Form Cd-3 - Application For Meals & Rentals Tax Operators License & Ach Debit Authorization Page 2

ADVERTISEMENT

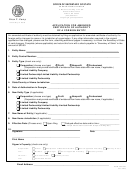

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

MEALS & RENTALS TAX OPERATORS (RSA 78-A:4)

CD-3

GENERAL INSTRUCTIONS

* *

A separate application must be made for each place of business.

Licenses are not transferable.

Incomplete applications are returned to the applicant and will result in a delay in issuing. Some common omissions/errors are:

*

*

Application is incomplete or illegible.

The entity name (Line 2) in the case of a corporation is the corporate name,

*

The application has not been signed.

not the president's name.

*

ACH Debit Authorization incomplete.

Line 1

Type or Print Business/Trade Name - One (1) letter per block.

Line 2

Type or Print the business entity name (Corporate, Partnership, or Proprietor's Name - One (1) letter per block).

Line 3

Type or Print the street address - One (1) letter per block; abbreviate when possible.

Line 4

Type or Print the Post Office Box, rural route number, etc.

Line 5

Type or Print the city or town, state and zip code.

Check the type of legal organization if other than a Limited Liability Company (LLC).

Line 6a

If this operation is a Limited Liability Company (LLC) show whether the entity is taxed as a single member, corporation or partnership.

Line 6b

Line 7

Type or Print the Federal Employer Identification Number. If applied for, enter "Applied for" and notify the Department when received.

Type or Print the Social Security Number or NH Department of Revenue issued Identification Number (Single Member LLC's) under which

Line 8

your business taxes for this operation will be reported.

List the names, titles, social security numbers and home addresses of the individual owners (Proprietorships), partners (Partnerships),

Line 9

members and managers (Limited Liability Companies) and president and treasurer and anyone else in a managerial capacity (Corporations).

Disclosure

Disclosure of your Social Security Number is mandatory under Department of Revenue Administration rule 708.05(d)(4). This information

of SSN:

is required for the purpose of administering the tax laws of this state and authorized by 42 U.S.C.S. 405(c)(2)(C)(i). The tax information

which is disclosed to the NH Department of Revenue Administration is held in strict confidence by law. The information may be disclosed

to the US Internal Revenue Service, agencies responsible for the administration of taxes in other states in accordance with compacts for

the exchange of information, and as otherwise authorized by NH RSA 21-J:14. The failure to provide a Social Security Number will result

in a rejection of an application.

Line 10

If there is a designated person to contact regarding licensing, returns or payments, please indicate on this line.

Provide the business and home telephone numbers.

Line 11

Type or Print the actual address where the business is located. For example, "1 Main St., Manchester, NH".

Line 12

Enter the proposed opening date of the business. NOTE: This license is required prior to operating.

Line 13

Line 14

Enter the type of business activity. (For example, hotel, inn, restaurant, tavern, club, motel, dairy bar, ski area, tourist home, cottage, motor

vehicle rentals, store, service station, rental agent and caterer).

Line 15

Please check all applicable items served by this business.

If this business has room rentals, please check appropriate box(es). If sleeping accommodations are rented, please indicate the number

Line 16

of rooms at this business. If you are a motor vehicle rental operator only, disregard Line 16.

If this is a seasonal business indicate the months it will be operated. If the operator desires to file tax returns on a seasonal basis, that

Line 17

is, less than twelve returns per year, check the appropriate block. Monthly filing will be required unless seasonal permission is granted.

A return will be required for each month of the filing status, whether there is tax due or not.

Line 18

In case of change of ownership, provide the name the business previously operated under and the name of former owner(s).

The signature, in ink, of the person who is certifying the application information is required on all forms regardless of whether or not ACH

Signature

debits will be authorized.

- INSTRUCTIONS for ACH DEBIT AUTHORIZATION

-

Note: any reference to bank means any financial institution

Applicants choosing not to file via Telefile or E-FILE should leave line 19 through 24 blank.

Line 19

Bank Name. The name of the bank where the account is located.

Line 20

Bank Routing/Transit Number. The number assigned to your particular banking institution.

Line 21

Name on Bank Account. The name in which this account is held (i.e. business name, personal name, etc.).

Line 22

FEIN/SSN on Bank Account. The identification number on this bank account.

Line 23

Bank Account Number. The account number assigned to your particular account.

Line 24

Account Type. Check whether a checking or statement savings account.

Authori-

If this person is authorizing the ACH Debit on this account this person must be an authorized signatory on the account.

zation

ACH

The signature (in ink) of the person who is authorizing the ACH information is required on all ACH Debit Authorizations.

Signature

Title

The title of the person who certified the application and authorized the ACH Debit on this account.

Date

The date this authorization is given.

Form CD-3

(13)

Rev. 10/03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2