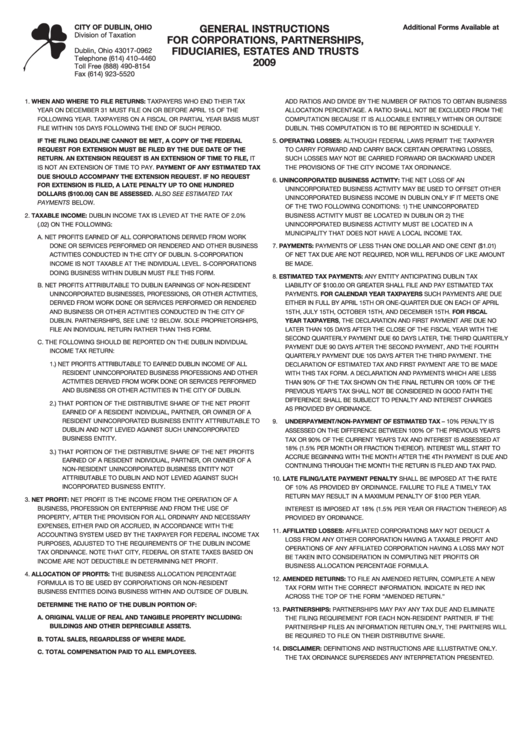

General Instructions For Corporations, Partnerships, Fiduciaries, Estates And Trusts - City Of Dublin, Ohio - 2009, Afti Worksheet Adjusted Federal Taxable Income

ADVERTISEMENT

CITY OF DUBLIN, OHIO

GENERAL INSTRUCTIONS

Additional Forms Available at

Division of Taxation

FOR CORPORATIONS, PARTNERSHIPS,

P.O. Box 9062

FIDUCIARIES, ESTATES AND TRUSTS

Dublin, Ohio 43017-0962

Telephone (614) 410-4460

2009

Toll Free (888) 490-8154

Fax (614) 923-5520

1.

WHEN AND WHERE TO FILE RETURNS: TAXPAYERS WHO END THEIR TAX

ADD RATIOS AND DIVIDE BY THE NUMBER OF RATIOS TO OBTAIN BUSINESS

YEAR ON DECEMBER 31 MUST FILE ON OR BEFORE APRIL 15 OF THE

ALLOCATION PERCENTAGE. A RATIO SHALL NOT BE EXCLUDED FROM THE

FOLLOWING YEAR. TAXPAYERS ON A FISCAL OR PARTIAL YEAR BASIS MUST

COMPUTATION BECAUSE IT IS ALLOCABLE ENTIRELY WITHIN OR OUTSIDE

FILE WITHIN 105 DAYS FOLLOWING THE END OF SUCH PERIOD.

DUBLIN. THIS COMPUTATION IS TO BE REPORTED IN SCHEDULE Y.

IF THE FILING DEADLINE CANNOT BE MET, A COPY OF THE FEDERAL

5.

OPERATING LOSSES: ALTHOUGH FEDERAL LAWS PERMIT THE TAXPAYER

REQUEST FOR EXTENSION MUST BE FILED BY THE DUE DATE OF THE

TO CARRY FORWARD AND CARRY BACK CERTAIN OPERATING LOSSES,

RETURN. AN EXTENSION REQUEST IS AN EXTENSION OF TIME TO FILE, IT

SUCH LOSSES MAY NOT BE CARRIED FORWARD OR BACKWARD UNDER

IS NOT AN EXTENSION OF TIME TO PAY. PAYMENT OF ANY ESTIMATED TAX

THE PROVISIONS OF THE CITY INCOME TAX ORDINANCE.

DUE SHOULD ACCOMPANY THE EXTENSION REQUEST. IF NO REQUEST

6.

UNINCORPORATED BUSINESS ACTIVITY: THE NET LOSS OF AN

FOR EXTENSION IS FILED, A LATE PENALTY UP TO ONE HUNDRED

UNINCORPORATED BUSINESS ACTIVITY MAY BE USED TO OFFSET OTHER

DOLLARS ($100.00) CAN BE ASSESSED. ALSO SEE ESTIMATED TAX

UNINCORPORATED BUSINESS INCOME IN DUBLIN ONLY IF IT MEETS ONE

PAYMENTS BELOW.

OF THE TWO FOLLOWING CONDITIONS: 1) THE UNINCORPORATED

2.

