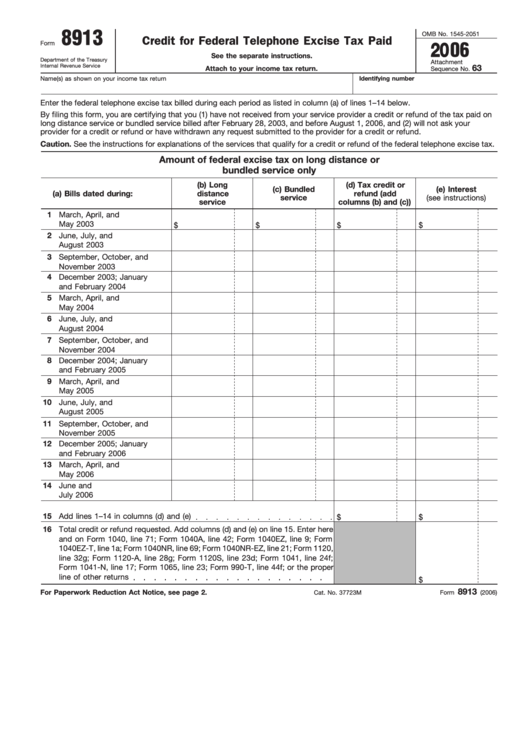

8913

OMB No. 1545-2051

Credit for Federal Telephone Excise Tax Paid

Form

2006

See the separate instructions.

Department of the Treasury

Attachment

Internal Revenue Service

63

Attach to your income tax return.

Sequence No.

Name(s) as shown on your income tax return

Identifying number

Enter the federal telephone excise tax billed during each period as listed in column (a) of lines 1–14 below.

By filing this form, you are certifying that you (1) have not received from your service provider a credit or refund of the tax paid on

long distance service or bundled service billed after February 28, 2003, and before August 1, 2006, and (2) will not ask your

provider for a credit or refund or have withdrawn any request submitted to the provider for a credit or refund.

Caution. See the instructions for explanations of the services that qualify for a credit or refund of the federal telephone excise tax.

Amount of federal excise tax on long distance or

bundled service only

(b) Long

(d) Tax credit or

(c) Bundled

(e) Interest

(a) Bills dated during:

distance

refund (add

service

(see instructions)

service

columns (b) and (c))

1

March, April, and

May 2003

$

$

$

$

2

June, July, and

August 2003

3

September, October, and

November 2003

4

December 2003; January

and February 2004

5

March, April, and

May 2004

6

June, July, and

August 2004

7

September, October, and

November 2004

8

December 2004; January

and February 2005

9

March, April, and

May 2005

10

June, July, and

August 2005

11

September, October, and

November 2005

12

December 2005; January

and February 2006

13

March, April, and

May 2006

14 June and

July 2006

15

Add lines 1–14 in columns (d) and (e)

$

$

16

Total credit or refund requested. Add columns (d) and (e) on line 15. Enter here

and on Form 1040, line 71; Form 1040A, line 42; Form 1040EZ, line 9; Form

1040EZ-T, line 1a; Form 1040NR, line 69; Form 1040NR-EZ, line 21; Form 1120,

line 32g; Form 1120-A, line 28g; Form 1120S, line 23d; Form 1041, line 24f;

Form 1041-N, line 17; Form 1065, line 23; Form 990-T, line 44f; or the proper

line of other returns

$

8913

For Paperwork Reduction Act Notice, see page 2.

Cat. No. 37723M

Form

(2006)

1

1 2

2