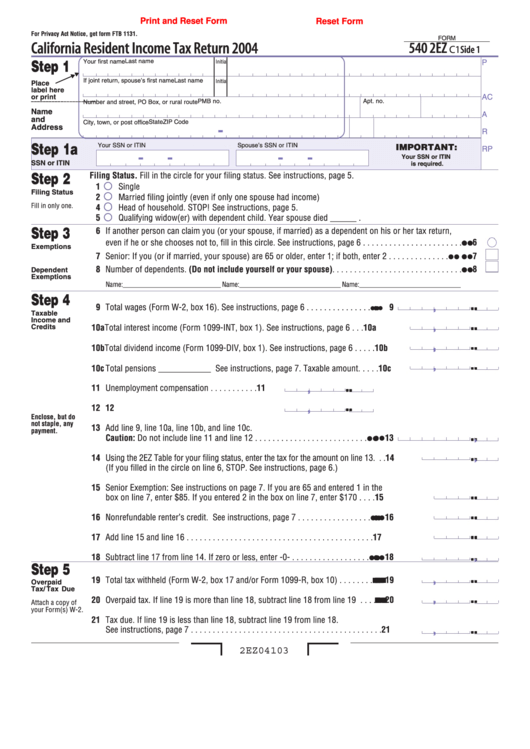

Print and Reset Form

Reset Form

For Privacy Act Notice, get form FTB 1131.

FORM

California Resident Income Tax Return 2004

540 2EZ

C1 Side 1

Last name

Your first name

Initial

P

Step 1

If joint return, spouse’s first name

Last name

Initial

Place

label here

or print

AC

___________

___________

___________

___________

___________

Apt. no.

PMB no.

Number and street, PO Box, or rural route

Name

A

and

State

ZIP Code

City, town, or post office

Address

-

R

Your SSN or ITIN

Spouse’s SSN or ITIN

Step 1a

IMPORTANT:

RP

-

-

-

-

Your SSN or ITIN

SSN or ITIN

is required.

Filing Status. Fill in the circle for your filing status. See instructions, page 5.

Step 2

1

Single

Filing Status

2

Married filing jointly (even if only one spouse had income)

Fill in only one.

4

Head of household. STOP! See instructions, page 5.

5

Qualifying widow(er) with dependent child. Year spouse died ______ .

Step 3

6 If another person can claim you (or your spouse, if married) as a dependent on his or her tax return,

¼ ¼ ¼ ¼ ¼

even if he or she chooses not to, fill in this circle. See instructions, page 6 . . . . . . . . . . . . . . . . . . . . . . .

6

Exemptions

¼ ¼ ¼ ¼ ¼

7 Senior: If you (or if married, your spouse) are 65 or older, enter 1; if both, enter 2 . . . . . . . . . . . . . .

7

¼ ¼ ¼ ¼ ¼

8 Number of dependents. (Do not include yourself or your spouse). . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

Dependent

Exemptions

Name:____________________________ Name:_____________________________ Name:_____________________________

Step 4

9 Total wages (Form W-2, box 16). See instructions, page 6 . . . . . . . . . . . . . . . ¼ ¼ ¼ ¼ ¼

. . . . .

9

,

Taxable

Income and

. . . . .

Credits

10a Total interest income (Form 1099-INT, box 1). See instructions, page 6 . . .

10a

,

. . . . .

,

10b Total dividend income (Form 1099-DIV, box 1). See instructions, page 6 . . . . . 10b

,

. . . . .

,

10c Total pensions ____________ See instructions, page 7. Taxable amount. . . . . 10c

. . . . .

11 Unemployment compensation . . . . . . . . . . .

11

,

. . . . .

12 U.S. Social security or railroad retirement . .

12

,

Enclose, but do

not staple, any

13 Add line 9, line 10a, line 10b, and line 10c.

payment.

¼ ¼ ¼ ¼ ¼

. . . . .

Caution: Do not include line 11 and line 12 . . . . . . . . . . . . . . . . . . . . . . . . . .

13

,

. . . . .

14 Using the 2EZ Table for your filing status, enter the tax for the amount on line 13. . . 14

,

(If you filled in the circle on line 6, STOP. See instructions, page 6.)

15 Senior Exemption: See instructions on page 7. If you are 65 and entered 1 in the

. . . . .

box on line 7, enter $85. If you entered 2 in the box on line 7, enter $170 . . . .

15

¼ ¼ ¼ ¼ ¼

. . . . .

16 Nonrefundable renter’s credit. See instructions, page 7 . . . . . . . . . . . . . . . . .

16

. . . . .

. . . . .

17 Add line 15 and line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

¼ ¼ ¼ ¼ ¼

. . . . .

18 Subtract line 17 from line 14. If zero or less, enter -0- . . . . . . . . . . . . . . . . . .

18

,

Step 5

. . . . .

19 Total tax withheld (Form W-2, box 17 and/or Form 1099-R, box 10) . . . . . . . .

19

,

Overpaid

Tax/ Tax Due

. . . . .

20 Overpaid tax. If line 19 is more than line 18, subtract line 18 from line 19 . . . .

20

,

Attach a copy of

your Form(s) W-2.

21 Tax due. If line 19 is less than line 18, subtract line 19 from line 18.

. . . . .

See instructions, page 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

,

2EZ04103

1

1 2

2