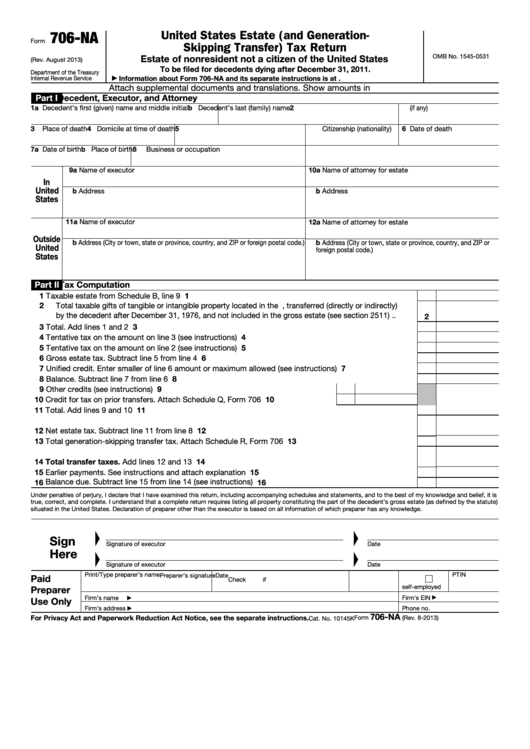

706-NA

United States Estate (and Generation-

Form

Skipping Transfer) Tax Return

Estate of nonresident not a citizen of the United States

OMB No. 1545-0531

(Rev. August 2013)

To be filed for decedents dying after December 31, 2011.

Department of the Treasury

Internal Revenue Service

Information about Form 706-NA and its separate instructions is at

▶

Attach supplemental documents and translations. Show amounts in U.S. dollars.

Part I

Decedent, Executor, and Attorney

1a Decedent’s first (given) name and middle initial

b Decedent’s last (family) name

2 U.S. taxpayer ID number (if any)

3

Place of death

4 Domicile at time of death

5

Citizenship (nationality)

6 Date of death

7a Date of birth

b Place of birth

8

Business or occupation

9a Name of executor

10a Name of attorney for estate

In

United

b Address

b Address

States

11a Name of executor

12a Name of attorney for estate

Outside

b Address (City or town, state or province, country, and ZIP or foreign postal code.)

b Address (City or town, state or province, country, and ZIP or

United

foreign postal code.)

States

Part II

Tax Computation

1

1

Taxable estate from Schedule B, line 9 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

Total taxable gifts of tangible or intangible property located in the U.S., transferred (directly or indirectly)

by the decedent after December 31, 1976, and not included in the gross estate (see section 2511) .

.

2

3

3

Total. Add lines 1 and 2 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

Tentative tax on the amount on line 3 (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5

Tentative tax on the amount on line 2 (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6

6

Gross estate tax. Subtract line 5 from line 4

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

Unified credit. Enter smaller of line 6 amount or maximum allowed (see instructions) .

.

.

.

.

.

7

8

Balance. Subtract line 7 from line 6

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9

9

Other credits (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

Credit for tax on prior transfers. Attach Schedule Q, Form 706

.

.

.

.

.

10

11

Total. Add lines 9 and 10 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

12

12

Net estate tax. Subtract line 11 from line 8 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13

Total generation-skipping transfer tax. Attach Schedule R, Form 706 .

.

.

.

.

.

.

.

.

.

.

13

14

Total transfer taxes. Add lines 12 and 13 .

14

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

15

Earlier payments. See instructions and attach explanation .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

15

Balance due. Subtract line 15 from line 14 (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

16

16

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

true, correct, and complete. I understand that a complete return requires listing all property constituting the part of the decedent’s gross estate (as defined by the statute)

situated in the United States. Declaration of preparer other than the executor is based on all information of which preparer has any knowledge.

Sign

Signature of executor

Date

Here

Signature of executor

Date

Print/Type preparer’s name

PTIN

Preparer’s signature

Date

Paid

Check

if

self-employed

Preparer

Firm’s name

Firm's EIN

▶

Use Only

▶

Firm’s address

Phone no.

▶

706-NA

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.

Form

(Rev. 8-2013)

Cat. No. 10145K

1

1 2

2