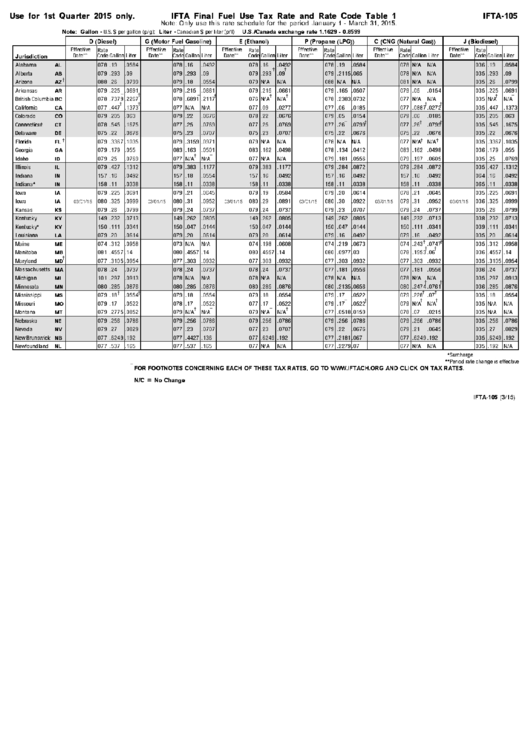

Form Ifta-105 - Ifta Final Fuel Use Tax Rate And Rate Code Table 1

ADVERTISEMENT

Use for 1st Quarter 2015 only.

IFTA Final Fuel Use Tax Rate and Rate Code Table 1

IFTA-105

Note: Only use this rate schedule for the period January 1 - March 31, 2015.

Note: Gallon

Liter

U.S./Canada exchange rate 1.1629 - 0.8599

- U.S. $ per gallon (p/g);

- Canadian $ per liter (p/l)

D (Diesel)

G (Motor Fuel Gasoline)

E (Ethanol)

P (Propane (LPG))

C (CNG (Natural Gas))

J (Biodiesel)

