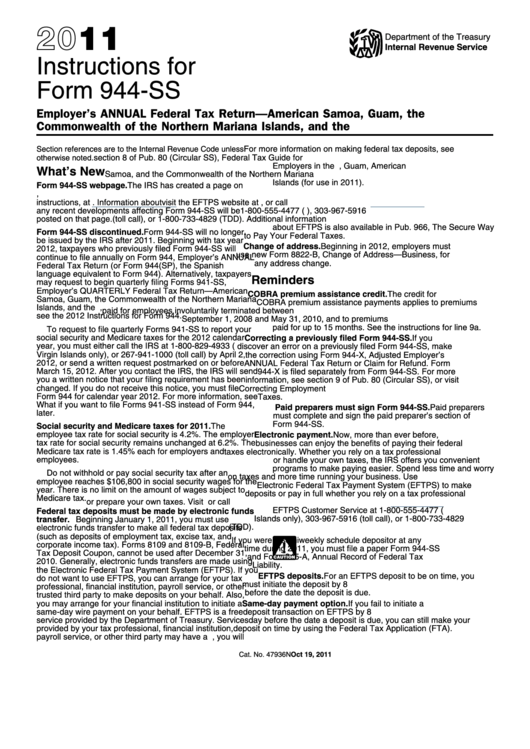

Instructions For Form 944-Ss - Employer'S Annual Federal Tax Return - American Samoa, Guam, The Commonwealth Of The Northern Mariana Islands, And The U.s. Virgin Islands - 2011

ADVERTISEMENT

2011

Department of the Treasury

Internal Revenue Service

Instructions for

Form 944-SS

Employer’s ANNUAL Federal Tax Return—American Samoa, Guam, the

Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands

For more information on making federal tax deposits, see

Section references are to the Internal Revenue Code unless

section 8 of Pub. 80 (Circular SS), Federal Tax Guide for

otherwise noted.

Employers in the U.S. Virgin Islands, Guam, American

What’s New

Samoa, and the Commonwealth of the Northern Mariana

Islands (for use in 2011).

Form 944-SS webpage. The IRS has created a page on

IRS.gov for information about Form 944-SS and its

For more information about EFTPS or to enroll in EFTPS,

instructions, at Information about

visit the EFTPS website at , or call

any recent developments affecting Form 944-SS will be

1-800-555-4477 (U.S. Virgin Islands only), 303-967-5916

posted on that page.

(toll call), or 1-800-733-4829 (TDD). Additional information

about EFTPS is also available in Pub. 966, The Secure Way

Form 944-SS discontinued. Form 944-SS will no longer

to Pay Your Federal Taxes.

be issued by the IRS after 2011. Beginning with tax year

Change of address. Beginning in 2012, employers must

2012, taxpayers who previously filed Form 944-SS will

use new Form 8822-B, Change of Address — Business, for

continue to file annually on Form 944, Employer’s ANNUAL

any address change.

Federal Tax Return (or Form 944(SP), the Spanish

language equivalent to Form 944). Alternatively, taxpayers

Reminders

may request to begin quarterly filing Forms 941-SS,

Employer’s QUARTERLY Federal Tax Return — American

COBRA premium assistance credit. The credit for

Samoa, Guam, the Commonwealth of the Northern Mariana

COBRA premium assistance payments applies to premiums

Islands, and the U.S. Virgin Islands. For more information,

paid for employees involuntarily terminated between

see the 2012 Instructions for Form 944.

September 1, 2008 and May 31, 2010, and to premiums

paid for up to 15 months. See the instructions for line 9a.

To request to file quarterly Forms 941-SS to report your

social security and Medicare taxes for the 2012 calendar

Correcting a previously filed Form 944-SS. If you

year, you must either call the IRS at 1-800-829-4933 (U.S.

discover an error on a previously filed Form 944-SS, make

Virgin Islands only), or 267-941-1000 (toll call) by April 2,

the correction using Form 944-X, Adjusted Employer’s

2012, or send a written request postmarked on or before

ANNUAL Federal Tax Return or Claim for Refund. Form

March 15, 2012. After you contact the IRS, the IRS will send

944-X is filed separately from Form 944-SS. For more

you a written notice that your filing requirement has been

information, see section 9 of Pub. 80 (Circular SS), or visit

changed. If you do not receive this notice, you must file

IRS.gov and enter the keywords Correcting Employment

Form 944 for calendar year 2012. For more information, see

Taxes.

What if you want to file Forms 941-SS instead of Form 944,

Paid preparers must sign Form 944-SS. Paid preparers

later.

must complete and sign the paid preparer’s section of

Form 944-SS.

Social security and Medicare taxes for 2011. The

employee tax rate for social security is 4.2%. The employer

Electronic payment. Now, more than ever before,

tax rate for social security remains unchanged at 6.2%. The

businesses can enjoy the benefits of paying their federal

Medicare tax rate is 1.45% each for employers and

taxes electronically. Whether you rely on a tax professional

employees.

or handle your own taxes, the IRS offers you convenient

programs to make paying easier. Spend less time and worry

Do not withhold or pay social security tax after an

on taxes and more time running your business. Use

employee reaches $106,800 in social security wages for the

Electronic Federal Tax Payment System (EFTPS) to make

year. There is no limit on the amount of wages subject to

deposits or pay in full whether you rely on a tax professional

Medicare tax.

or prepare your own taxes. Visit

or call

EFTPS Customer Service at 1-800-555-4477 (U.S. Virgin

Federal tax deposits must be made by electronic funds

Islands only), 303-967-5916 (toll call), or 1-800-733-4829

transfer. Beginning January 1, 2011, you must use

(TDD).

electronic funds transfer to make all federal tax deposits

(such as deposits of employment tax, excise tax, and

If you were a semiweekly schedule depositor at any

corporate income tax). Forms 8109 and 8109-B, Federal

!

time during 2011, you must file a paper Form 944-SS

Tax Deposit Coupon, cannot be used after December 31,

and Form 945-A, Annual Record of Federal Tax

CAUTION

2010. Generally, electronic funds transfers are made using

Liability.

the Electronic Federal Tax Payment System (EFTPS). If you

EFTPS deposits. For an EFTPS deposit to be on time, you

do not want to use EFTPS, you can arrange for your tax

must initiate the deposit by 8 p.m. Eastern time the day

professional, financial institution, payroll service, or other

before the date the deposit is due.

trusted third party to make deposits on your behalf. Also,

Same-day payment option. If you fail to initiate a

you may arrange for your financial institution to initiate a

same-day wire payment on your behalf. EFTPS is a free

deposit transaction on EFTPS by 8 p.m. Eastern time the

service provided by the Department of Treasury. Services

day before the date a deposit is due, you can still make your

provided by your tax professional, financial institution,

deposit on time by using the Federal Tax Application (FTA).

payroll service, or other third party may have a fee.

If you ever need the same-day payment method, you will

Oct 19, 2011

Cat. No. 47936N

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7