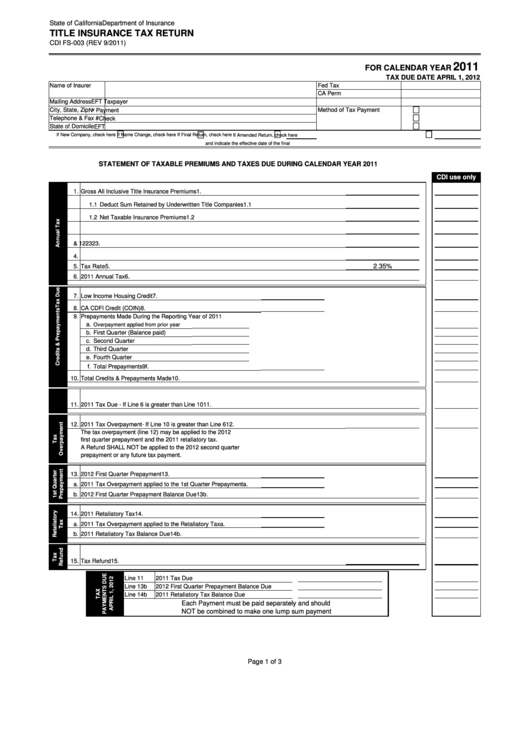

State of California

Department of Insurance

TITLE INSURANCE TAX RETURN

CDI FS-003 (REV 9/2011)

2011

FOR CALENDAR YEAR

TAX DUE DATE APRIL 1, 2012

Name of Insurer

Fed Tax I.D. No.

CA Perm No.

NAIC No.

Mailing Address

EFT Taxpayer I.D. No.

City, State, Zip

Method of Tax Payment

No Payment

Telephone & Fax #

Check

State of Domicile

EFT

If New Company, check here

If Name Change, check here

If Final Return, check here

If Amended Return, check here

and indicate the effective date of the final transaction.

and indicate the date when it was amended.

STATEMENT OF TAXABLE PREMIUMS AND TAXES DUE DURING CALENDAR YEAR 2011

CDI use only

1.

Gross All Inclusive Title Insurance Premiums

1.

1.1

Deduct Sum Retained by Underwritten Title Companies

1.1

1.2

Net Taxable Insurance Premiums

1.2

2. All Income Received on Reinsurance Assumed without deducting for reinsurance ceded

2.

3. All Other Income Pursuant to RTC 12231 & 12232

3.

4. Total Taxable Income

4.

2.35%

5.

Tax Rate

5.

6.

2011 Annual Tax

6.

7.

Low Income Housing Credit

7.

8.

CA CDFI Credit (COIN)

8.

9.

Prepayments Made During the Reporting Year of 2011

a.

Overpayment applied from prior year

b.

First Quarter (Balance paid)

c.

Second Quarter

d.

Third Quarter

e.

Fourth Quarter

f.

Total Prepayments

9f.

10.

Total Credits & Prepayments Made

10.

11.

2011 Tax Due - If Line 6 is greater than Line 10

11.

12.

2011 Tax Overpayment- If Line 10 is greater than Line 6

12.

The tax overpayment (line 12) may be applied to the 2012

first quarter prepayment and the 2011 retaliatory tax.

A Refund SHALL NOT be applied to the 2012 second quarter

prepayment or any future tax payment.

13.

2012 First Quarter Prepayment

13.

a.

2011 Tax Overpayment applied to the 1st Quarter Prepayment

a.

b.

2012 First Quarter Prepayment Balance Due

13b.

14.

2011 Retaliatory Tax

14.

a.

2011 Tax Overpayment applied to the Retaliatory Tax

a.

b.

2011 Retaliatory Tax Balance Due

14b.

15.

Tax Refund

15.

Line 11

2011 Tax Due

Line 13b

2012 First Quarter Prepayment Balance Due

Line 14b

2011 Retaliatory Tax Balance Due

Each Payment must be paid separately and should

NOT be combined to make one lump sum payment

Page 1 of 3

1

1 2

2 3

3