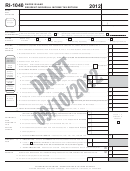

Form Mo-1040p Draft - Missouri Individual Income Tax Return And Property Tax Credit Claim Page 4

ADVERTISEMENT

DRAFT * DRAFT * DRAFT * DRAFT * DRAFT * DRAFT

FORM MO-1040P

Missouri Itemized Deductions

• C omplete this section only if you itemized deductions on your federal return. (See the information on pages 6 and 7.)

• Attach a copy of your Federal Form 1040 (pages 1 and 2) and Federal Schedule A.

• If you are subject to “additional Medicare tax”, attach a copy of Federal Form 8959.

1. Total federal itemized deductions from Federal Form 1040, Line 40 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

2. 2016 Social security tax - (Yourself) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

3. 2016 Social security tax - (Spouse) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4. 2016 Railroad retirement tax - Tier I and Tier II (Yourself) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

5. 2016 Railroad retirement tax - Tier I and Tier II (Spouse) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6. 2016 Medicare tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7. 2016 Self-employment tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8. TOTAL - Add Lines 1 through 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

9

9. State and local income taxes - from Federal Schedule A, Line 5, or see worksheet below. . . .

00

10. Earnings taxes included in Line 9. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

00

11. Net state income taxes - Subtract Line 10 from Line 9 or enter Line 8 from worksheet below. . . . . . . . . . . . . . . . . . . . . . .

11

00

12. MISSOURI ITEMIZED DEDUCTIONS - Subtract Line 11 from Line 8. Enter here and on Form MO-1040P, Line 8 . . . . . . . . 12

00

Note: If Line 12 is less than your federal standard deduction, see information on pages 6 & 7.

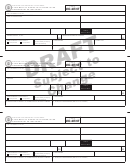

Worksheet For Net State Income Taxes of Missouri Itemized Deductions, Line 11

Complete this worksheet only if your federal adjusted gross income from Federal Form 1040, Line 37 is more than $311,300 if married filing combined or qualifying widow(er),

$285,350 if head of household, $259,400 if single or claimed as a dependent, or $155,650 if married filing separate. If your federal adjusted gross income is less than or equal

to these amounts, do not complete this worksheet. Attach a copy of your Federal Itemized Deduction Worksheet (Page A-13 of Federal Schedule A instructions).

1. Enter amount from Federal Itemized Deduction Worksheet, Line 3

1

00

(See page A-13 of Federal Schedule A instructions.) If $0 or less, enter “0”. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

2. Enter amount from Federal Itemized Deduction Worksheet, Line 9 (See Federal Schedule A instructions.) . . . . . . . . . . .

3

00

3. State and local income taxes from Federal Form 1040, Schedule A, Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

4. Earnings taxes included on Federal Form 1040, Schedule A, Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Subtract Line 4 from Line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6. Divide Line 5 by Line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

%

7. Multiply Line 2 by Line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8. Subtract Line 7 from Line 5. Enter here and on Missouri Itemized Deductions, Line 11 above . . . . . . . . . . . . . . . . . . . . .

8

00

2016 TAX CHART

If Missouri taxable income from Form-1040P, Line 15, is less than $9,000, use the chart to figure tax;

if more than $9,000, use worksheet below or use the online tax calculator at

If the Missouri taxable income is:

The tax is:

$0 to $99 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $0

At least $100 but not over $1,000 . . . . . . . . . . . . 1½% of the Missouri taxable income

FIGURING TAX

Over $1,000 but not over $2,000 . . . . . . . . . . . . . $15 plus 2% of excess over $1,000

ON $9,000 OR LESS

Over $2,000 but not over $3,000 . . . . . . . . . . . . . $35 plus 2½% of excess over $2,000

Over $3,000 but not over $4,000 . . . . . . . . . . . . . $60 plus 3% of excess over $3,000

Example: If Line 15 is $3,090, the tax

would be computed as follows: $60 +

Over $4,000 but not over $5,000 . . . . . . . . . . . . . $90 plus 3½% of excess over $4,000

$2.70 (3% of $90) = $62.70. The whole

Over $5,000 but not over $6,000 . . . . . . . . . . . . . $125 plus 4% of excess over $5,000

dollar amount to enter on Line 16 would

Over $6,000 but not over $7,000 . . . . . . . . . . . . . $165 plus 4½% of excess over $6,000

be $63.

Over $7,000 but not over $8,000 . . . . . . . . . . . . . $210 plus 5% of excess over $7,000

Over $8,000 but not over $9,000 . . . . . . . . . . . . . $260 plus 5½% of excess over $8,000

Over $9,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $315 plus 6% of excess over $9,000

Yourself

Spouse

Example

If more than $9,000,

$ _______________

$ _______________

Missouri taxable income (Line 15) . . . .

tax is $315 PLUS

$ 12,000

6% of excess over

Subtract $9,000 . . . . . . . . . . . . . . . .

– $

9,000

– $

9,000

– $ 9,000

$9,000.

Difference . . . . . . . . . . . . . . . . . . . . .

= $ _______________

= $ _______________

= $ 3,000

Round to nearest

Multiply by 6%. . . . . . . . . . . . . . . . . .

x

6%

x

6%

x

6%

whole dollar and enter

= $ _______________

= $ _______________

Tax on income over $9,000

on Form MO-1040P,

= $

180

Add $315 (tax on first $9,000) . . . . .

+ $

315

+ $

315

Line 16.

+ $

315

TOTAL MISSOURI TAX . . . . . . . . . .

= $ _______________

= $ _______________

= $

495

A separate tax must be computed for you and your spouse.

DRAFT * DRAFT * DRAFT * DRAFT * DRAFT * DRAFT

MO-1040P 2-D (Revised 12-2016)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4