Page 3

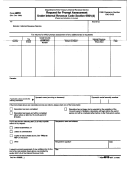

Instructions for Form 14402, Internal Revenue Code (IRC) Section 6702(d)

Frivolous Tax Submissions Penalty Reduction

General Instructions

Purpose of Form

Use Form 14402 to request a reduction in your unpaid section 6702 penalty liabilities. Section 6702(d) of the Internal Revenue Code

authorizes the Internal Revenue Service (IRS) to reduce the amount of the frivolous tax submissions penalty assessed under section

6702(a) or (b) if the IRS determines that a reduction would promote compliance with and administration of the Federal tax laws.

Revenue Procedure 2012-43 describes the requirements you must meet to qualify for reduction.

The Service will treat a written statement that includes the same information prescribed by Form 14402 and these instructions as the

submission of Form 14402 if the statement is filed in accordance with Revenue Procedure 2012-43 and these instructions.

Do not use Form 14402 if you want to challenge the merits of a section 6702 penalty assessment. Other procedures may be available

to challenge the merits, such as paying the penalty and filing a refund claim or raising the issue in a Collection Due Process hearing.

Do not use Form 14402 to request a refund of any section 6702 penalty liabilities that you have already paid in full or in part. If you have

fully paid any assessed section 6702 penalty liabilities, you are not eligible for reduction.

Who Can File

Any person may use Form 14402 to request a reduction of any unpaid section 6702 penalty liabilities.

Where to File

To request a reduction of your unpaid section 6702 penalty liabilities, you must mail a completed Form 14402 to the following address.

Internal Revenue Service

Frivolous Return Program

1973 N Rulon White Blvd. M/S 4450

Ogden, UT 84404

Specific Instructions

Section I – Requestor’s Information. You must provide your name, Social Security Number (SSN) or other Tax Identification Number,

and contact information so we can access your account and contact you if we need to clarify any of the information you provide on the

form.

Section II – Eligibility Requirements. You must check either “YES” or “NO” to every question in this section to determine whether you

meet the requirements described in Revenue Procedure 2012-43.

Question 1

If we have previously reduced any of your section 6702 penalty liabilities, then you are not eligible for another reduction of any section

6702 penalty liabilities.

Question 2

If the United States has filed suit against you either to collect your section 6702 penalty liabilities or to reduce any assessment of your

section 6702 penalty liabilities to judgment, then you are not eligible for a section 6702 penalty reduction. Unless you have been served

a complaint filed by the Department of Justice in United States District Court to collect your unpaid tax liabilities, you should check “NO”

to this question.

Question 3

If you have entered into a partial payment installment agreement with us, then you are not eligible for a section 6702 penalty reduction

because successful completion of the agreement will result in you paying less than the full amount of your federal tax liabilities. All

taxpayers are expected to immediately pay their tax liabilities in full. When immediate payment is not possible, we may enter into

agreements under section 6159 that allow taxpayers to pay their tax liabilities in installments over a prescribed period of time.

Generally, we have ten years to collect tax liabilities after they are assessed. If taxpayers cannot fully pay their liabilities before this

collection statute of limitations period expires, we may enter into partial payment installment agreements that allow taxpayers to pay as

much of their tax liabilities as possible.

Question 4

If you have entered into a closing agreement with the IRS under section 7121 (for example, Form 906, Closing Agreement on Final

Determination Covering Specific Matters) with respect to your section 6702 penalty liabilities, then you are not eligible for a section

6702 penalty reduction.

Question 5

If you have an open bankruptcy case, then you are not eligible for a section 6702 penalty reduction. A bankruptcy case is considered

open from the date you file a bankruptcy petition to the date the case is dismissed or you receive a discharge.

14402

Catalog Number 59694G

Form

(11-2012)

1

1 2

2 3

3 4

4