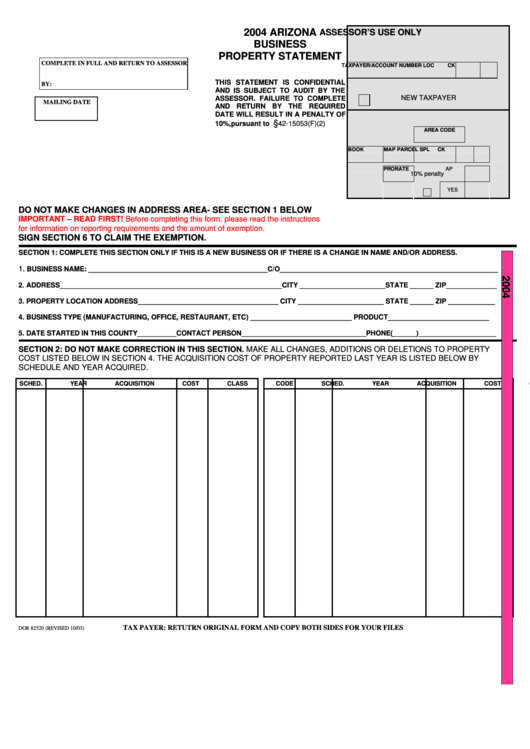

Form Dor 82520 - Arizona Business Property Statement - 2004

ADVERTISEMENT

2004 ARIZONA

ASSESSOR’S USE ONLY

BUSINESS

PROPERTY STATEMENT

COMPLETE IN FULL AND RETURN TO ASSESSOR

TAXPAYER/ACCOUNT NUMBER

LOC

CK

THIS STATEMENT IS CONFIDENTIAL

BY:

AND IS SUBJECT TO AUDIT BY THE

ASSESSOR. FAILURE TO COMPLETE

NEW TAXPAYER

MAILING DATE

AND RETURN BY THE REQUIRED

DATE WILL RESULT IN A PENALTY OF

§

10%,pursuant to A.R.S.

42-15053(F)(2)

AREA CODE

BOOK

MAP

PARCEL

SPL

CK

PRORATE

AP

10% penalty

YES

DO NOT MAKE CHANGES IN ADDRESS AREA- SEE SECTION 1 BELOW

IMPORTANT – READ FIRST! Before completing this form, please read the instructions

for information on reporting requirements and the amount of exemption.

SIGN SECTION 6 TO CLAIM THE EXEMPTION.

SECTION 1: COMPLETE THIS SECTION ONLY IF THIS IS A NEW BUSINESS OR IF THERE IS A CHANGE IN NAME AND/OR ADDRESS.

1

. BUSINESS NAME: ______________________________________________C/O________________________________________________________

2. ADDRESS_________________________________________________________CITY ______________________STATE ______ ZIP_____________

3. PROPERTY LOCATION ADDRESS____________________________________ CITY ______________________ STATE ______ ZIP ____________

4. BUSINESS TYPE (MANUFACTURING, OFFICE, RESTAURANT, ETC) __________________________ PRODUCT__________________________

5. DATE STARTED IN THIS COUNTY__________CONTACT PERSON________________________________PHONE(______)____________________

SECTION 2: DO NOT MAKE CORRECTION IN THIS SECTION. MAKE ALL CHANGES, ADDITIONS OR DELETIONS TO PROPERTY

COST LISTED BELOW IN SECTION 4. THE ACQUISITION COST OF PROPERTY REPORTED LAST YEAR IS LISTED BELOW BY

SCHEDULE AND YEAR ACQUIRED.

SCHED.

YEAR

ACQUISITION COST

CLASS

CODE

SCHED.

YEAR

ACQUISITION COST

CLASS

CODE

TAX PAYER: RETUTRN ORIGINAL FORM AND COPY BOTH SIDES FOR YOUR FILES

DOR 82520 (REVISED 10/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2