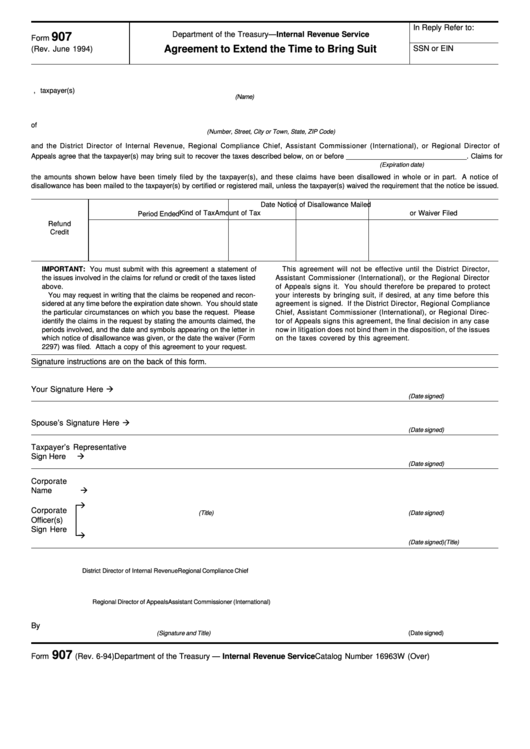

Form 907 - Agreement To Extend The Time To Bring Suit

ADVERTISEMENT

In Reply Refer to:

Department of the Treasury—Internal Revenue Service

907

Form

Agreement to Extend the Time to Bring Suit

SSN or EIN

(Rev. June 1994)

............................................................................................................................................................................................................................. , taxpayer(s)

(Name)

of ................................................................................................................................................................................................................................................

(Number, Street, City or Town, State, ZIP Code)

and the District Director of Internal Revenue, Regional Compliance Chief, Assistant Commissioner (International), or Regional Director of

Appeals agree that the taxpayer(s) may bring suit to recover the taxes described below, on or before _______________________________. Claims for

(Expiration date)

the amounts shown below have been timely filed by the taxpayer(s), and these claims have been disallowed in whole or in part. A notice of

disallowance has been mailed to the taxpayer(s) by certified or registered mail, unless the taxpayer(s) waived the requirement that the notice be issued.

Date Notice of Disallowance Mailed

Kind of Tax

Amount of Tax

or Waiver Filed

Period Ended

Refund

Credit

IMPORTANT: You must submit with this agreement a statement of

This agreement will not be effective until the District Director,

the issues involved in the claims for refund or credit of the taxes listed

Assistant Commissioner (International), or the Regional Director

above.

of Appeals signs it. You should therefore be prepared to protect

You may request in writing that the claims be reopened and recon-

your interests by bringing suit, if desired, at any time before this

sidered at any time before the expiration date shown. You should state

agreement is signed. If the District Director, Regional Compliance

the particular circumstances on which you base the request. Please

Chief, Assistant Commissioner (International), or Regional Direc-

identify the claims in the request by stating the amounts claimed, the

tor of Appeals signs this agreement, the final decision in any case

periods involved, and the date and symbols appearing on the letter in

now in litigation does not bind them in the disposition, of the issues

which notice of disallowance was given, or the date the waiver (Form

on the taxes covered by this agreement.

2297) was filed. Attach a copy of this agreement to your request.

Signature instructions are on the back of this form.

Your Signature Here

..................................................................................................

.............................................................

(Date signed)

Spouse’s Signature Here

..........................................................................................

.............................................................

(Date signed)

Taxpayer’s Representative

Sign Here

..............................................................................................................

.............................................................

(Date signed)

Corporate

Name

..............................................................................................................

.............................................................

..............................................................................................................

.............................................................

Corporate

(Title)

(Date signed)

Officer(s)

Sign Here

..............................................................................................................

.............................................................

(Title)

(Date signed)

...........................................................................................

.....................................................................................................

District Director of Internal Revenue

Regional Compliance Chief

.....................................................................................................

...........................................................................................

Regional Director of Appeals

Assistant Commissioner (International)

By .................................................................................................................................................

..............................................................

(Signature and Title)

(Date signed)

907

Form

(Rev. 6-94)

Catalog Number 16963W (Over)

Department of the Treasury — Internal Revenue Service

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1