’s, eligibility statements, form 8609’s (first year) and schedule a’s/form 8609a’s in order to take the low income housing

credit on your premium tax return. you will also need to submit a spreadsheet listing each low income housing credit and how it is

distributed for each building. do not round the amounts distributed to each company or individual to the nearest dollar (round to

the nearest penny). if the information is not complete with signatures and dates, the credit will be disallowed.

send copies of receipts and cancelled checks for any other credits taken on the premium tax return. make sure the invoices are in

your company’s name, and that the proof of payment documentation shows payment during 2011.

If the above stated documentation is not submitted for credits claimed, the credits will be disallowed.

mo 375-0429 (10-11)

page 3

1

1 2

2 3

3 4

4