Income Tax Withheld Form

Download a blank fillable Income Tax Withheld Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Income Tax Withheld Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

FILING FREQUENCY

DUE ON OR BEFORE

FOR TAX PERIOD ENDING

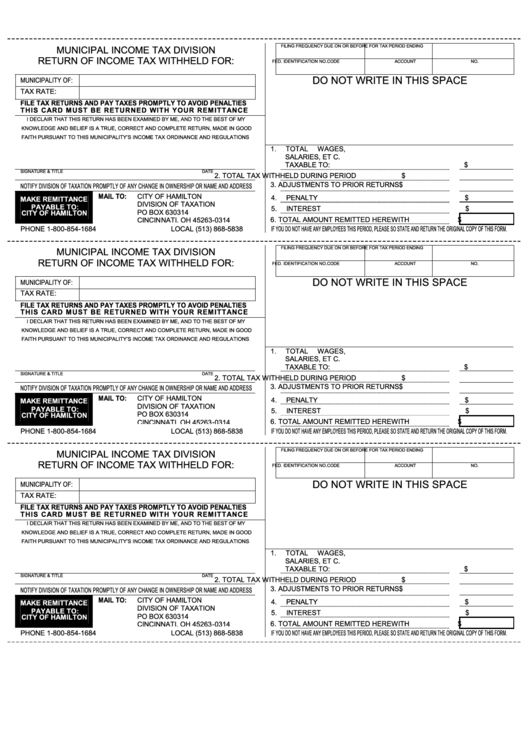

MUNICIPAL INCOME TAX DIVISION

RETURN OF INCOME TAX WITHHELD FOR:

FED. IDENTIFICATION NO.

CODE

ACCOUNT NO.

DO NOT WRITE IN THIS SPACE

MUNICIPALITY OF:

TAX RATE:

FILE TAX RETURNS AND PAY TAXES PROMPTLY TO AVOID PENALTIES

THIS C ARD M UST BE RE TURNED W ITH YOUR REM ITTANCE

I DECLAIR THAT THIS RETURN HAS BEEN EXAMINED BY ME, AND TO THE BEST OF MY

KNOWLEDGE AND BELIEF IS A TRUE, CORRECT AND COMPLETE RETURN, MADE IN GOOD

FAITH PURSUANT TO THIS MUNICIPALITY’S INCOME TAX ORDINANCE AND REGULATIONS

1.

TOTAL WAGES,

SALARIES, ET C.

TAXABLE TO:

$

SIGNATURE & TITLE

DATE

2.

TOTAL TAX WITHHELD DURING PERIOD

$

NOTIFY DIVISION OF TAXATION PROMPTLY OF ANY CHANGE IN OWNERSHIP OR NAME AND ADDRESS

3.

ADJUSTMENTS TO PRIOR RETURNS

$

MAIL TO:

CITY OF HAMILTON

4.

PENALTY

$

MAKE REMITTANCE

DIVISION OF TAXATION

PAYABLE TO:

5.

INTEREST

$

PO BOX 630314

CITY OF HAMILTON

6.

TOTAL AMOUNT REMITTED HEREWITH

$

CINCINNATI, OH 45263-0314

PHONE 1-800-854-1684

LOCAL (513) 868-5838

IF YOU DO NOT HAVE ANY EMPLOYEES THIS PERIOD, PLEASE SO STATE AND RETURN THE ORIGINAL COPY OF THIS FORM.

FILING FREQUENCY

DUE ON OR BEFORE

FOR TAX PERIOD ENDING

MUNICIPAL INCOME TAX DIVISION

RETURN OF INCOME TAX WITHHELD FOR:

FED. IDENTIFICATION NO.

CODE

ACCOUNT NO.

DO NOT WRITE IN THIS SPACE

MUNICIPALITY OF:

TAX RATE:

FILE TAX RETURNS AND PAY TAXES PROMPTLY TO AVOID PENALTIES

THIS C ARD M UST BE RE TURNED W ITH YOUR REM ITTANCE

I DECLAIR THAT THIS RETURN HAS BEEN EXAMINED BY ME, AND TO THE BEST OF MY

KNOWLEDGE AND BELIEF IS A TRUE, CORRECT AND COMPLETE RETURN, MADE IN GOOD

FAITH PURSUANT TO THIS MUNICIPALITY’S INCOME TAX ORDINANCE AND REGULATIONS

1.

TOTAL WAGES,

SALARIES, ET C.

TAXABLE TO:

$

SIGNATURE & TITLE

DATE

2.

TOTAL TAX WITHHELD DURING PERIOD

$

NOTIFY DIVISION OF TAXATION PROMPTLY OF ANY CHANGE IN OWNERSHIP OR NAME AND ADDRESS

3.

ADJUSTMENTS TO PRIOR RETURNS

$

MAIL TO:

CITY OF HAMILTON

4.

PENALTY

$

MAKE REMITTANCE

DIVISION OF TAXATION

PAYABLE TO:

5.

INTEREST

$

PO BOX 630314

CITY OF HAMILTON

6.

TOTAL AMOUNT REMITTED HEREWITH

$

CINCINNATI, OH 45263-0314

PHONE 1-800-854-1684

LOCAL (513) 868-5838

IF YOU DO NOT HAVE ANY EMPLOYEES THIS PERIOD, PLEASE SO STATE AND RETURN THE ORIGINAL COPY OF THIS FORM.

FILING FREQUENCY

DUE ON OR BEFORE

FOR TAX PERIOD ENDING

MUNICIPAL INCOME TAX DIVISION

RETURN OF INCOME TAX WITHHELD FOR:

FED. IDENTIFICATION NO.

CODE

ACCOUNT NO.

DO NOT WRITE IN THIS SPACE

MUNICIPALITY OF:

TAX RATE:

FILE TAX RETURNS AND PAY TAXES PROMPTLY TO AVOID PENALTIES

THIS C ARD M UST BE RE TURNED W ITH YOUR REM ITTANCE

I DECLAIR THAT THIS RETURN HAS BEEN EXAMINED BY ME, AND TO THE BEST OF MY

KNOWLEDGE AND BELIEF IS A TRUE, CORRECT AND COMPLETE RETURN, MADE IN GOOD

FAITH PURSUANT TO THIS MUNICIPALITY’S INCOME TAX ORDINANCE AND REGULATIONS

1.

TOTAL WAGES,

SALARIES, ET C.

TAXABLE TO:

$

SIGNATURE & TITLE

DATE

2.

TOTAL TAX WITHHELD DURING PERIOD

$

NOTIFY DIVISION OF TAXATION PROMPTLY OF ANY CHANGE IN OWNERSHIP OR NAME AND ADDRESS

3.

ADJUSTMENTS TO PRIOR RETURNS

$

MAIL TO:

CITY OF HAMILTON

4.

PENALTY

$

MAKE REMITTANCE

DIVISION OF TAXATION

PAYABLE TO:

5.

INTEREST

$

PO BOX 630314

CITY OF HAMILTON

6.

TOTAL AMOUNT REMITTED HEREWITH

$

CINCINNATI, OH 45263-0314

PHONE 1-800-854-1684

LOCAL (513) 868-5838

IF YOU DO NOT HAVE ANY EMPLOYEES THIS PERIOD, PLEASE SO STATE AND RETURN THE ORIGINAL COPY OF THIS FORM.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1