DHS-2 Rev. 10-14

Page 28

RESPONSIBILITIES

You have a RESPONSIBILITY to supply the Department with accurate information about your income, resources and living arrangements.

You have a RESPONSIBILITY to tell us immediately (within ten (10) days) of any changes in your income, resources, family composition,

or any other changes that affect your household. For RIW Cash and CCAP, you must tell us immediately (within five (5) days) when

a child leaves your household for any reason. For SNAP, if you are a simplified reporter, you must report changes in income which brings

the household's gross income in excess of the applicable SNAP Gross Income Eligibility Standard for your household size. If you are unsure

about your reporting requirements, contact you DHS worker.

You have a RESPONSIBILITY if you are applying for CCAP, to find a suitable child care provider for your child(ren) and to make

appropriate arrangements to have your child(ren) attend that provider. The Department of Human Services will pay only for those hours

when you are either at work or involved in a DHS approved education/training activity, and the cost of any child care in excess of those hours

is your sole responsibility. If found eligible, you may be responsible for a share of the child care cost (co-payment) and you are responsible

to make such payment directly to your child care provider. If you are not found eligible, you have 30 days from the written notice to request a

hearing in writing to appeal your ineligibility. If the decision of the hearing is not in your favor, DHS is not responsible for any of the child

care costs that you may have incurred with your child care provider. By signing this form, you are authorizing the Department of Human

Services to inform the child care provider(s) after you have been notified if your child care assistance has been approved, discontinued or

denied.

You have a RESPONSIBILITY to provide Social Security numbers (or proof that you have applied for one) for yourself and your

household, or to apply, if you are required to, for them as a condition of eligibility. The collection of information on the application, as well

as the Social Security numbers of all members of your household for whom you receive assistance, is authorized under the Food and

Nutrition Act of 2008 (formerly the Food Stamp Act), as amended, 7 U.S.C. 2011-2036. This information will be used to determine whether

your household is eligible or continues to be eligible to participate in SNAP, MA, RIW, GPA and/or CCAP. The Department will verify this

information through computer matching with the Department of Labor and Training, the Social Security Administration, the Internal Revenue

Service, the Food and Nutrition Service, and other governmental and non-governmental entities authorized by law, regulation or contract,

and they will be subject to verification by Federal, State, and local officials. The income and eligibility information obtained from these

agencies will be used to make sure your household is eligible for and receiving the correct amount of SNAP benefits, GPA, Child Care, RIW,

and/or Medicaid. This information will also be used to monitor compliance with program regulations and for program management.

This information may be disclosed to other Federal and State agencies for official examination, and to law enforcement officials for the

purpose of apprehending persons fleeing to avoid the law. If a claim arises against your household, the information on this application,

including all SSNs, may be referred to Federal and State agencies as well as private claims collection agencies for claims collection action.

Providing the requested information is voluntary. However, failure to provide a SSN will result in the denial of benefits to each individual

failing to provide a SSN. Any SSNs provided will be used and disclosed in the same manner as SSNs of eligible household members.

You have a RESPONSIBILITY to report and provide proof of your expenses shown in questions 29 through 38 in order to get the

maximum amount of SNAP benefits allowed. Failure to report or provide proof of your expenses will be regarded as your statement

that you do not want to receive a deduction for the unreported or unproven expense.

You have a RESPONSIBILITY to cooperate fully with State and Federal personnel conducting quality control reviews.

Only U.S. citizens and certain legal immigrants may be eligible for SNAP benefits. If there are non-citizens living with you who are

not eligible, you may still apply for and receive benefits for other eligible household members. You are not required to provide

immigration information for people not applying for benefits, but you may need to provide other information for those people, such as,

income and resources.

RIW Restrictions on Use of EBT Cash Benefits and Penalties: Pursuant to Section 4004 of Public Law 112-96, it is prohibited for

a TANF recipient to use their TANF cash assistance benefits received under RI Works, Rhode Island General Laws 40-5.2 et seq., in

any electronic benefit transfer transaction (EBT) in:

any liquor store; or

any casino, gambling casino, or gaming establishment; or

any retail establishment which provides adult-oriented entertainment in which performers disrobe or perform in an unclothed

state for entertainment.

Any person receiving cash assistance through the RI Works Program who uses an EBT card in violation of the above standards shall

be subject to the following penalties:

For the first violation, the household will be sent a warning that a prohibited transaction occurred;

For the second violation, the household will be charged a penalty in the amount of the EBT transaction that occurred at the

prohibited location;

For the third and all subsequent violations, the household will be charged a penalty in the amount of the EBT transaction that

occurred at the prohibited location AND for the month following the month of infraction, the amount of cash assistance to

which an otherwise eligible recipient family is entitled shall be reduced by the portion of the family's benefit attributable to

any parent who utilized the EBT card in a restricted location. For a family size of two (2), the benefit reduction due to

noncompliance with use of EBT at a restricted location shall be computed utilizing a family size of three (3), in which the

parent's portion equals one hundred five dollars ($105).

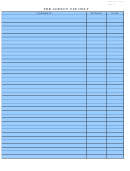

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38