TAXABLE INCOME: DUBLIN INCOME TAX IS LEVIED AT THE RATE OF 2.0%

BUSINESS ACTIVITY MUST BE LOCATED IN DUBLIN OR 2) THE

(.02) ON THE FOLLOWING:

UNINCORPORATED BUSINESS ACTIVITY MUST BE LOCATED IN A

MUNICIPALITY THAT DOES NOT HAVE A LOCAL INCOME TAX.

A.

NET PROFITS EARNED OF ALL CORPORATIONS DERIVED FROM WORK

DONE OR SERVICES PERFORMED OR RENDERED AND OTHER BUSINESS

7.

PAYMENTS: PAYMENTS OF LESS THAN ONE DOLLAR AND ONE CENT ($1.01)

ACTIVITIES CONDUCTED IN THE CITY OF DUBLIN. S-CORPORATION

OF NET TAX DUE ARE NOT REQUIRED, NOR WILL REFUNDS OF LIKE AMOUNT

INCOME IS NOT TAXABLE AT THE INDIVIDUAL LEVEL. S-CORPORATIONS

BE MADE.

DOING BUSINESS WITHIN DUBLIN MUST FILE THIS FORM.

8.

ESTIMATED TAX PAYMENTS: ANY ENTITY ANTICIPATING DUBLIN TAX

B.

NET PROFITS ATTRIBUTABLE TO DUBLIN EARNINGS OF NON-RESIDENT

LIABILITY OF $100.00 OR GREATER SHALL FILE AND PAY ESTIMATED TAX

UNINCORPORATED BUSINESSES, PROFESSIONS, OR OTHER ACTIVITIES,

PAYMENTS. FOR CALENDAR YEAR TAXPAYERS SUCH PAYMENTS ARE DUE

DERIVED FROM WORK DONE OR SERVICES PERFORMED OR RENDERED

EITHER IN FULL BY APRIL 15TH OR ONE-QUARTER DUE ON EACH OF APRIL

AND BUSINESS OR OTHER ACTIVITIES CONDUCTED IN THE CITY OF

15TH, JULY 15TH, OCTOBER 15TH, AND DECEMBER 15TH. FOR FISCAL

DUBLIN. PARTNERSHIPS, SEE LINE 12 BELOW. SOLE PROPRIETORSHIPS,

YEAR TAXPAYERS, THE DECLARATION AND FIRST PAYMENT ARE DUE NO

FILE AN INDIVIDUAL RETURN RATHER THAN THIS FORM.

LATER THAN 105 DAYS AFTER THE CLOSE OF THE FISCAL YEAR WITH THE

SECOND QUARTERLY PAYMENT DUE 60 DAYS LATER, THE THIRD QUARTERLY

C.

THE FOLLOWING SHOULD BE REPORTED ON THE DUBLIN INDIVIDUAL

PAYMENT DUE 90 DAYS AFTER THE SECOND PAYMENT, AND THE FOURTH

INCOME TAX RETURN:

QUARTERLY PAYMENT DUE 105 DAYS AFTER THE THIRD PAYMENT. THE

1.) NET PROFITS ATTRIBUTABLE TO EARNED DUBLIN INCOME OF ALL

DECLARATION OF ESTIMATED TAX AND FIRST PAYMENT ARE TO BE MADE

RESIDENT UNINCORPORATED BUSINESS PROFESSIONS AND OTHER

WITH THIS TAX FORM. A DECLARATION AND PAYMENTS WHICH ARE LESS

ACTIVITIES DERIVED FROM WORK DONE OR SERVICES PERFORMED

THAN 90% OF THE TAX SHOWN ON THE FINAL RETURN OR 100% OF THE

AND BUSINESS OR OTHER ACTIVITIES IN THE CITY OF DUBLIN.

PREVIOUS YEAR’S TAX SHALL NOT BE CONSIDERED IN GOOD FAITH THE

DIFFERENCE SHALL BE SUBJECT TO PENALTY AND INTEREST CHARGES

2.) THAT PORTION OF THE DISTRIBUTIVE SHARE OF THE NET PROFIT

AS PROVIDED BY ORDINANCE.

EARNED OF A RESIDENT INDIVIDUAL, PARTNER, OR OWNER OF A

RESIDENT UNINCORPORATED BUSINESS ENTITY ATTRIBUTABLE TO

9.

