Instructions For Completing The Request For Corporate Estimated Quarterly Income Tax Returns

ADVERTISEMENT

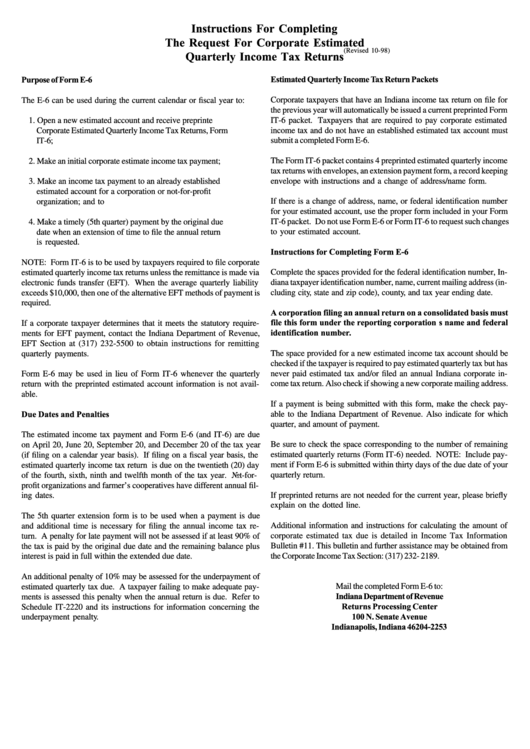

Instructions For Completing

The Request For Corporate Estimated

(Revised 10-98)

Quarterly Income Tax Returns

Purpose of Form E-6

Estimated Quarterly Income Tax Return Packets

Corporate taxpayers that have an Indiana income tax return on file for

The E-6 can be used during the current calendar or fiscal year to:

the previous year will automatically be issued a current preprinted Form

IT-6 packet. Taxpayers that are required to pay corporate estimated

1. Open a new estimated account and receive preprinte

income tax and do not have an established estimated tax account must

Corporate Estimated Quarterly Income Tax Returns, Form

IT-6;

submit a completed Form E-6.

The Form IT-6 packet contains 4 preprinted estimated quarterly income

2. Make an initial corporate estimate income tax payment;

tax returns with envelopes, an extension payment form, a record keeping

envelope with instructions and a change of address/name form.

3. Make an income tax payment to an already established

estimated account for a corporation or not-for-profit

If there is a change of address, name, or federal identification number

organization; and to

for your estimated account, use the proper form included in your Form

4. Make a timely (5th quarter) payment by the original due

IT-6 packet. Do not use Form E-6 or Form IT-6 to request such changes

to your estimated account.

date when an extension of time to file the annual return

is requested.

Instructions for Completing Form E-6

NOTE: Form IT-6 is to be used by taxpayers required to file corporate

estimated quarterly income tax returns unless the remittance is made via

Complete the spaces provided for the federal identification number, In-

electronic funds transfer (EFT). When the average quarterly liability

diana taxpayer identification number, name, current mailing address (in-

cluding city, state and zip code), county, and tax year ending date.

exceeds $10,000, then one of the alternative EFT methods of payment is

required.

A corporation filing an annual return on a consolidated basis must

file this form under the reporting corporation’s name and federal

If a corporate taxpayer determines that it meets the statutory require-

identification number.

ments for EFT payment, contact the Indiana Department of Revenue,

EFT Section at (317) 232-5500 to obtain instructions for remitting

quarterly payments.

The space provided for a new estimated income tax account should be

checked if the taxpayer is required to pay estimated quarterly tax but has

never paid estimated tax and/or filed an annual Indiana corporate in-

Form E-6 may be used in lieu of Form IT-6 whenever the quarterly

come tax return. Also check if showing a new corporate mailing address.

return with the preprinted estimated account information is not avail-

able.

If a payment is being submitted with this form, make the check pay-

Due Dates and Penalties

able to the Indiana Department of Revenue. Also indicate for which

quarter, and amount of payment.

The estimated income tax payment and Form E-6 (and IT-6) are due

Be sure to check the space corresponding to the number of remaining

on April 20, June 20, September 20, and December 20 of the tax year

estimated quarterly returns (Form IT-6) needed. NOTE: Include pay-

(if filing on a calendar year basis). If filing on a fiscal year basis, the

ment if Form E-6 is submitted within thirty days of the due date of your

estimated quarterly income tax return is due on the twentieth (20) day

of the fourth, sixth, ninth and twelfth month of the tax year. Not-for-

quarterly return.

profit organizations and farmer’s cooperatives have different annual fil-

If preprinted returns are not needed for the current year, please briefly

ing dates.

explain on the dotted line.

The 5th quarter extension form is to be used when a payment is due

Additional information and instructions for calculating the amount of

and additional time is necessary for filing the annual income tax re-

turn. A penalty for late payment will not be assessed if at least 90% of

corporate estimated tax due is detailed in Income Tax Information

Bulletin #11. This bulletin and further assistance may be obtained from

the tax is paid by the original due date and the remaining balance plus

interest is paid in full within the extended due date.

the Corporate Income Tax Section: (317) 232- 2189.

An additional penalty of 10% may be assessed for the underpayment of

estimated quarterly tax due. A taxpayer failing to make adequate pay-

Mail the completed Form E-6 to:

Indiana Department of Revenue

ments is assessed this penalty when the annual return is due. Refer to

Returns Processing Center

Schedule IT-2220 and its instructions for information concerning the

100 N. Senate Avenue

underpayment penalty.

Indianapolis, Indiana 46204-2253

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1