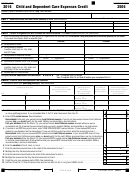

Part IV Dependent Care Benefits

13 Enter the total amount of dependent care benefits you received for 2016. This amount should be shown in box 10 of

your Form(s) W-2. Do not include amounts that were reported to you as wages in box 1 of Form(s) W-2. If you were

self-employed or a partner, include amounts you received under a dependent care assistance program from your

sole proprietorship or partnership . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

00

14 Enter the amount, if any, you carried over from 2015 and used in 2016 during the grace period . . . . . . . . . . . . . . . . . . . . . 14

00

15 Enter the amount, if any, you forfeited or carried forward to 2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

00

16 Combine line 13 through line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

00

17 Enter the total amount of qualified expenses incurred in 2016 for the

care of the qualifying person(s). See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

00

18 Enter the smaller of line 16 or line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

00

19 Enter YOUR earned income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

00

20 If married or an RDP filing a joint return, enter YOUR SPOUSE’S/RDP’s earned

income (if your spouse/RDP was a student or was disabled, see the instructions

for line 5); if married or an RDP filing a separate tax return, see the instructions

for the amount to enter; all others, enter the amount from line 19 . . . . . . . . . . . . . . . 20

00

21 Enter the smallest of line 18, line 19, or line 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

00

22 Enter $5,000 ($2,500 if married or an RDP filing separately and you were required

to enter your spouse’s/RDP’s earned income on line 20) . . . . . . . . . . . . . . . . . . . . . . . 22

00

23 Enter the amount from line 13 that you received from your sole proprietorship or partnership.

If you did not receive any amounts, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

00

24 Subtract line 23 from line 16. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

00

25 Deductible benefits. Enter the smallest of line 21, line 22, or line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

00

26 Excluded benefits. Subtract line 25 from the smaller of line 21 or line 22. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . 26

00

27 Taxable benefits. Subtract line 26 from line 24. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

00

28 Enter $3,000 ($6,000 if two or more qualifying persons) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

00

29 Add line 25 and line 26 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

00

30 Subtract the amount on line 29 from the amount on line 28. If zero or less, stop. You do not qualify for the credit.

Exception – If you paid 2015 expenses in 2016, see instructions for line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

00

31 Complete Side 1, Part III, line 2. Add the amounts in column (e) and enter the total here . . . . . . . . . . . . . . . . . . . . . . . . . . 31

00

32 Enter the amount from your federal Form 2441, Part III, line 31. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

00

33 Enter the smaller of line 30, line 31, or line 32. Also, enter this amount on Side 1, Part III, line 3 and

complete line 4 through line 12. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

00

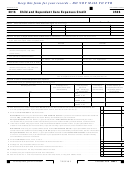

Worksheet – Credit for 2015 Expenses Paid in 2016

1. Enter your 2015 qualified expenses paid in 2015. If you did not claim the credit for these expenses on your 2015

tax return, get and complete a 2015 form FTB 3506 for these expenses. You may need to amend your 2015 tax return . . . . . . . 1.____________________

2. Enter your 2015 qualified expenses paid in 2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.____________________

3. Add the amounts on line 1 and line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.____________________

4. Enter $3,000 if care was for one qualifying person ($6,000 for two or more) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.____________________

5. Enter any dependent care benefits received for 2015 and excluded from your income

(from your 2015 form FTB 3506, Part IV, line 26) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.____________________

6. Subtract amount on line 5 from amount on line 4 and enter the result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.____________________

7. Compare your and your spouse’s/RDP’s earned income for 2015 and enter the smaller amount . . . . . . . . . . . . . . . . . . . . . . . . . 7.____________________

8. If filing a joint tax return, compare the amounts on line 3, line 6, and line 7 and enter the smallest amount. If not filing

a joint tax return, enter your earned income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.____________________

9. Enter the amount from your 2015 form FTB 3506, Side 1, Part III, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.____________________

10. Subtract amount on line 9 from amount on line 8 and enter the result. If zero or less, stop here. You cannot increase

your credit by any previous year’s expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.____________________

11. Enter your 2015 federal adjusted gross income (AGI) (from your 2015 Form 540, line 13;

or Long Form 540NR, line 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.____________________

.

12. 2015 federal AGI decimal amount (from 2015 form FTB 3506, instructions for line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.______

______ ______

13. Multiply line 10 by line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.____________________

.

14. 2015 California AGI decimal amount (from 2015 form FTB 3506, instructions for line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.______

______ ______

15. Multiply line 13 by line 14. Enter the result here and on your 2016 form FTB 3506, Side 1, Part III, line 11 . . . . . . . . . . . . . . . . . 15.____________________

Side 2 FTB 3506 2016

7252163

1

1 2

2