Application For Electronic Refund Account And (If So Designated) Refund Anticipation Loan (Ral) Form

ADVERTISEMENT

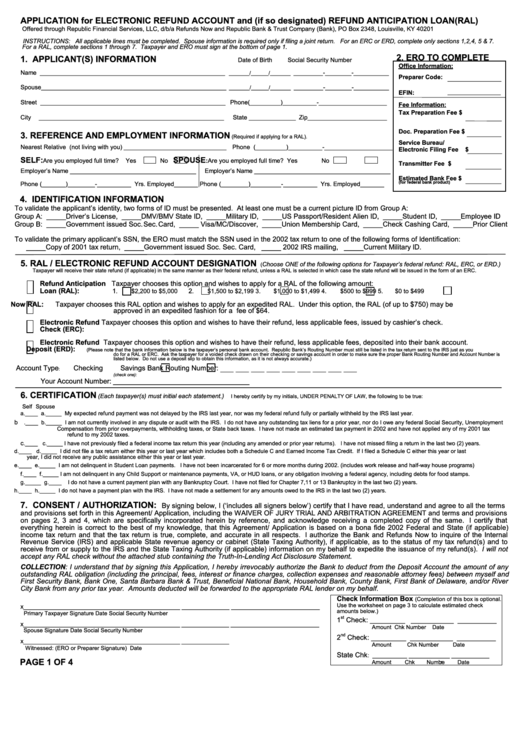

APPLICATION for ELECTRONIC REFUND ACCOUNT and (if so designated) REFUND ANTICIPATION LOAN (RAL)

Offered through Republic Financial Services, LLC, d/b/a Refunds Now and Republic Bank & Trust Company (Bank), PO Box 2348, Louisville, KY 40201

INSTRUCTIONS: All applicable lines must be completed. Spouse information is required only if filing a joint return. For an ERC or ERD, complete only sections 1,2,4, 5 & 7.

For a RAL, complete sections 1 through 7. Taxpayer and ERO must sign at the bottom of page 1.

2. ERO TO COMPLETE

1. APPLICANT(S) INFORMATION

Date of Birth

Social Security Number

Office Information:

Name

-

-

_______________________________________________________________ _______/______/_______ __________

_________

____________

Preparer Code:

Spouse

-

-

_______________________________________________________________ _______/______/_______ __________

_________

____________

EFIN:

Street

Phone (_________)__________-____________________

_______________________________________________________________

Fee Information:

Tax Preparation Fee

$

City

State

Zip

_______________________________________________________________

________________

___________________________

Doc. Preparation Fee $

3. REFERENCE AND EMPLOYMENT INFORMATION

(Required if applying for a RAL).

Service Bureau/

Nearest Relative (not living with you)

Phone (_________)__________-____________________

___________________________________

Electronic Filing Fee

$

SELF:

SPOUSE

Are you employed full time?

Yes

No

: Are you employed full time? Yes

No

Transmitter Fee

$

Employer’s Name _____________________________________

Employer’s Name ________________________________________

Estimated Bank Fee

$

Phone (_______)________-__________ Yrs. Employed_______

Phone (________)_________-__________ Yrs. Employed_______

(for federal bank product)

4. IDENTIFICATION INFORMATION

To validate the applicant’s identity, two forms of ID must be presented. At least one must be a current picture ID from Group A:

Group A: _____Driver’s License, _____DMV/BMV State ID, _____Military ID, _____US Passport/Resident Alien ID, _____Student ID, _____Employee ID

Group B: _____Government issued Soc. Sec. Card, _____ Visa/MC/Discover, _____Union Membership Card, _____Check Cashing Card, _____Prior Client

To validate the primary applicant’s SSN, the ERO must match the SSN used in the 2002 tax return to one of the following forms of Identification:

_____Copy of 2001 tax return, _____Government issued Soc. Sec. Card, _____ 2002 IRS mailing, _____Current Military ID.

5. RAL / ELECTRONIC REFUND ACCOUNT DESIGNATION

Choose ONE of the following options for Taxpayer’s federal refund: RAL, ERC, or ERD.)

(

Taxpayer will receive their state refund (if applicable) in the same manner as their federal refund, unless a RAL is selected in which case the state refund will be issued in the form of an ERC.

Refund Anticipation

Taxpayer chooses this option and wishes to apply for a RAL of the following amount:

Loan (RAL):

1

2.

.

.

$2,200 to $5,000

$1,500 to $2,199

3

$1,000 to $1,499

4.

$500 to $999

5.

$0 to $499

Now RAL:

Taxpayer chooses this RAL option and wishes to apply for an expedited RAL. Under this option, the RAL (of up to $750) may be

approved in an expedited fashion for a fee of $64.

