Schedule Lp - Credit For Removing Or Covering Lead Paint On Residential Premises - 2008 Page 2

ADVERTISEMENT

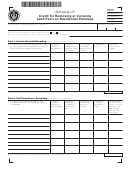

Part 4. Unused Lead Paint Carryover

10 Complete only if line 7 is greater than line 8, or if you have unused credits from prior years.

Year

a. Unused credits from prior years

b. Portion used

c. Unused credit available

and current year credit

this year

S S u u b b t t r r a a c c t t c c o o l l u u m m n n b b f f r r o o m m c c o o l l u u m m n n a a

Amount

For

2002

(2007 Sch. LP, line 10, col. c)

$________________

$________________

$________________

2009

2003

(2007 Sch. LP, line 10, col. c)

$________________

$________________

$________________

2009–2010

2004

(2007 Sch. LP, line 10, col. c)

$________________

$________________

$________________

2009–2011

2005

(2007 Sch. LP, line 10, col. c)

$________________

$________________

$________________

2009–2012

2006

(2007 Sch. LP, line 10, col. c)

$________________

$________________

$________________

2009–2013

2007

(2007 Sch. LP, line 10, col. c)

$________________

$________________

$________________

2009–2014

2008

(2008 Sch. LP, line 5)

$________________

$________________

$________________

2009–2015

General Information

What Are Interim Control Measures?

Interim control measures are deleading activities undertaken to ad-

What Is the Lead Paint Credit?

dress urgent lead hazards pursuant to an emergency lead man-

The Lead Paint Credit is a credit provided for covering or remov-

agement plan pending the issuance of a Letter of Compliance.

ing materials on residential premises in Massachusetts that have

been established as containing dangerously high levels of lead.

What Steps Must Be Taken to Claim the Credit?

The credit for each residence is equal to the cost of the delead-

To claim the Lead Paint Credit, the following steps must be

ing expenses, or $1,500, whichever is less. In addition, a credit

completed:

for interim controls — abatement measures taken pending com-

• The residential unit must be inspected by an inspector (for pur-

plete deleading — is allowed for up to $500 per residence. This

poses of full compliance) or by a risk assessor (for purposes of

$500 amount applies toward the $1,500 limit.

interim control) licensed by the Department of Public Health

What Kinds of Properties Qualify for the Lead

(Childhood Lead Poisoning Prevention Program) who establishes

Paint Credit?

the presence of dangerous levels of lead.

Only “residential premises” qualify for the lead paint removal

• The contaminated areas must be deleaded or interim control

credit. Among the residential premises that qualify for the credit

measures instituted by a licensed deleader or authorized person.

are:

• The property must be reinspected by a licensed risk assessor

• single family homes;

who issues a Letter of Interim Control or by a licensed inspector

• individual units in an apartment building;

who issues a Letter of Compliance.

• condominium units; or

When Does the Taxpayer Become Entitled to

the Credit?

• individual units in multi-family homes.

You are entitled to claim a Lead Paint Credit in the taxable year

Which Taxpayers Are Qualified to Take the

in which compliance is certified or in the year in which the pay-

Credit?

ment for the deleading occurs, whichever is later.

The credit may only be claimed by the owner of a residential

Do not enclose or attach Schedule LP with your return. Retain for

premise.

your records. Taxpayers must also retain a copy of the Letter of

What Type of Work Is Covered by the Credit?

Interim Control and/or Letter of Compliance.

A tax credit is only given for work done actually deleading the

What If My Lead Paint Credit Is Larger Than

contaminated areas. Deleading refers to the removal or covering

My Tax Liability?

of paint, plaster or other materials that could be readily accessi-

If the credit you derive from deleading a residential dwelling

ble to children under the age of six. Only costs that are incurred

amounts to more than the amount you owe in income taxes for

for legally required deleading qualify for the tax credit.

the year, the balance may be carried over into the next tax year.

You may carry over an unused portion of the original credit for

up to seven years.

1500 12/01 CRP0102

printed on recycled paper

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2