Form 13369 - Agreement To Mediate

Download a blank fillable Form 13369 - Agreement To Mediate in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 13369 - Agreement To Mediate with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

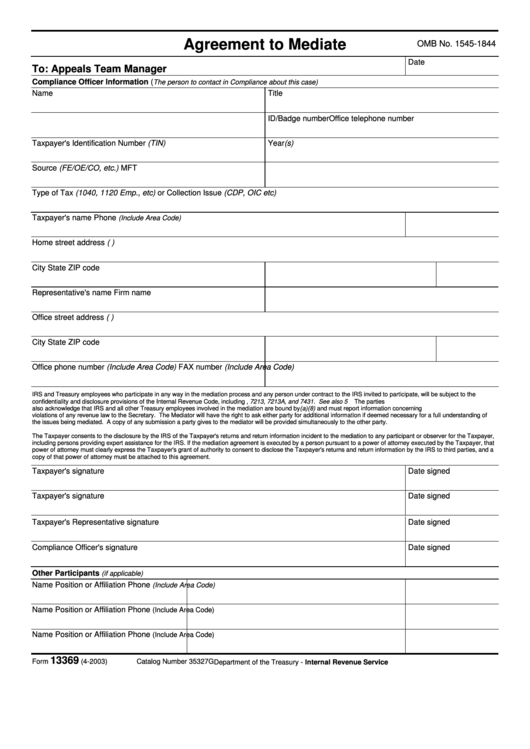

Agreement to Mediate

OMB No. 1545-1844

Date

To: Appeals Team Manager

Compliance Officer Information (

The person to contact in Compliance about this case)

Name

Title

Office telephone number

ID/Badge number

Taxpayer's Identification Number (TIN)

Year(s)

Source (FE/OE/CO, etc.)

MFT

Type of Tax (1040, 1120 Emp., etc) or Collection Issue (CDP, OIC etc)

Taxpayer's name

Phone

(Include Area Code)

Home street address (P.O. Boxes are not allowed)

City

State

ZIP code

Representative's name

Firm name

Office street address (P.O. Boxes are not allowed)

City

State

ZIP code

Office phone number (Include Area Code)

FAX number (Include Area Code)

IRS and Treasury employees who participate in any way in the mediation process and any person under contract to the IRS invited to participate, will be subject to the

confidentiality and disclosure provisions of the Internal Revenue Code, including I.R.C. sections 6103, 7213, 7213A, and 7431. See also 5 U.S.C. section 574. The parties

also acknowledge that IRS and all other Treasury employees involved in the mediation are bound by I.R.C. section 7214(a)(8) and must report information concerning

violations of any revenue law to the Secretary. The Mediator will have the right to ask either party for additional information if deemed necessary for a full understanding of

the issues being mediated. A copy of any submission a party gives to the mediator will be provided simultaneously to the other party.

The Taxpayer consents to the disclosure by the IRS of the Taxpayer's returns and return information incident to the mediation to any participant or observer for the Taxpayer,

including persons providing expert assistance for the IRS. If the mediation agreement is executed by a person pursuant to a power of attorney executed by the Taxpayer, that

power of attorney must clearly express the Taxpayer's grant of authority to consent to disclose the Taxpayer's returns and return information by the IRS to third parties, and a

copy of that power of attorney must be attached to this agreement.

Taxpayer's signature

Date signed

Taxpayer's signature

Date signed

Taxpayer's Representative signature

Date signed

Compliance Officer's signature

Date signed

Other Participants

(if applicable)

Name

Position or Affiliation

Phone

(Include Area Code)

Name

Position or Affiliation

Phone

(Include Area Code)

Name

Position or Affiliation

Phone

(Include Area Code)

13369

Form

(4-2003)

Catalog Number 35327G

Department of the Treasury - Internal Revenue Service

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2