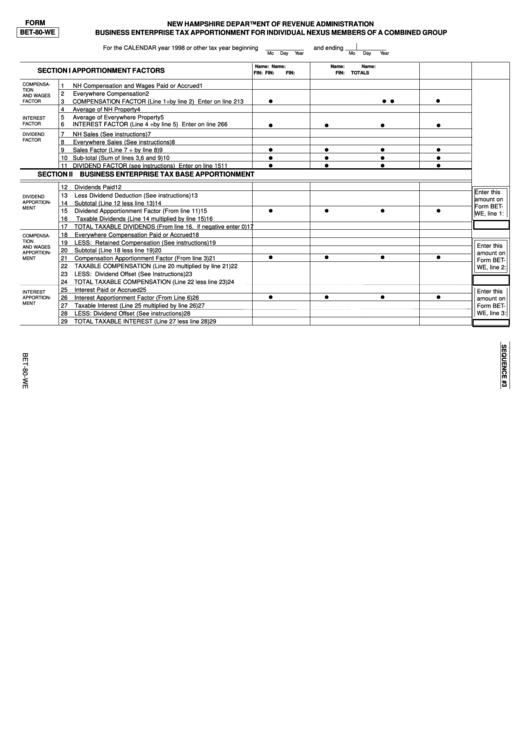

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

BET-80-WE

BUSINESS ENTERPRISE TAX APPORTIONMENT FOR INDIVIDUAL NEXUS MEMBERS OF A COMBINED GROUP

For the CALENDAR year 1998 or other tax year beginning

and ending

Mo

Day

Year

Mo

Day

Year

Name:

Name:

Name:

Name:

SECTION I APPORTIONMENT FACTORS

FIN:

FIN:

FIN:

FIN:

TOTALS

.

.

.

.

COMPENSA-

1

NH Compensation and Wages Paid or Accrued

1

TION

2

Everywhere Compensation

2

AND WAGES

FACTOR

3

COMPENSATION FACTOR (Line 1÷ by line 2) Enter on line 21

3

.

.

.

.

4

Average of NH Property

4

5

Average of Everywhere Property

5

INTEREST

FACTOR

6

INTEREST FACTOR (Line 4 ÷ by line 5) Enter on line 26

6

.

.

.

.

7

NH Sales (See instructions)

7

DIVIDEND

.

.

.

.

FACTOR

8

Everywhere Sales (See instructions)

8

.

.

.

.

9

Sales Factor (Line 7 ÷ by line 8)

9

10 Sub-total (Sum of lines 3,6 and 9)

10

11 DIVIDEND FACTOR (see instructions) Enter on line 15

11

SECTION II BUSINESS ENTERPRISE TAX BASE APPORTIONMENT

12

Dividends Paid

12

Enter this

.

.

.

.

13

Less Dividend Deduction (See instructions)

13

DIVIDEND

amount on

APPORTION-

14

Subtotal (Line 12 less line 13)

14

Form BET-

MENT

15

Dividend Appportionment Factor (From line 11)

15

WE, line 1:

16

Taxable Dividends (Line 14 multiplied by line 15)

16

17

TOTAL TAXABLE DIVIDENDS (From line 16. If negative enter 0)

17

18

Everywhere Compensation Paid or Accrued

18

COMPENSA-

.

.

.

.

TION

19

LESS: Retained Compensation (See instructions)

19

Enter this

AND WAGES

20

Subtotal (Line 18 less line 19)

20

APPORTION-

amount on

21

Compensation Apportionment Factor (From line 3)

21

MENT

Form BET-

22

TAXABLE COMPENSATION (Line 20 multiplied by line 21)

22

WE, line 2:

23

LESS: Dividend Offset (See Instructions)

23

.

.

.

.

24

TOTAL TAXABLE COMPENSATION (Line 22 less line 23)

24

25

Interest Paid or Accrued

25

Enter this

INTEREST

26

Interest Apportionment Factor (From Line 6)

26

APPORTION-

amount on

MENT

27

Taxable Interest (Line 25 multiplied by line 26)

27

Form BET-

WE, line 3:

28

LESS: Dividend Offset (See instructions)

28

29

TOTAL TAXABLE INTEREST (Line 27 less line 28)

29

1

1