Instructions For Preparing And Filing Dover Tax Form Eqr

ADVERTISEMENT

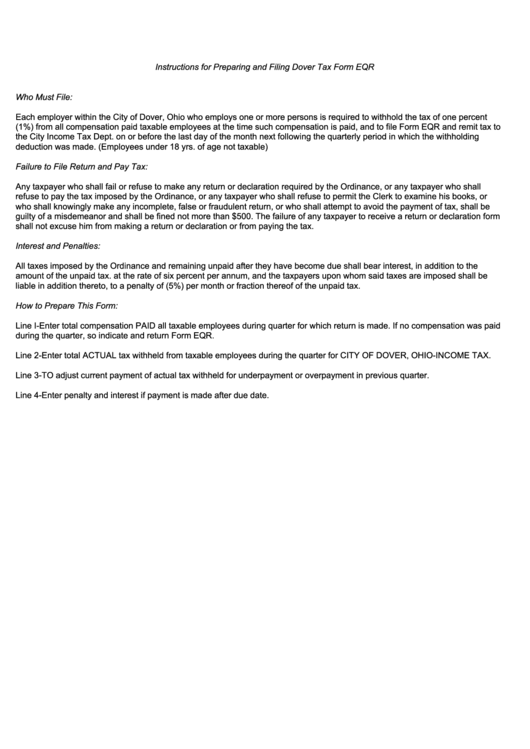

Instructions for Preparing and Filing Dover Tax Form EQR

Who Must File:

Each employer within the City of Dover, Ohio who employs one or more persons is required to withhold the tax of one percent

(1%) from all compensation paid taxable employees at the time such compensation is paid, and to file Form EQR and remit tax to

the City Income Tax Dept. on or before the last day of the month next following the quarterly period in which the withholding

deduction was made. (Employees under 18 yrs. of age not taxable)

Failure to File Return and Pay Tax:

Any taxpayer who shall fail or refuse to make any return or declaration required by the Ordinance, or any taxpayer who shall

refuse to pay the tax imposed by the Ordinance, or any taxpayer who shall refuse to permit the Clerk to examine his books, or

who shall knowingly make any incomplete, false or fraudulent return, or who shall attempt to avoid the payment of tax, shall be

guilty of a misdemeanor and shall be fined not more than $500. The failure of any taxpayer to receive a return or declaration form

shall not excuse him from making a return or declaration or from paying the tax.

Interest and Penalties:

All taxes imposed by the Ordinance and remaining unpaid after they have become due shall bear interest, in addition to the

amount of the unpaid tax. at the rate of six percent per annum, and the taxpayers upon whom said taxes are imposed shall be

liable in addition thereto, to a penalty of (5%) per month or fraction thereof of the unpaid tax.

How to Prepare This Form:

Line I-Enter total compensation PAID all taxable employees during quarter for which return is made. If no compensation was paid

during the quarter, so indicate and return Form EQR.

Line 2-Enter total ACTUAL tax withheld from taxable employees during the quarter for CITY OF DOVER, OHIO-INCOME TAX.

Line 3-TO adjust current payment of actual tax withheld for underpayment or overpayment in previous quarter.

Line 4-Enter penalty and interest if payment is made after due date.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1