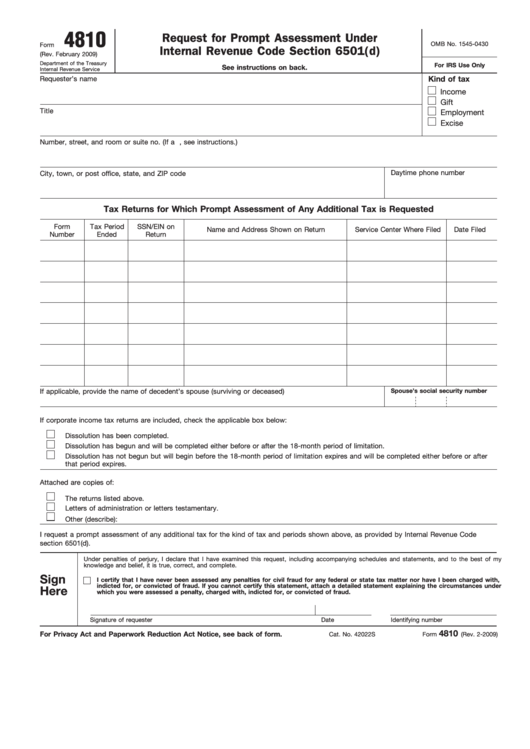

4810

Request for Prompt Assessment Under

OMB No. 1545-0430

Form

Internal Revenue Code Section 6501(d)

(Rev. February 2009)

Department of the Treasury

For IRS Use Only

See instructions on back.

Internal Revenue Service

Requester’s name

Kind of tax

Income

Gift

Title

Employment

Excise

Number, street, and room or suite no. (If a P.O. box, see instructions.)

Daytime phone number

City, town, or post office, state, and ZIP code

Tax Returns for Which Prompt Assessment of Any Additional Tax is Requested

Form

Tax Period

SSN/EIN on

Name and Address Shown on Return

Service Center Where Filed

Date Filed

Number

Ended

Return

If applicable, provide the name of decedent’s spouse (surviving or deceased)

Spouse’s social security number

If corporate income tax returns are included, check the applicable box below:

Dissolution has been completed.

Dissolution has begun and will be completed either before or after the 18-month period of limitation.

Dissolution has not begun but will begin before the 18-month period of limitation expires and will be completed either before or after

that period expires.

Attached are copies of:

The returns listed above.

Letters of administration or letters testamentary.

Other (describe):

I request a prompt assessment of any additional tax for the kind of tax and periods shown above, as provided by Internal Revenue Code

section 6501(d).

Under penalties of perjury, I declare that I have examined this request, including accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct, and complete.

Sign

I certify that I have never been assessed any penalties for civil fraud for any federal or state tax matter nor have I been charged with,

indicted for, or convicted of fraud. If you cannot certify this statement, attach a detailed statement explaining the circumstances under

Here

which you were assessed a penalty, charged with, indicted for, or convicted of fraud.

Signature of requester

Date

Identifying number

4810

For Privacy Act and Paperwork Reduction Act Notice, see back of form.

Cat. No. 42022S

Form

(Rev. 2-2009)

1

1 2

2