Publication 530 - Tax Information For Homeowners - 2008 Page 4

ADVERTISEMENT

you deducted in an earlier year and that reduced

home mortgage interest if you own a coopera-

appraisal fees, inspection fees, title fees,

your tax, you generally must include the refund

tive apartment and the cooperative housing cor-

attorney fees, and property taxes.

in income in the year you receive it. For more

poration meets the conditions described earlier

6. The funds you provided at or before clos-

information, see Recoveries in Publication 525.

under Special Rules for Cooperatives. In addi-

ing, plus any points the seller paid, were at

The amount of the refund will usually be shown

tion, you can treat as home mortgage interest

least as much as the points charged. The

on the mortgage interest statement you receive

your share of the corporation’s deductible mort-

funds you provided do not have to have

from your mortgage lender. See Mortgage Inter-

gage interest. Figure your share of mortgage

been applied to the points. They can in-

est Statement, later.

interest the same way that is shown for figuring

clude a down payment, an escrow deposit,

your share of real estate taxes in the Example

earnest money, and other funds you paid

under Division of real estate taxes, earlier. For

Deductible Mortgage Interest

at or before closing for any purpose. You

more information on cooperatives, see Special

cannot have borrowed these funds from

Rule for Tenant-Stockholders in Cooperative

To be deductible, the interest you pay must be

your lender or mortgage broker.

Housing Corporations in Publication 936.

on a loan secured by your main home or a

7. You use your loan to buy or build your

Refund of cooperative’s mortgage inter-

second home. The loan can be a first or second

main home.

est. You must reduce your mortgage interest

mortgage, a home improvement loan, or a home

deduction by your share of any cash portion of a

equity loan.

8. The points were computed as a percent-

patronage dividend that the cooperative re-

age of the principal amount of the mort-

Prepaid interest. If you pay interest in ad-

ceives. The patronage dividend is a partial re-

gage.

vance for a period that goes beyond the end of

fund to the cooperative housing corporation of

the tax year, you must spread this interest over

9. The amount is clearly shown on the settle-

mortgage interest it paid in a prior year.

the tax years to which it applies. Generally, you

ment statement (such as the Uniform Set-

If you receive a Form 1098 from the coopera-

can deduct in each year only the interest that

tlement Statement, Form HUD-1) as points

tive housing corporation, the form should show

qualifies as home mortgage interest for that

charged for the mortgage. The points may

only the amount you can deduct.

year. An exception applies to points, which are

be shown as paid from either your funds or

discussed later.

the seller’s.

Mortgage Interest Paid

Late payment charge on mortgage payment.

at Settlement

Note. If you meet all of the tests listed above

You can deduct as home mortgage interest a

late payment charge if it was not for a specific

and you itemize your deductions in the year you

One item that normally appears on a settlement

service in connection with your mortgage loan.

get the loan, you can either deduct the full

or closing statement is home mortgage interest.

amount of points in the year paid or deduct them

You can deduct the interest that you pay at

Mortgage prepayment penalty. If you pay off

over the life of the loan, beginning in the year

settlement if you itemize your deductions on

your home mortgage early, you may have to pay

you get the loan. If you do not itemize your

Schedule A (Form 1040). This amount should

a penalty. You can deduct that penalty as home

deductions in the year you get the loan, you can

be included in the mortgage interest statement

mortgage interest provided the penalty is not for

spread the points over the life of the loan and

provided by your lender. See the discussion

a specific service performed or cost incurred in

deduct the appropriate amount in each future

under Mortgage Interest Statement, later. Also,

connection with your mortgage loan.

year, if any, when you do itemize your deduc-

if you pay interest in advance, see Prepaid inter-

Ground rent. In some states (such as Mary-

tions.

est, earlier, and Points, next.

land), you may buy your home subject to a

Home improvement loan. You can also

ground rent. A ground rent is an obligation you

fully deduct in the year paid points paid on a loan

Points

assume to pay a fixed amount per year on the

to improve your main home, if you meet the first

property. Under this arrangement, you are leas-

six tests listed earlier.

The term “points” is used to describe certain

ing (rather than buying) the land on which your

charges paid, or treated as paid, by a borrower

home is located.

Refinanced loan. If you use part of the refi-

to obtain a home mortgage. Points also may be

nanced mortgage proceeds to improve your

Redeemable ground rents. If you make

called loan origination fees, maximum loan

main home and you meet the first six tests listed

annual or periodic rental payments on a re-

charges, loan discount, or discount points.

earlier, you can fully deduct the part of the points

deemable ground rent, you can deduct the pay-

A borrower is treated as paying any points

related to the improvement in the year you paid

ments as mortgage interest. The ground rent is a

that a home seller pays for the borrower’s mort-

them with your own funds. You can deduct the

redeemable ground rent only if all of the follow-

gage. See Points paid by the seller, later.

rest of the points over the life of the loan.

ing are true.

General rule. You cannot deduct the full

Points not fully deductible in year paid.

If

•

Your lease, including renewal periods, is

amount of points in the year paid. They are

you do not qualify under the exception to deduct

for more than 15 years.

prepaid interest, so you generally must deduct

the full amount of points in the year paid (or

•

them over the life (term) of the mortgage.

You can freely assign the lease.

choose not to do so), see Points in Publication

936, Home Mortgage Interest Deduction, for the

•

Exception. You can deduct the full amount

You have a present or future right (under

rules on when and how much you can deduct.

of points in the year paid if you meet all the

state or local law) to end the lease and

following tests.

buy the lessor’s entire interest in the land

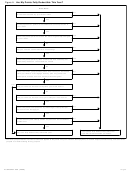

Figure A. You can use Figure A as a quick

by paying a specified amount.

guide to see whether your points are fully de-

1. Your loan is secured by your main home.

•

ductible in the year paid.

The lessor’s interest in the land is primarily

(Generally, your main home is the one you

a security interest to protect the rental

live in most of the time.)

Amounts charged for services. Amounts

payments to which he or she is entitled.

2. Paying points is an established business

charged by the lender for specific services con-

practice in the area where the loan was

Payments made to end the lease and buy the

nected to the loan are not interest. Examples of

made.

lessor’s entire interest in the land are not re-

these charges are:

deemable ground rents. You cannot deduct

3. The points paid were not more than the

•

Appraisal fees,

them.

points generally charged in that area.

•

Notary fees, and

Nonredeemable ground rents. Payments

4. You use the cash method of accounting.

•

on a nonredeemable ground rent are not mort-

Preparation costs for the mortgage note or

This means you report income in the year

gage interest. You can deduct them as rent only

deed of trust.

you receive it and deduct expenses in the

if they are a business expense or if they are for

year you pay them. Most individuals use

You cannot deduct these amounts as points

rental property.

this method.

either in the year paid or over the life of the

mortgage. For information about the tax treat-

Cooperative apartment. You can usually

5. The points were not paid in place of

ment of these amounts and other settlement

treat the interest on a loan you took out to buy

amounts that ordinarily are stated sepa-

stock in a cooperative housing corporation as

rately on the settlement statement, such as

fees and closing costs, see Basis, later.

Publication 530 (2008)

Page 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16