Montana Form Iufc - Infrastructure User Fee Credit - 2013

ADVERTISEMENT

1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

3

3

MONTANA

4

4

IUFC

5

5

Rev 06 13

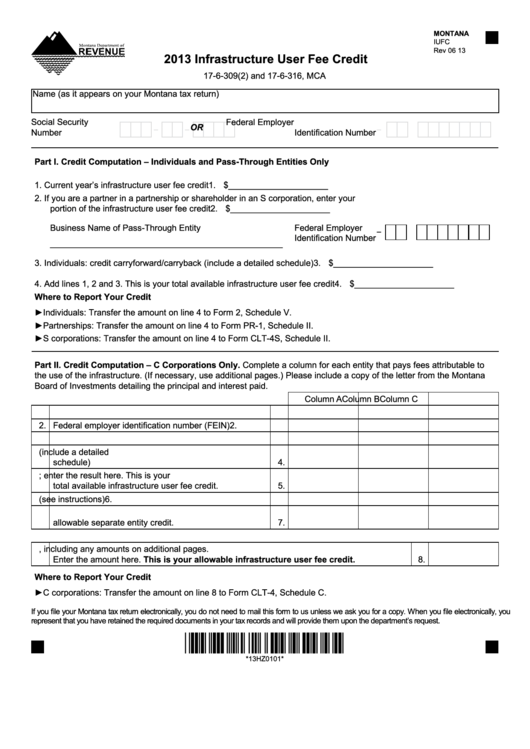

2013 Infrastructure User Fee Credit

6

6

7

7

17-6-309(2) and 17-6-316, MCA

8

8

9

9

Name (as it appears on your Montana tax return)

10

10

11

11

12

12

Social Security

Federal Employer

OR

-

-

-

X X X X X X X X X

X X X X X X X X X

13

13

Number

Identification Number

14

14

15

15

16

Part I. Credit Computation – Individuals and Pass-Through Entities Only

16

17

17

18

18

1. Current year’s infrastructure user fee credit ................................................................ 1. $_____________________

19

19

2. If you are a partner in a partnership or shareholder in an S corporation, enter your

20

20

portion of the infrastructure user fee credit ................................................................. 2. $_____________________

21

21

22

22

Business Name of Pass-Through Entity

Federal Employer

-

X X X X X X X X X

23

23

Identification Number

_________________________________________________

24

24

25

25

3. Individuals: credit carryforward/carryback (include a detailed schedule) .................... 3. $_____________________

26

26

27

27

4. Add lines 1, 2 and 3. This is your total available infrastructure user fee credit ........... 4. $_____________________

28

28

29

Where to Report Your Credit

29

30

30

►Individuals: Transfer the amount on line 4 to Form 2, Schedule V.

31

31

►Partnerships: Transfer the amount on line 4 to Form PR-1, Schedule II.

32

32

33

33

►S corporations: Transfer the amount on line 4 to Form CLT-4S, Schedule II.

34

34

35

35

Part II. Credit Computation – C Corporations Only. Complete a column for each entity that pays fees attributable to

36

36

the use of the infrastructure. (If necessary, use additional pages.) Please include a copy of the letter from the Montana

37

37

Board of Investments detailing the principal and interest paid.

38

38

Column A

Column B

Column C

39

39

40

40

1. Entity name

1.

41

41

2. Federal employer identification number (FEIN)

2.

42

42

3. Current year infrastructure user fee credit

3.

43

43

44

4. Credit carryforward/carryback (include a detailed

44

schedule)

4.

45

45

46

46

5. Add lines 3 and 4; enter the result here. This is your

47

47

total available infrastructure user fee credit.

5.

48

48

6. Montana tax liability (see instructions)

6.

49

49

7. Enter the lesser of line 5 or line 6 here. This is your

50

50

allowable separate entity credit.

7.

51

51

52

52

53

53

8. Add the amounts on line 7 of each column, including any amounts on additional pages.

54

54

Enter the amount here. This is your allowable infrastructure user fee credit.

8.

55

55

56

56

Where to Report Your Credit

57

57

►C corporations: Transfer the amount on line 8 to Form CLT-4, Schedule C.

58

58

59

59

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically, you

60

60

represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

61

61

62

*13HZ0101*

62

63

63

64

64

*13HZ0101*

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

8485

66

66

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2