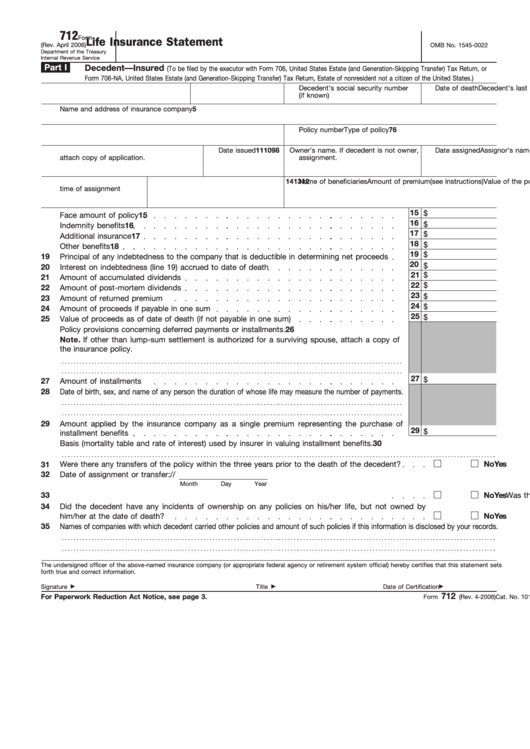

712

Form

Life Insurance Statement

(Rev. April 2006)

OMB No. 1545-0022

Department of the Treasury

Internal Revenue Service

Part I

Decedent—Insured

(To be filed by the executor with Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return, or

Form 706-NA, United States Estate (and Generation-Skipping Transfer) Tax Return, Estate of nonresident not a citizen of the United States.)

1

Decedent’s first name and middle initial

2

Decedent’s last name

3

Decedent’s social security number

4

Date of death

(if known)

5

Name and address of insurance company

6

Type of policy

7

Policy number

8

Owner’s name. If decedent is not owner,

9

Date issued

10

Assignor’s name. Attach copy of

11

Date assigned

attach copy of application.

assignment.

12

Value of the policy at the

13

Amount of premium (see instructions)

14

Name of beneficiaries

time of assignment

15

$

15

Face amount of policy

16

$

16

Indemnity benefits

17

$

17

Additional insurance

18

$

18

Other benefits

19

$

19

Principal of any indebtedness to the company that is deductible in determining net proceeds

20

$

20

Interest on indebtedness (line 19) accrued to date of death

21

$

21

Amount of accumulated dividends

22

$

22

Amount of post-mortem dividends

23

$

23

Amount of returned premium

24

$

24

Amount of proceeds if payable in one sum

25

$

25

Value of proceeds as of date of death (if not payable in one sum)

26

Policy provisions concerning deferred payments or installments.

Note. If other than lump-sum settlement is authorized for a surviving spouse, attach a copy of

the insurance policy.

27

$

27

Amount of installments

28

Date of birth, sex, and name of any person the duration of whose life may measure the number of payments.

29

Amount applied by the insurance company as a single premium representing the purchase of

29

$

installment benefits

30

Basis (mortality table and rate of interest) used by insurer in valuing installment benefits.

Were there any transfers of the policy within the three years prior to the death of the decedent?

Yes

No

31

32

Date of assignment or transfer:

/

/

Month

Day

Year

33

Was the insured the annuitant or beneficiary of any annuity contract issued by the company?

Yes

No

34

Did the decedent have any incidents of ownership on any policies on his/her life, but not owned by

him/her at the date of death?

Yes

No

35

Names of companies with which decedent carried other policies and amount of such policies if this information is disclosed by your records.

The undersigned officer of the above-named insurance company (or appropriate federal agency or retirement system official) hereby certifies that this statement sets

forth true and correct information.

Signature

Title

Date of Certification

712

For Paperwork Reduction Act Notice, see page 3.

Cat. No. 10170V

Form

(Rev. 4-2006)

1

1 2

2 3

3