Electronic Refund

Taxpayer chooses this option and wishes to have their refund, less applicable fees, issued by cashier’s check.

Check (ERC):

Electronic Refund

Taxpayer chooses this option and wishes to have their refund, less applicable fees, deposited into their bank account.

Deposit (ERD):

(Please note that the bank information below is the taxpayer’s personal bank account. Republic Bank’s Routing Number must still be listed in the tax return sent to the IRS just as you

do for a RAL or ERC. Ask the taxpayer for a voided check drawn on their checking or savings account in order to make sure the proper Bank Routing Number and Account Number is

listed below. Do not use a deposit slip to obtain this information, as it is not always accurate.)

___ ___ ___ ___ ___ ___ ___ ___ ___

Account Type

Checking

Savings

Bank Routing Number:

:

(check one):

Your Account Number: ___________________________________

6. CERTIFICATION

(Each taxpayer(s) must initial each statement.)

I hereby certify by my initials, UNDER PENALTY OF LAW, the following to be true:

Self

Spouse

a.____

a._____ My expected refund payment was not delayed by the IRS last year, nor was my federal refund fully or partially withheld by the IRS last year.

b

.____

b._____ I am not currently involved in any dispute or audit with the IRS. I do not have any outstanding tax liens for a prior year, nor do I owe any federal Social Security, Unemployment

Compensation from prior overpayments, withholding taxes, or State back taxes. I have not made an estimated tax payment in 2002 and have not applied any of my 2001 tax

refund to my 2002 taxes.

c

.____

c._____ I have not previously filed a federal income tax return this year (including any amended or prior year returns). I have not missed filing a return in the last two (2) years.

d.____

d._____ I did not file a tax return either this year or last year which includes both a Schedule C and Earned Income Tax Credit. If I filed a Schedule C either this year or last

year, I did not receive any public assistance either this year or last year.

e.____

e._____ I am not delinquent in Student Loan payments. I have not been incarcerated for 6 or more months during 2002. (includes work release and half-way house programs)

f.____

f._____ I am not delinquent in any Child Support or maintenance payments, VA, or HUD loans, or any obligation involving a federal agency, including debts for food stamps.

g._____ g.____

I do not have a current payment plan with any Bankruptcy Court. I have not filed for Chapter 7,11 or 13 Bankruptcy in the last two (2) years.

h.____

h._____ I do not have a payment plan with the IRS. I have not made a settlement for any amounts owed to the IRS in the last two (2) years.

7. CONSENT / AUTHORIZATION:

By signing below, I (‘includes all signers below’) certify that I have read, understand and agree to all the terms

and provisions set forth in this Agreement/ Application, including the WAIVER OF JURY TRIAL AND ARBITRATION AGREEMENT and terms and provisions

on pages 2, 3 and 4, which are specifically incorporated herein by reference, and acknowledge receiving a completed copy of the same. I certify that

everything herein is correct to the best of my knowledge, that this Agreement/ Application is based on a bona fide 2002 Federal and State (if applicable)

income tax return and that the tax return is true, complete, and accurate in all respects. I authorize the Bank and Refunds Now to inquire of the Internal

Revenue Service (IRS) and applicable State revenue agency or cabinet (State Taxing Authority), if applicable, as to the status of my tax refund(s) and to

receive from or supply to the IRS and the State Taxing Authority (if applicable) information on my behalf to expedite the issuance of my refund(s). I will not

accept any RAL check without the attached stub containing the Truth-In-Lending Act Disclosure Statement.

COLLECTION: I understand that by signing this Application, I hereby irrevocably authorize the Bank to deduct from the Deposit Account the amount of any

outstanding RAL obligation (including the principal, fees, interest or finance charges, collection expenses and reasonable attorney fees) between myself and

First Security Bank, Bank One, Santa Barbara Bank & Trust, Beneficial National Bank, Household Bank, County Bank, First Bank of Delaware, and/or River

City Bank from any prior tax year. Amounts deducted will be forwarded to the appropriate RAL lender on my behalf.

Check Information Box

(Completion of this box is optional.

Use the worksheet on page 3 to calculate estimated check

x______________________________________________ ______________ __________________________

amounts below.)

Primary Taxpayer Signature

Date

Social Security Number

st

1

Check: _________ ___________ __________

x______________________________________________ ______________ __________________________

Amount

Chk Number

Date

Spouse Signature

Date

Social Security Number

nd

2

Check: _________ ___________ __________

x______________________________________________ ______________

Amount

Chk Number

Date

Witnessed: (ERO or Preparer Signature)

Date

State Chk

: ___________ _____________

____________

PAGE 1 OF 4

Amount

Chk Number

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4