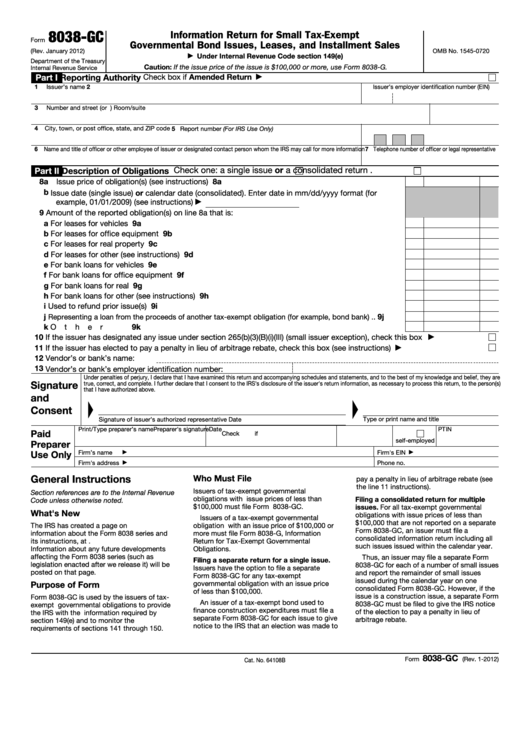

8038-GC

Information Return for Small Tax-Exempt

Form

Governmental Bond Issues, Leases, and Installment Sales

(Rev. January 2012)

OMB No. 1545-0720

Under Internal Revenue Code section 149(e)

▶

Department of the Treasury

Caution: If the issue price of the issue is $100,000 or more, use Form 8038-G.

Internal Revenue Service

Part I

Reporting Authority

Check box if Amended Return

▶

1

2 Issuer’s employer identification number (EIN)

Issuer’s name

3

Number and street (or P.O. box if mail is not delivered to street address)

Room/suite

4

City, town, or post office, state, and ZIP code

5 Report number (For IRS Use Only)

6 Name and title of officer or other employee of issuer or designated contact person whom the IRS may call for more information 7 Telephone number of officer or legal representative

Description of Obligations Check one: a single issue

or a consolidated return

.

Part II

8a Issue price of obligation(s) (see instructions)

8a

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b Issue date (single issue) or calendar date (consolidated). Enter date in mm/dd/yyyy format (for

example, 01/01/2009) (see instructions)

▶

9

Amount of the reported obligation(s) on line 8a that is:

a For leases for vehicles

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9a

b For leases for office equipment .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9b

c For leases for real property .

9c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

d For leases for other (see instructions) .

9d

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

e For bank loans for vehicles .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9e

f

For bank loans for office equipment .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9f

g For bank loans for real property.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9g

h For bank loans for other (see instructions) .

9h

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

i

9i

Used to refund prior issue(s)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

j

9j

Representing a loan from the proceeds of another tax-exempt obligation (for example, bond bank) .

.

k Other .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9k

10

If the issuer has designated any issue under section 265(b)(3)(B)(i)(III) (small issuer exception), check this box .

.

.

.

▶

11

If the issuer has elected to pay a penalty in lieu of arbitrage rebate, check this box (see instructions) .

.

.

.

.

.

.

▶

12

Vendor’s or bank’s name:

13

Vendor’s or bank’s employer identification number:

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are

Signature

true, correct, and complete. I further declare that I consent to the IRS's disclosure of the issuer's return information, as necessary to process this return, to the person(s)

that I have authorized above.

and

Consent

Type or print name and title

Signature of issuer’s authorized representative

Date

Print/Type preparer’s name

Preparer's signature

Date

PTIN

Paid

Check

if

self-employed

Preparer

Use Only

Firm’s name

Firm's EIN

▶

▶

Firm's address

Phone no.

▶

General Instructions

Who Must File

pay a penalty in lieu of arbitrage rebate (see

the line 11 instructions).

Issuers of tax-exempt governmental

Section references are to the Internal Revenue

obligations with issue prices of less than

Filing a consolidated return for multiple

Code unless otherwise noted.

$100,000 must file Form 8038-GC.

issues. For all tax-exempt governmental

What's New

obligations with issue prices of less than

Issuers of a tax-exempt governmental

$100,000 that are not reported on a separate

The IRS has created a page on IRS.gov for

obligation with an issue price of $100,000 or

Form 8038-GC, an issuer must file a

information about the Form 8038 series and

more must file Form 8038-G, Information

consolidated information return including all

its instructions, at

Return for Tax-Exempt Governmental

such issues issued within the calendar year.

Information about any future developments

Obligations.

affecting the Form 8038 series (such as

Thus, an issuer may file a separate Form

Filing a separate return for a single issue.

legislation enacted after we release it) will be

8038-GC for each of a number of small issues

Issuers have the option to file a separate

posted on that page.

and report the remainder of small issues

Form 8038-GC for any tax-exempt

issued during the calendar year on one

governmental obligation with an issue price

Purpose of Form

consolidated Form 8038-GC. However, if the

of less than $100,000.

issue is a construction issue, a separate Form

Form 8038-GC is used by the issuers of tax-

An issuer of a tax-exempt bond used to

8038-GC must be filed to give the IRS notice

exempt governmental obligations to provide

finance construction expenditures must file a

of the election to pay a penalty in lieu of

the IRS with the information required by

separate Form 8038-GC for each issue to give

arbitrage rebate.

section 149(e) and to monitor the

notice to the IRS that an election was made to

requirements of sections 141 through 150.

8038-GC

Form

(Rev. 1-2012)

Cat. No. 64108B

1

1 2

2 3

3