Series 66 Test Specifications Sheet

ADVERTISEMENT

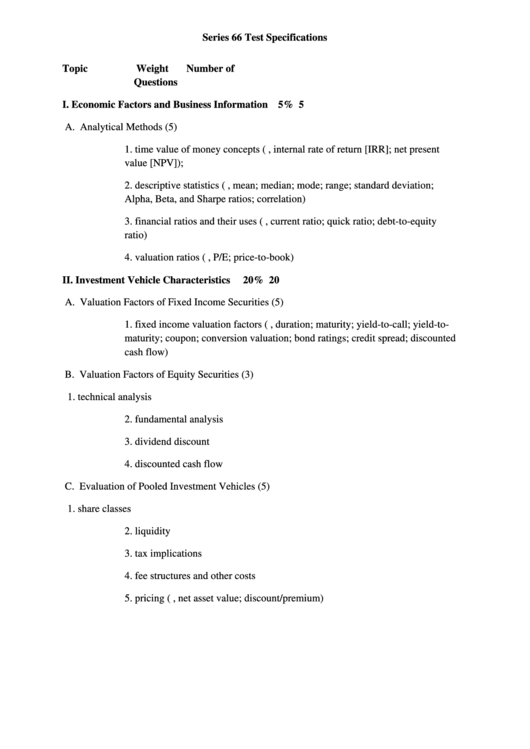

Series 66 Test Specifications

Topic

Weight

Number of

Questions

I. Economic Factors and Business Information

5%

5

A. Analytical Methods (5)

1. time value of money concepts (e.g., internal rate of return [IRR]; net present

value [NPV]);

2. descriptive statistics (e.g., mean; median; mode; range; standard deviation;

Alpha, Beta, and Sharpe ratios; correlation)

3. financial ratios and their uses (e.g., current ratio; quick ratio; debt-to-equity

ratio)

4. valuation ratios (e.g., P/E; price-to-book)

II. Investment Vehicle Characteristics

20%

20

A. Valuation Factors of Fixed Income Securities (5)

1. fixed income valuation factors (e.g., duration; maturity; yield-to-call; yield-to-

maturity; coupon; conversion valuation; bond ratings; credit spread; discounted

cash flow)

B. Valuation Factors of Equity Securities (3)

1. technical analysis

2. fundamental analysis

3. dividend discount

4. discounted cash flow

C. Evaluation of Pooled Investment Vehicles (5)

1. share classes

2. liquidity

3. tax implications

4. fee structures and other costs

5. pricing (e.g., net asset value; discount/premium)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Education

1

1 2

2 3

3 4

4 5

5 6

6