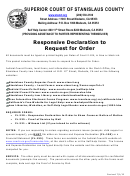

Form Fl-320 - Responsive Declaration To Request For Order - Superior Court Of Stanislaus County Page 14

ADVERTISEMENT

FL-150

ATTORNEY OR PARTY WITHOUT ATTORNEY (Name, State Bar number, and address):

FOR COURT USE ONLY

NAME:

ADDRESS:

TELEPHONE NO.:

E-MAIL ADDRESS (Optional):

IN PRO PER

ATTORNEY FOR (Name):

STANISLAUS

SUPERIOR COURT OF CALIFORNIA, COUNTY OF

1100 I Street

STREET ADDRESS:

PO Box 1098

MAILING ADDRESS:

Modesto, CA 95353-1098

CITY AND ZIP CODE:

BRANCH NAME:

PETITIONER/PLAINTIFF:

RESPONDENT/DEFENDANT:

OTHER PARENT/CLAIMANT:

CASE NUMBER:

INCOME AND EXPENSE DECLARATION

1.

Employment (Give information on your current job or, if you're unemployed, your most recent job.)

a.

Employer:

b.

Employer's address:

Attach copies

of your pay

c.

Employer's phone number:

stubs for last

d.

Occupation:

two months

e.

Date job started:

(black out

f.

If unemployed, date job ended:

social

security

g.

I work about

hours per week.

numbers).

h.

I get paid $

gross (before taxes)

per month

per week

per hour.

(If you have more than one job, attach an 8½-by-11-inch sheet of paper and list the same information as above for your other

jobs. Write "Question 1—Other Jobs" at the top.)

2.

Age and education

a.

My age is (specify):

b.

I have completed high school or the equivalent:

Yes

No

If no, highest grade completed (specify):

c.

Number of years of college completed (specify):

Degree(s) obtained (specify):

d.

Number of years of graduate school completed (specify):

Degree(s) obtained (specify):

e.

I have:

professional/occupational license(s) (specify):

vocational training (specify):

3. Tax information

a.

I last filed taxes for tax year (specify year):

b.

My tax filing status is

single

head of household

married, filing separately

married, filing jointly with (specify name):

c.

I file state tax returns in

California

other (specify state):

d.

I claim the following number of exemptions (including myself) on my taxes (specify):

4. Other party's income. I estimate the gross monthly income (before taxes) of the other party in this case at (specify): $

This estimate is based on (explain):

(If you need more space to answer any questions on this form, attach an 8½-by-11-inch sheet of paper and write the

question number before your answer.)

Number of pages attached:

I declare under penalty of perjury under the laws of the State of California that the information contained on all pages of this form and

any attachments is true and correct.

Date:

(TYPE OR PRINT NAME)

(SIGNATURE OF DECLARANT)

Page 1 of 4

Form Adopted for Mandatory Use

INCOME AND EXPENSE DECLARATION

Family Code, §§ 2030–2032,

Judicial Council of California

2100–2113, 3552, 3620–3634,

FL-150 [Rev. January 1, 2007]

4050–4076, 4300–4339

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17