Finance Exam Enclosure: Formula Sheet

ADVERTISEMENT

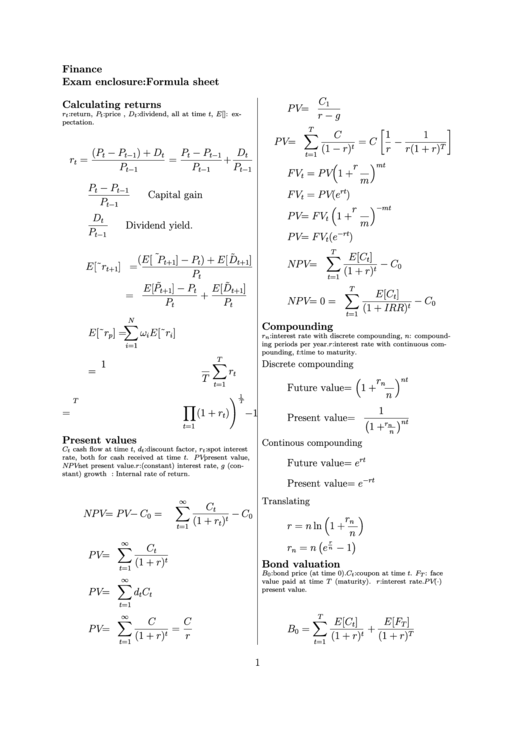

Finance

Exam enclosure: Formula sheet

C

Calculating returns

1

P V =

r : return, P : price , D : dividend, all at time t, E[]: ex-

r

g

pectation.

T

C

1

1

P V =

= C

t

T

(1

r)

r

r(1 + r)

(P

P

) + D

P

P

D

t=1

t

t 1

t

t

t 1

t

r

=

=

+

t

P

P

P

r

mt

t 1

t 1

t 1

F V

= P V 1 +

t

m

P

P

t

t 1

rt

Capital gain

F V

= P V (e

)

t

P

t 1

r

mt

P V = F V

1 +

D

t

t

m

Dividend yield.

P

rt

t 1

P V = F V

(e

)

t

T

E[C

]

(E[ ˜ P

) + E[ ˜ D

]

P

]

t

t+1

t

t+1

N P V =

C

E[˜ r

] =

0

t+1

t

(1 + r)

P

t

t=1

E[ ˜ P

E[ ˜ D

]

P

]

T

t+1

t

t+1

E[C

]

=

+

t

N P V = 0 =

C

P

P

0

t

t

t

(1 + IRR)

t=1

N

Compounding

E[˜ r

] =

ω

E[˜ r

]

p

i

i

r : interest rate with discrete compounding, n: compound-

ing periods per year. r: interest rate with continuous com-

i=1

pounding, t: time to maturity.

T

1

Discrete compounding

Aritmetric avg. return =

r

t

T

r

nt

n

t=1

Future value = 1 +

n

1

T

1

Geometric avg. return =

(1 + r

)

1

t

Present value =

nt

r

1 +

t=1

n

Present values

Continous compounding

C cash flow at time t, d : discount factor, r : spot interest

rate, both for cash received at time t. P V present value,

rt

Future value = e

N P V net present value. r: (constant) interest rate, g (con-

stant) growth rate. IRR: Internal rate of return.

rt

Present value = e

Translating

C

t

N P V = P V

C

=

C

0

0

r

t

(1 + r

)

n

t

r = n ln 1 +

t=1

n

r

= n e

1

C

t

n

P V =

t

(1 + r)

Bond valuation

t=1

B

: bond price (at time 0). C : coupon at time t. F : face

0

value paid at time T (maturity). r: interest rate. P V ( )

present value.

P V =

d

C

t

t

t=1

T

C

C

E[C

]

E[F

]

t

T

P V =

=

B

=

+

0

t

t

T

(1 + r)

r

(1 + r)

(1 + r)

t=1

t=1

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Education

1

1 2

2 3

3 4

4