If you need additional space to list property under schedules B and C, please attach a separate report in the same format as

below. Write “see attached” on the schedules if this is necessary.

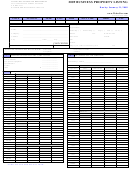

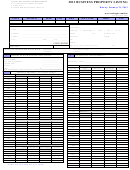

SCHEDULE B. AIRCRAFT, MOBILE HOMES & OFFICES, MULTIYEAR OR IRP REGISTERED TRACTOR TRAILERS, SEMI TRAILERS OR TRAILERS,

UNLICENSED VEHICULAR EQUIPMENT

(DO NOT LIST TAGGED VEHICLES). Short Term Rental or Leased Vehicles with U-Drive It Tags Are Exempt From Property Tax, Session Law 2000-2 Gross

Receipts Tax Replaces the Ad Valorem Tax Previously Levied On These Vehicles

CAT

MAKE

MODEL

YEAR

VIN/SPEC. BODY

COST

TITLE#FAA# FOR OFFICE USE

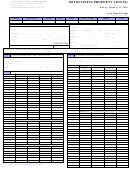

SCHEDULE C. LEASED EQUIPMENT

IN YOUR POSSESSION ON JANUARY 1 (IF ADDITIONAL SPACE NEEDED-ATTACH SHEET) ATTACH COPIES OF ALL LEASE CONTRACTS.

LEASE # OR

MONTHLY

COST NEW

START & END

NAME AND ADDRESS OF OWNER

DESCRIPTION OF PROPERTY

ACCOUNT#

PAYMENT

(QUOTED)

LEASE DATES

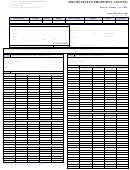

SCHEDULE D. HEAVY EQUIPMENT RENTAL -

Short Term Heavy Rental Equipment is exempt from Property Tax Session law 2008 -144 gross receipts tax replace the Ad Valorem tax previously levied on this equipment.

AFFIRMATION: LISTING FORM MUST BE SIGNED BY LEGALLY AUTHORIZED PERSON

TO AVOID LATE PENALTY, COMPLETE

SEE INSTRUCTIONS

AND RETURN BY FEBRUARY 1, 2016

Under penalties prescribed by law, I hereby affirm that to the best of my knowledge and belief this listing, including any accompanying statements, inventories, schedules,

and other information, is true and complete. (If this affirmation is signed by an individual other than the taxpayer, he affirms that he is familiar with the extent and true cost of

all the taxpayer’s property subject to taxation in this county and that his affirmation is based on all the information of which he has any knowledge.)

SIGN FORM

Registered Agent Name _________________________ Address ____________________________________________ Phone # ______________________

Listing MUST be signed by A PRINCIPAL OFFICER of the taxpayer or a FULL-TIME employee of the taxpayer who has been officially empowered by the principal officer to

list the property. FORMS WITHOUT PROPER SIGNATURE WILL BE RETURNED. (AGENTS AND CPA’S ARE NOT AUTHORIZED TO SIGN FORM)

_____________________________________________________________________

__________________________________________________________________________

SIGNATURE (OWNER/PRINCIPAL OFFICER)

DATE

PREPARER OTHER THAN TAXPAYER

DATE

_____________________________________________________________________

PRINTED NAME

_____________________________________________________________________

__________________________________________________________________________

TITLE

TELEPHONE NUMBER

ADDRESS

TELEPHONE NUMBER

Any individual who willfully makes and subscribes an abstract listing required by this Subchapter 105-310 (of the Revenue Laws) which he does not believe to be true and

correct as to every material matter shall be guilty of Class 2 misdemeanor.

1

1 2

2