Form 8038-G - Information Return For Tax-Exempt Governmental Obligations

ADVERTISEMENT

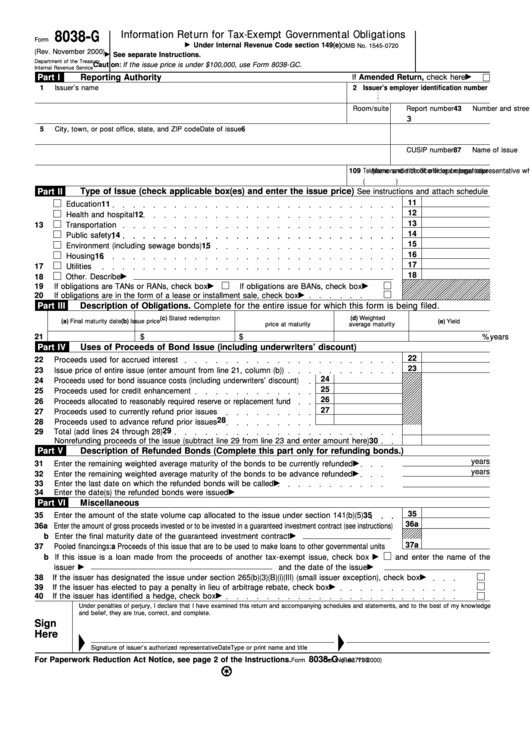

8038-G

Information Return for Tax-Exempt Governmental Obligations

Form

Under Internal Revenue Code section 149(e)

OMB No. 1545-0720

(Rev. November 2000)

See separate Instructions.

Department of the Treasury

Caution: If the issue price is under $100,000, use Form 8038-GC.

Internal Revenue Service

Part I

Reporting Authority

If Amended Return, check here

1

Issuer’s name

2 Issuer’s employer identification number

3

Number and street (or P.O. box if mail is not delivered to street address)

Room/suite

4

Report number

3

5

City, town, or post office, state, and ZIP code

6

Date of issue

7

Name of issue

8

CUSIP number

9

Name and title of officer or legal representative whom the IRS may call for more information

10

Telephone number of officer or legal representative

(

)

Type of Issue (check applicable box(es) and enter the issue price)

Part II

See instructions and attach schedule

11

11

Education

12

12

Health and hospital

13

13

Transportation

14

14

Public safety

15

15

Environment (including sewage bonds)

16

16

Housing

17

17

Utilities

18

18

Other. Describe

19

If obligations are TANs or RANs, check box

If obligations are BANs, check box

20

If obligations are in the form of a lease or installment sale, check box

Description of Obligations. Complete for the entire issue for which this form is being filed.

Part III

(c) Stated redemption

(d) Weighted

(a) Final maturity date

(b) Issue price

(e) Yield

price at maturity

average maturity

21

$

$

years

%

Part IV

Uses of Proceeds of Bond Issue (including underwriters’ discount)

22

22

Proceeds used for accrued interest

23

23

Issue price of entire issue (enter amount from line 21, column (b))

24

24

Proceeds used for bond issuance costs (including underwriters’ discount)

25

25

Proceeds used for credit enhancement

26

26

Proceeds allocated to reasonably required reserve or replacement fund

27

27

Proceeds used to currently refund prior issues

28

28

Proceeds used to advance refund prior issues

29

29

Total (add lines 24 through 28)

30

Nonrefunding proceeds of the issue (subtract line 29 from line 23 and enter amount here)

30

Part V

Description of Refunded Bonds (Complete this part only for refunding bonds.)

years

31

Enter the remaining weighted average maturity of the bonds to be currently refunded

years

32

Enter the remaining weighted average maturity of the bonds to be advance refunded

33

Enter the last date on which the refunded bonds will be called

34

Enter the date(s) the refunded bonds were issued

Miscellaneous

Part VI

35

35

35

Enter the amount of the state volume cap allocated to the issue under section 141(b)(5)

36a

36a Enter the amount of gross proceeds invested or to be invested in a guaranteed investment contract (see instructions)

b Enter the final maturity date of the guaranteed investment contract

37a

37

Pooled financings: a Proceeds of this issue that are to be used to make loans to other governmental units

b If this issue is a loan made from the proceeds of another tax-exempt issue, check box

and enter the name of the

issuer

and the date of the issue

38

If the issuer has designated the issue under section 265(b)(3)(B)(i)(III) (small issuer exception), check box

39

If the issuer has elected to pay a penalty in lieu of arbitrage rebate, check box

40

If the issuer has identified a hedge, check box

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge

and belief, they are true, correct, and complete.

Sign

Here

Signature of issuer’s authorized representative

Date

Type or print name and title

8038-G

For Paperwork Reduction Act Notice, see page 2 of the Instructions.

Cat. No. 63773S

Form

(Rev. 11-2000)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1