UNDERPAYMENT/NON-PAYMENT OF ESTIMATED TAX – 10% PENALTY IS

DUBLIN AND NOT LEVIED AGAINST SUCH UNINCORPORATED

ASSESSED ON THE DIFFERENCE BETWEEN 100% OF THE PREVIOUS YEAR’S

BUSINESS ENTITY.

TAX OR 90% OF THE CURRENT YEAR’S TAX AND INTEREST IS ASSESSED AT

18% (1.5% PER MONTH OR FRACTION THEREOF). INTEREST WILL START TO

3.) THAT PORTION OF THE DISTRIBUTIVE SHARE OF THE NET PROFITS

ACCRUE BEGINNING WITH THE MONTH AFTER THE 4TH PAYMENT IS DUE AND

EARNED OF A RESIDENT INDIVIDUAL, PARTNER, OR OWNER OF A

CONTINUING THROUGH THE MONTH THE RETURN IS FILED AND TAX PAID.

NON-RESIDENT UNINCORPORATED BUSINESS ENTITY NOT

ATTRIBUTABLE TO DUBLIN AND NOT LEVIED AGAINST SUCH

10. LATE FILING/LATE PAYMENT PENALTY SHALL BE IMPOSED AT THE RATE

INCORPORATED BUSINESS ENTITY.

OF 10% AS PROVIDED BY ORDINANCE. FAILURE TO FILE A TIMELY TAX

RETURN MAY RESULT IN A MAXIMUM PENALTY OF $100 PER YEAR.

3.

NET PROFIT: NET PROFIT IS THE INCOME FROM THE OPERATION OF A

BUSINESS, PROFESSION OR ENTERPRISE AND FROM THE USE OF

INTEREST IS IMPOSED AT 18% (1.5% PER YEAR OR FRACTION THEREOF) AS

PROPERTY, AFTER THE PROVISION FOR ALL ORDINARY AND NECESSARY

PROVIDED BY ORDINANCE.

EXPENSES, EITHER PAID OR ACCRUED, IN ACCORDANCE WITH THE

11. AFFILIATED LOSSES: AFFILIATED CORPORATIONS MAY NOT DEDUCT A

ACCOUNTING SYSTEM USED BY THE TAXPAYER FOR FEDERAL INCOME TAX

LOSS FROM ANY OTHER CORPORATION HAVING A TAXABLE PROFIT AND

PURPOSES, ADJUSTED TO THE REQUIREMENTS OF THE DUBLIN INCOME

OPERATIONS OF ANY AFFILIATED CORPORATION HAVING A LOSS MAY NOT

TAX ORDINANCE. NOTE THAT CITY, FEDERAL OR STATE TAXES BASED ON

BE TAKEN INTO CONSIDERATION IN COMPUTING NET PROFITS OR

INCOME ARE NOT DEDUCTIBLE IN DETERMINING NET PROFIT.

BUSINESS ALLOCATION PERCENTAGE FORMULA.

4.

ALLOCATION OF PROFITS: THE BUSINESS ALLOCATION PERCENTAGE

12. AMENDED RETURNS: TO FILE AN AMENDED RETURN, COMPLETE A NEW

FORMULA IS TO BE USED BY CORPORATIONS OR NON-RESIDENT

TAX FORM WITH THE CORRECT INFORMATION. INDICATE IN RED INK

BUSINESS ENTITIES DOING BUSINESS WITHIN AND OUTSIDE OF DUBLIN.

ACROSS THE TOP OF THE FORM “AMENDED RETURN.”

DETERMINE THE RATIO OF THE DUBLIN PORTION OF:

13. PARTNERSHIPS: PARTNERSHIPS MAY PAY ANY TAX DUE AND ELIMINATE

A.

ORIGINAL VALUE OF REAL AND TANGIBLE PROPERTY INCLUDING:

THE FILING REQUIREMENT FOR EACH NON-RESIDENT PARTNER. IF THE

BUILDINGS AND OTHER DEPRECIABLE ASSETS.

PARTNERSHIP FILES AN INFORMATION RETURN ONLY, THE PARTNERS WILL

BE REQUIRED TO FILE ON THEIR DISTRIBUTIVE SHARE.

B.

TOTAL SALES, REGARDLESS OF WHERE MADE.

14. DISCLAIMER: DEFINITIONS AND INSTRUCTIONS ARE ILLUSTRATIVE ONLY.

C. TOTAL COMPENSATION PAID TO ALL EMPLOYEES.

THE TAX ORDINANCE SUPERSEDES ANY INTERPRETATION PRESENTED.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3