Effective

Effective

Effective

Effective

Effective

Effective

Rate

Rate

Rate

Rate

Rate

Rate

Date**

Code

Gallon

Liter

Date**

Code

Gallon

Liter

Date**

Code

Gallon

Liter

Date**

Code

Gallon

Liter

Date**

Code

Gallon

Liter

Date**

Code

Gallon

Liter

Jurisdiction

Alabama

078

.19

.0584

078

.16

.0492

078

.16

.0492

078

.19

.0584

078

N/A

N/A

036

.19

.0584

AL

†

†

Alberta

079

.293

.09

079

.293

.09

079

.293

.09

079

.2115

.065

078

N/A

N/A

035

.293

.09

AB

Arizona

†

088

.26

.0799

079

.18

.0554

079

N/A

N/A

088

N/A

N/A

081

N/A

N/A

035

.26

.0799

AZ

Arkansas

079

.225

.0691

079

.215

.0661

079

.215

.0661

079

.165

.0507

079

.05

.0154

035

.225

.0691

AR

†

†

†

†

†

†

†

†

British Columbia

078

.7379

.2267

078

.6891

.2117

076

N/A

N/A

078

.2383

.0732

077

N/A

N/A

035

N/A

N/A

BC

†

†

†

†

California

077

.447

.1373

077

N/A

N/A

077

.09

.0277

077

.06

.0185

077

.0887

.0272

035

.447

.1373

CA

Colorado

079

.205

.063

079

.22

.0676

078

.22

.0676

079

.05

.0154

079

.06

.0185

035

.205

.063

CO

†

†

†

†

Connecticut

078

.545

.1675

077

.25

.0769

077

.25

.0769

077

.26

.0799

077

.26

.0799

035

.545

.1675

CT

Delaware

075

.22

.0676

075

.23

.0707

075

.23

.0707

075

.22

.0676

075

.22

.0676

035

.22

.0676

DE

Florida

079

.3367

.1035

079

.3159

.0971

079

N/A

N/A

078

N/A

N/A

077

N/A

N/A

035

.3367

.1035

FL

†

†

†

Georgia

079

.179

.055

083

.163

.0501

083

.162

.0498

078

.134

.0412

083

.162

.0498

036

.179

.055

GA

†

†

Idaho

079

.25

.0769

077

N/A

N/A

077

N/A

N/A

079

.181

.0556

079

.197

.0605

035

.25

.0769

ID

Illinois

079

.427

.1312

079

.383

.1177

079

.383

.1177

079

.284

.0872

079

.284

.0872

035

.427

.1312

IL

Indiana

157

.16

.0492

157

.18

.0554

157

.16

.0492

157

.16

.0492

157

.16

.0492

064

.16

.0492

IN

*

Indiana

158

.11

.0338

158

.11

.0338

158

.11

.0338

158

.11

.0338

158

.11

.0338

065

.11

.0338

IN

Iowa

079

.225

.0691

079

.21

.0645

079

.19

.0584

079

.20

.0614

078

.21

.0645

035

.225

.0691

IA

Iowa

080

.325

.0999

080

.31

.0952

080

.29

.0891

080

.30

.0922

079

.31

.0952

036

.325

.0999

IA

03/01/15

03/01/15

03/01/15

03/01/15

03/01/15

03/01/15

Kansas

079

.26

.0799

079

.24

.0737

079

.24

.0737

079

.23

.0707

079

.24

.0737

035

.26

.0799

KS

Kentucky

149

.232

.0713

149

.262

.0805

149

.262

.0805

149

.262

.0805

149

.232

.0713

038

.232

.0713

KY

*

Kentucky

150

.111

.0341

150

.047

.0144

150

.047

.0144

150

.047

.0144

150

.111

.0341

039

.111

.0341

KY

Louisiana

079

.20

.0614

079

.20

.0614

079

.20

.0614

079

.16

.0492

079

.16

.0492

035

.20

.0614

LA

†

†

Maine

ME

074

.312

.0958

073

N/A

N/A

074

.198

.0608

074

.219

.0673

074

.243

.0747

035

.312

.0958

†

†

Manitoba

081

.4557

.14

080

.4557

.14

080

.4557

.14

080

.0977

.03

078

.1953

.06

036

.4557

.14

MB

†

Maryland

077

.3105

.0954

077

.303

.0932

077

.303

.0932

077

.303

.0932

077

.303

.0932

035

.3105

.0954

MD

Massachusetts

MA

078

.24

.0737

078

.24

.0737

078

.24

.0737

077

.181

.0556

077

.181

.0556

036

.24

.0737

Michigan

101

.297

.0913

078

N/A

N/A

078

N/A

N/A

078

N/A

N/A

078

N/A

N/A

035

.297

.0913

MI

†

†

Minnesota

080

.285

.0876

080

.285

.0876

080

.285

.0876

080

.2135

.0656

080

.2474

.0761

036

.285

.0876

MN

†

†

Mississippi

†

†

MS

079

.18

.0554

079

.18

.0554

079

.18

.0554

079

.17

.0522

079

.228

.07

035

.18

.0554

†

†

†

†

Missouri

079

.17

.0522

078

.17

.0522

077

.17

.0522

079

.17

.0522

079

N/A

N/A

035

N/A

N/A

MO

†

†

†

†

Montana

079

.2775

.0852

079

N/A

N/A

079

N/A

N/A

077

.0518

.0159

078

.07

.0215

035

N/A

N/A

MT

Nebraska

079

.256

.0786

079

.256

.0786

079

.256

.0786

079

.256

.0786

079

.256

.0786

035

.256

.0786

NE

Nevada

079

.27

.0829

077

.23

.0707

077

.23

.0707

079

.22

.0676

079

.21

.0645

035

.27

.0829

NV

New Brunswick

077

.6249

.192

077

.4427

.136

077

.6249

.192

077

.2181

.067

077

.6249

.192

035

.6249

.192

NB

Newfoundland

077

.537

.165

077

.537

.165

077

N/A

N/A

077

.2279

.07

077

N/A

N/A

035

.192

N/A

NL

*

Surcharge

**

Period rate change is effective

†

FOR FOOTNOTES CONCERNING EACH OF THESE TAX RATES, GO TO AND CLICK ON TAX RATES.

N/C = No Change

IFTA-105

(3/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2