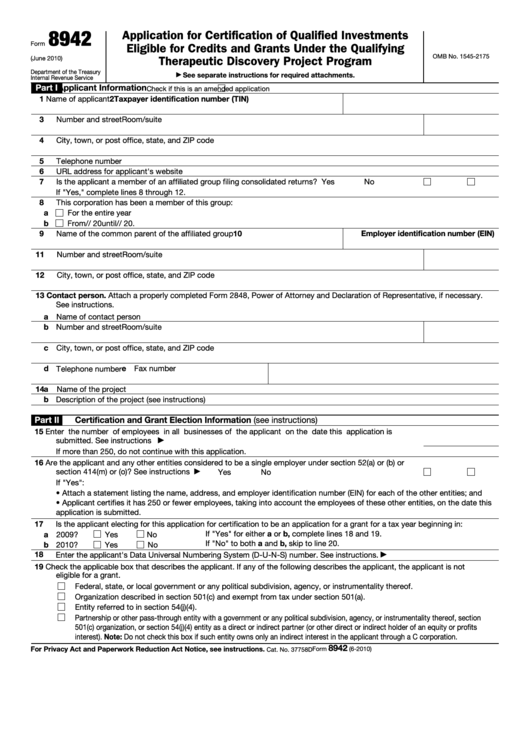

8942

Application for Certification of Qualified Investments

Form

Eligible for Credits and Grants Under the Qualifying

OMB No. 1545-2175

Therapeutic Discovery Project Program

(June 2010)

Department of the Treasury

See separate instructions for required attachments.

▶

Internal Revenue Service

Part I

Applicant Information

Check if this is an amended application

1

Name of applicant

2 Taxpayer identification number (TIN)

3

Number and street

Room/suite

4

City, town, or post office, state, and ZIP code

5

Telephone number

6

URL address for applicant's website

7

Is the applicant a member of an affiliated group filing consolidated returns? .

.

.

.

.

.

.

.

.

Yes

No

If "Yes," complete lines 8 through 12.

8

This corporation has been a member of this group:

a

For the entire year

b

From

/

/ 20

until

/

/ 20

.

9

Name of the common parent of the affiliated group

10 Employer identification number (EIN)

11

Number and street

Room/suite

12

City, town, or post office, state, and ZIP code

13

Contact person. Attach a properly completed Form 2848, Power of Attorney and Declaration of Representative, if necessary.

See instructions.

a Name of contact person

b Number and street

Room/suite

c City, town, or post office, state, and ZIP code

d Telephone number

e Fax number

14

a

Name of the project

b

Description of the project (see instructions)

Certification and Grant Election Information (see instructions)

Part II

15

Enter the number of employees in all businesses of the applicant on the date this application is

submitted. See instructions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

If more than 250, do not continue with this application.

16

Are the applicant and any other entities considered to be a single employer under section 52(a) or (b) or

section 414(m) or (o)? See instructions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

▶

If "Yes":

• Attach a statement listing the name, address, and employer identification number (EIN) for each of the other entities; and

• Applicant certifies it has 250 or fewer employees, taking into account the employees of these other entities, on the date this

application is submitted.

17

Is the applicant electing for this application for certification to be an application for a grant for a tax year beginning in:

If "Yes" for either a or b, complete lines 18 and 19.

a 2009?

Yes

No

If "No" to both a and b, skip to line 20.

b 2010?

Yes

No

18

Enter the applicant's Data Universal Numbering System (D-U-N-S) number. See instructions.

▶

19

Check the applicable box that describes the applicant. If any of the following describes the applicant, the applicant is not

eligible for a grant.

Federal, state, or local government or any political subdivision, agency, or instrumentality thereof.

Organization described in section 501(c) and exempt from tax under section 501(a).

Entity referred to in section 54(j)(4).

Partnership or other pass-through entity with a government or any political subdivision, agency, or instrumentality thereof, section

501(c) organization, or section 54(j)(4) entity as a direct or indirect partner (or other direct or indirect holder of an equity or profits

interest). Note: Do not check this box if such entity owns only an indirect interest in the applicant through a C corporation.

8942

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Form

(6-2010)

Cat. No. 37758D

1

1 2

2